Salesforce.com 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.customers at the time of renewal. Our plans to invest for future growth include the continuation of the expansion

of our data center capacity, the hiring of additional personnel, particularly in direct sales, other customer-related

areas and research and development, the expansion of domestic and international selling and marketing activities,

continuing to develop our brands, the addition of distribution channels, the upgrade of our service offerings, the

development of new services, the integration of acquired technologies, the expansion of our Salesforce1

ExactTarget Marketing Cloud and Salesforce1 Platform service offerings and the additions to our global

infrastructure to support our growth.

We also regularly evaluate acquisitions or investment opportunities in complementary businesses, joint

ventures, services and technologies and intellectual property rights in an effort to expand our service offerings.

We expect to continue to make such investments and acquisitions in the future and we plan to reinvest a

significant portion of our incremental revenue in future periods to grow our business and continue our leadership

role in the cloud computing industry. As a result of our aggressive growth plans, specifically our hiring plan and

acquisition activities, we have incurred significant expenses from equity awards and amortization of purchased

intangibles which have resulted in net losses on a GAAP basis. As we continue with our growth plan, we may

continue to have net losses on a GAAP basis.

Our typical subscription contract term is 12 to 36 months, although terms range from one to 60 months, so

during any fiscal reporting period only a subset of active subscription contracts are available for renewal. We

calculate our attrition rates as of the end of each reporting period. We do not calculate the attrition rate for

ExactTarget, Inc. (“ExactTarget”). Our attrition rate was in the high-single digit percentage range as of

January 31, 2014, declining from the low-double digit percentage range attrition rate as of January 31, 2013. We

expect our attrition rates to continue to decline slowly over time, as we continue to expand our enterprise

business and invest in customer success and other related programs.

The majority of our subscription and support revenues are derived from subscriptions to our Sales Cloud.

We expect marketing and sales costs, which were 53 percent of our total revenues for fiscal 2014 and

53 percent for the same period a year ago, to continue to represent a substantial portion of total revenues in the

future as we seek to add and manage more paying customers, and build greater brand awareness.

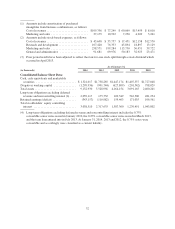

On March 18, 2013, we issued at par value $1.15 billion of 0.25% convertible senior notes due April 1,

2018. In connection with the issuance of the debt, we entered into convertible note hedge transactions that cover

the number of shares of our common stock that are underlying the notes. The note hedge transactions are

designed, but not guaranteed, to reduce or eliminate the potential economic dilution arising upon conversion.

On March 20, 2013, we amended and restated our certificate of incorporation to increase the number of

authorized shares of common stock from 400.0 million to 1.6 billion in order to provide for a four-for-one stock

split of the common stock effected in the form of a stock dividend. The record date for the stock split was

April 3, 2013, and the additional shares were distributed on April 17, 2013. Each stockholder of record on the

close of business on the record date received three additional shares of common stock for each share held. All

share and per share data presented herein reflect the impact of the increase in authorized shares and the stock

split, as appropriate.

In June 2013, we entered into a large capital lease agreement for software for a period of nine years, which

consists of the contractual term of six years and a renewal option of three years.

On July 11, 2013, we entered into a credit agreement which provides for a $300.0 million term loan due on

July 11, 2016. All amounts borrowed under the term loan were used to pay a portion of the total purchase price

for ExactTarget.

34