Salesforce.com 2014 Annual Report Download - page 59

Download and view the complete annual report

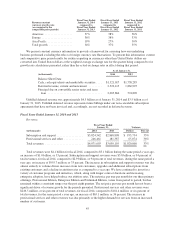

Please find page 59 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The majority of our operating lease agreements provide us with the option to renew. Our future operating

lease obligations would change if we exercised these options and if we entered into additional operating lease

agreements as we expand our operations. The Financing Obligation above represents the total obligation for our

lease of approximately 445,000 rentable square feet of office space in San Francisco, California. As of

January 31, 2014, $40.2 million of the total obligation noted above was recorded to Financing obligation,

building in progress—leased facility, which is included in Other noncurrent liabilities on the consolidated

balance sheets.

During fiscal 2014 and in future fiscal years, we have made and expect to continue to make additional

investments in our infrastructure to scale our operations and increase productivity. We plan to upgrade and/or

replace various internal systems to scale with the overall growth of the Company. Additionally, we expect capital

expenditures to be higher in absolute dollars and remain consistent as a percentage of total revenues in future

periods as a result of continued office build-outs, other leasehold improvements and data center investments.

In the future, we may enter into arrangements to acquire or invest in complementary businesses or joint

ventures, services and technologies, and intellectual property rights. We may be required to seek additional

equity or debt financing. Additional funds may not be available on terms favorable to us or at all.

We believe our existing cash, cash equivalents and short-term marketable securities and cash provided by

operating activities will be sufficient to meet our working capital, capital expenditure and debt repayment needs

over the next 12 months.

Non-GAAP Financial Measures

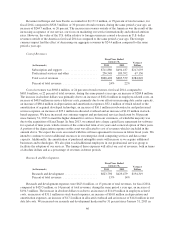

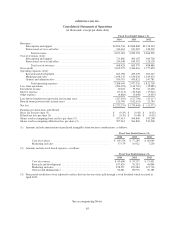

Regulation S-K Item 10(e), “Use of Non-GAAP Financial Measures in Commission Filings,” defines and

prescribes the conditions for use of non-GAAP financial information. Our measures of non-GAAP gross profit,

non-GAAP operating profit, non-GAAP net income and non-GAAP earnings per share each meet the definition

of a non-GAAP financial measure.

Non-GAAP gross profit, Non-GAAP operating profit and Non-GAAP net income

We use the non-GAAP measures of non-GAAP gross profit, non-GAAP operating profit and non-GAAP net

income to provide an additional view of operational performance by excluding non-cash expenses that are not

directly related to performance in any particular period. In addition to our GAAP measures we use these non-GAAP

measures when planning, monitoring, and evaluating our performance. We believe that these non-GAAP measures

reflect our ongoing business in a manner that allows for meaningful period-to-period comparisons and analysis of

trends in our business, as they exclude certain expenses and benefits. These items are excluded because the decisions

which gave rise to them are not made to increase revenue in a particular period, but are made for our long-term

benefit over multiple periods and we are not able to change or affect these items in any particular period.

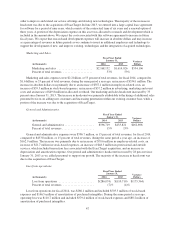

We define non-GAAP net income as our total net income excluding the following components, which we

believe are not reflective of our ongoing operational expenses. In each case, for the reasons set forth below, we

believe that excluding the component provides useful information to investors and others in understanding and

evaluating the impact of certain non-cash items to our operating results and future prospects in the same manner

as us, in comparing financial results across accounting periods and to those of peer companies and to better

understand the impact of these non-cash items on our gross margin and operating performance. Additionally, as

significant, unusual or discrete events occur, the results may be excluded in the period in which the events occur.

•Stock-Based Expenses. The Company’s compensation strategy includes the use of stock-based

compensation to attract and retain employees and executives. It is principally aimed at aligning their

interests with those of our stockholders and at long-term employee retention, rather than to motivate or

reward operational performance for any particular period. Thus, stock-based compensation expense

varies for reasons that are generally unrelated to operational decisions and performance in any

particular period.

55