Salesforce.com 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

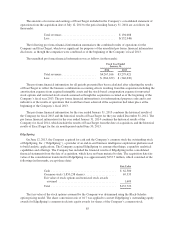

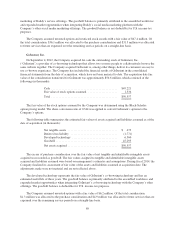

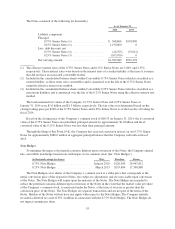

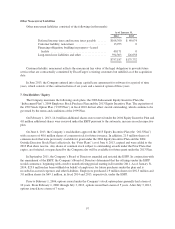

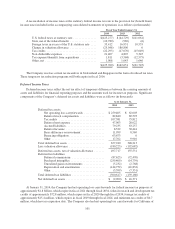

Interest Expense

The following table sets forth total interest expense recognized related to the Notes and the Term Loan prior

to capitalization of interest (in thousands):

Fiscal Year Ended January 31,

2014 2013 2012

Contractual interest expense ................... $10,195 $ 4,313 $ 4,312

Amortization of debt issuance costs .............. 4,470 1,324 1,324

Amortization of debt discount .................. 46,942 25,131 23,720

$61,607 $30,768 $29,356

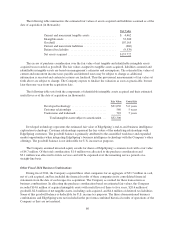

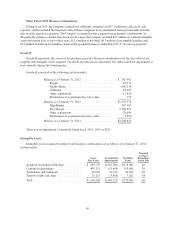

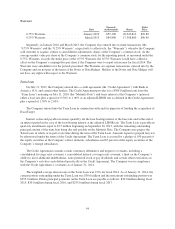

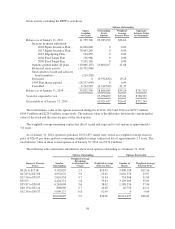

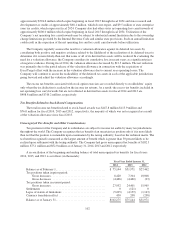

6. Other Balance Sheet Accounts

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following (in thousands):

As of January 31,

2014 2013

Deferred income taxes, net ........................ $ 49,279 $ 7,321

Prepaid income taxes ............................. 23,571 21,180

Customer contract asset ........................... 77,368 0

Prepaid expenses and other current assets ............ 158,962 104,813

$309,180 $133,314

Customer contract asset reflects future billings of amounts that are contractually committed by

ExactTarget’s existing customers as of the acquisition date that will be billed in the next twelve months. As the

Company bills these customers this balance will reduce and accounts receivable will increase.

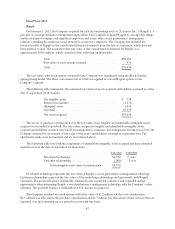

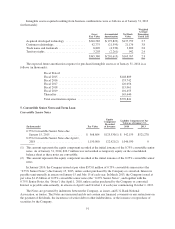

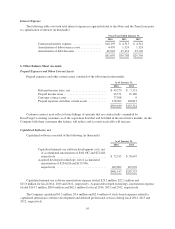

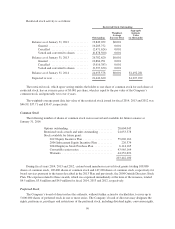

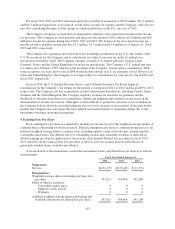

Capitalized Software, net

Capitalized software consisted of the following (in thousands):

As of January 31,

2014 2013

Capitalized internal-use software development costs, net

of accumulated amortization of $101,687 and $72,448,

respectively .................................. $ 72,915 $ 59,647

Acquired developed technology, net of accumulated

amortization of $294,628 and $179,906,

respectively .................................. 409,002 147,676

$481,917 $207,323

Capitalized internal-use software amortization expense totaled $29.2 million, $22.1 million and

$15.8 million for fiscal 2014, 2013 and 2012, respectively. Acquired developed technology amortization expense

totaled $114.7 million, $80.0 million and $62.1 million for fiscal 2014, 2013 and 2012, respectively.

The Company capitalized $3.5 million, $3.4 million and $2.4 million of stock-based expenses related to

capitalized internal-use software development and deferred professional services during fiscal 2014, 2013 and

2012, respectively.

95