Salesforce.com 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

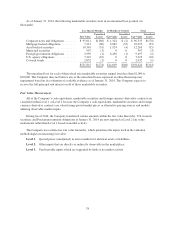

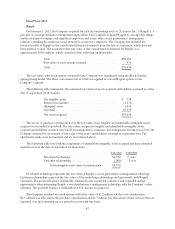

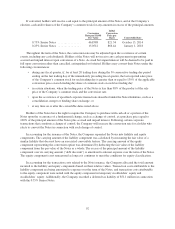

amounts reflected in the table above, the Company recorded $23.3 million related to the perpetual parking rights

and classified such rights as a purchased intangible asset as it represents an intangible right to use the existing

garage. The Company has capitalized pre-construction activities related to the development of the land, including

interest costs and property taxes since the November 2010 purchase. During the first quarter of fiscal 2013, the

Company suspended pre-construction activity. The total carrying value of the land, building improvements and

perpetual parking rights was $321.1 million as of January 31, 2014. The Company continues to evaluate its future

needs for office facilities space and its options for the undeveloped real estate, which may include selling a

portion of or all the real estate holdings, or suspending pre-construction activity for several more years.

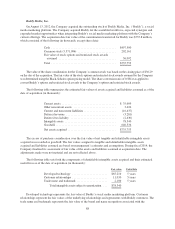

In December 2012, the Company entered into a lease agreement for approximately 445,000 rentable square

feet of office space in San Francisco, California. The space rented is for the total office space available in the

building, which is in the process of being constructed. As a result of the Company’s involvement during the

construction period, the Company is considered for accounting purposes to be the owner of the construction

project. As of January 31, 2014, the Company capitalized $40.2 million of construction costs, based on the

construction costs incurred to date by the landlord, and recorded a corresponding noncurrent financing obligation

liability of $40.2 million. The total expected financing obligation associated with this lease upon completion of

the construction of the building, inclusive of the amounts currently recorded, is $335.8 million (See Note 10 for

future commitment details). The obligation will be settled through monthly lease payments to the landlord once

the construction is complete and the office space is ready for occupancy.

There was no impairment of long-lived assets during fiscal 2014, 2013 and 2012, respectively.

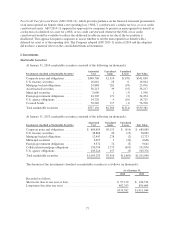

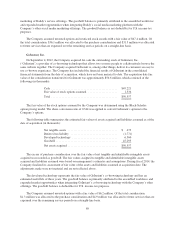

4. Business Combinations

ExactTarget

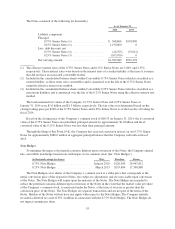

On July 12, 2013, the Company acquired for cash the outstanding stock of ExactTarget, a leading global

provider of cross-channel, digital marketing solutions that empower organizations of all sizes to communicate

with their customers through the digital channels they use most. The Company acquired ExactTarget to, among

other things, create a world-class marketing platform across the channels of email, social, mobile and the web.

The Company has included the financial results of ExactTarget in the consolidated financial statements from the

date of acquisition. The acquisition date fair value of the consideration transferred for ExactTarget was

approximately $2.6 billion, including the proceeds from the term loan of $300.0 million (see Note 5), which

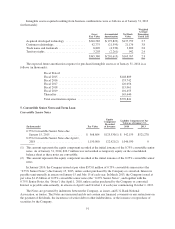

consisted of the following (in thousands):

Fair value

Cash ................................................... $2,567,098

Fair value of equity awards assumed ......................... 17,428

Total .................................................. $2,584,526

The estimated fair value of the stock options assumed by the Company was determined using the Black-

Scholes option pricing model. The share conversion ratio of 0.84 was applied to convert ExactTarget’s

outstanding equity awards for ExactTarget’s common stock into equity awards for shares of the Company’s

common stock.

83