Salesforce.com 2014 Annual Report Download - page 60

Download and view the complete annual report

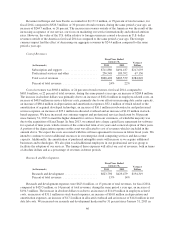

Please find page 60 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Amortization of Purchased Intangibles. The Company views amortization of acquisition-related

intangible assets, such as the amortization of the cost associated with an acquired company’s research

and development efforts, trade names, customer lists and customer relationships, as items arising from

pre-acquisition activities determined at the time of an acquisition. While it is continually viewed for

impairment, amortization of the cost of purchased intangibles is a static expense, one that is not

typically affected by operations during any particular period.

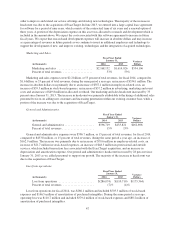

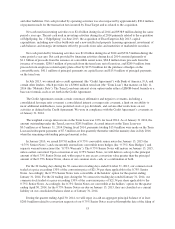

•Amortization of Debt Discount. Under GAAP, certain convertible debt instruments that may be settled

in cash (or other assets) on conversion are required to be separately accounted for as liability (debt) and

equity (conversion option) components of the instrument in a manner that reflects the issuer’s non-

convertible debt borrowing rate. Accordingly, for GAAP purposes we are required to recognize

imputed interest expense on the Company’s $575.0 million of convertible senior notes that were issued

in a private placement in January 2010 and the Company’s $1.15 billion of convertible senior notes that

were issued in a private placement in March 2013. The imputed interest rates were approximately 5.9%

for the notes issued in January 2010 and approximately 2.5% for the notes issued in March 2013, while

the coupon interest rates were 0.75% and 0.25%, respectively. The difference between the imputed

interest expense and the coupon interest expense, net of the interest amount capitalized, is excluded

from management’s assessment of the Company’s operating performance because management

believes that this non-cash expense is not indicative of ongoing operating performance. Management

believes that the exclusion of the non-cash interest expense provides investors an enhanced view of the

Company’s operational performance.

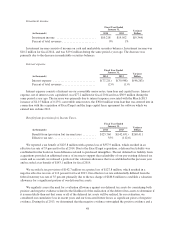

•Income Tax Effects and Adjustments. The Company’s non-GAAP tax provision excludes the tax effects

of expense items described above and certain tax items not directly related to the current fiscal year’s

ordinary operating results. Examples of such tax items include, but are not limited to, changes in the

valuation allowance related to deferred tax assets, certain acquisition-related costs and unusual or

infrequently occurring items. Management believes the exclusion of these income tax adjustments

provides investors with useful supplemental information about the Company’s operational

performance.

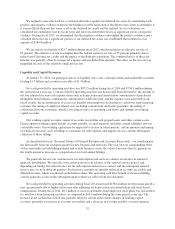

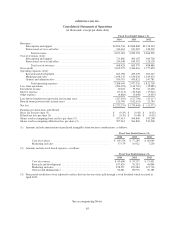

We define non-GAAP gross profit as our total revenues less cost of revenues, as reported on our

consolidated statement of operations, excluding the portions of stock-based expenses and amortization of

purchased intangibles that are included in cost of revenues.

We define non-GAAP operating profit as our non-GAAP gross profit less operating expenses, as reported

on our consolidated statement of operations, excluding the portions of stock-based expenses and amortization of

purchased intangibles that are included in operating expenses.

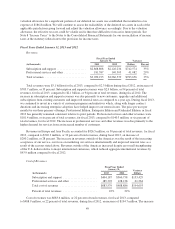

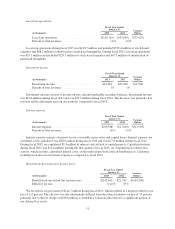

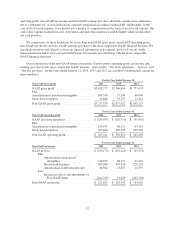

Non-GAAP earnings per share

Management uses the non-GAAP earnings per share to provide an additional view of performance by

excluding items that are not directly related to performance in any particular period in the earnings per share

calculation.

We define non-GAAP earnings per share as our non-GAAP net income, which excludes the above

components, which we believe are not reflective of our ongoing operational expenses, divided by basic or diluted

shares outstanding.

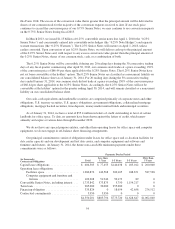

Limitations on the use of Non-GAAP financial measures

A limitation of our non-GAAP financial measures of non-GAAP gross profit, non-GAAP operating profit,

non-GAAP net income and non-GAAP earnings per share is that they do not have uniform definitions. Our

definitions will likely differ from the definitions used by other companies, including peer companies, and

therefore comparability may be limited. Thus, our non-GAAP measures of non-GAAP gross profit, non-GAAP

56