Salesforce.com 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

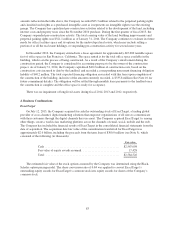

Other Fiscal 2013 Business Combinations

During fiscal 2013, the Company acquired five additional companies for $15.1 million in cash, net of cash

acquired, and has included the financial results of these companies in its consolidated financial statements from the

date of each respective acquisition. The Company accounted for these transactions as business combinations. In

allocating the purchase consideration based on fair values, the Company recorded $4.1 million of acquired intangible

assets with useful lives of one to three years, $12.4 million of goodwill, $0.3 million of net tangible liabilities and

$1.0 million of deferred tax liabilities. Some of this goodwill balance is deductible for U.S. income tax purposes.

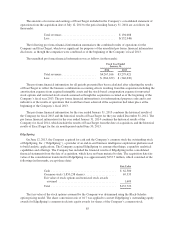

Goodwill

Goodwill represents the excess of the purchase price in a business combination over the fair value of net

tangible and intangible assets acquired. Goodwill amounts are not amortized, but rather tested for impairment at

least annually during the fourth quarter.

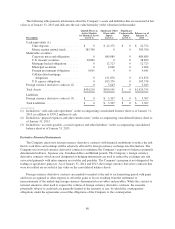

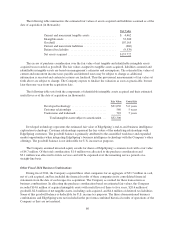

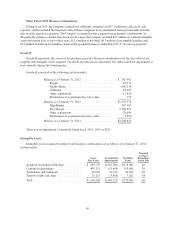

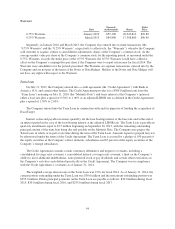

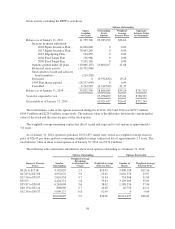

Goodwill consisted of the following (in thousands):

Balance as of January 31, 2012 ...................... $ 785,381

Rypple ..................................... 45,579

Buddy Media ................................ 640,534

GoInstant ................................... 45,295

Other acquisitions ............................ 12,410

Finalization of acquisition date fair values ......... 179

Balance as of January 31, 2013 ...................... $1,529,378

EdgeSpring ................................. 107,165

ExactTarget ................................. 1,848,653

Other acquisitions ............................ 20,646

Finalization of acquisition date fair values ......... (5,019)

Balance as of January 31, 2014 ...................... $3,500,823

There was no impairment of goodwill during fiscal 2014, 2013 or 2012.

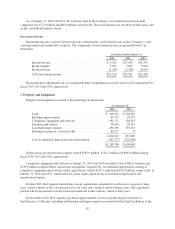

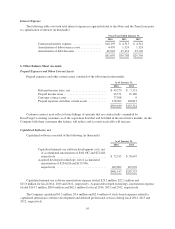

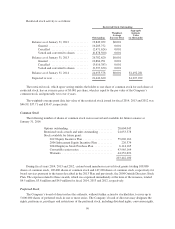

Intangible Assets

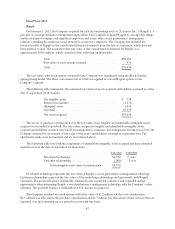

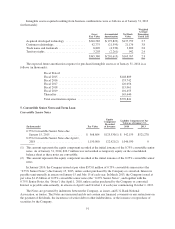

Intangible assets acquired resulting from business combinations are as follows as of January 31, 2014

(in thousands):

Gross

Fair Value

Accumulated

Amortization

Net Book

Value

Weighted

Average

Remaining

Useful Life

Acquired developed technology ............ $ 659,770 $(281,766) $378,004 4.9

Customer relationships ................... 409,135 (53,669) 355,466 7.0

Trade name and trademark ................ 38,930 (8,721) 30,209 9.0

Territory rights and other ................. 11,125 (3,963) 7,162 3.8

Total ................................. $1,118,960 $(348,119) $770,841 6.0

90