Salesforce.com 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

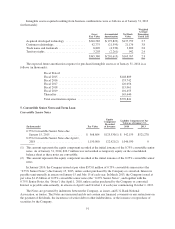

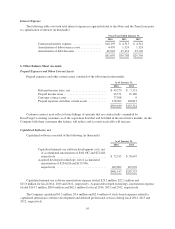

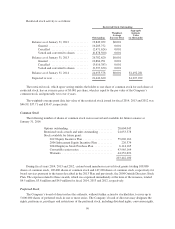

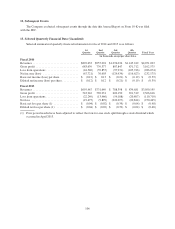

A reconciliation of income taxes at the statutory federal income tax rate to the provision for (benefit from)

income taxes included in the accompanying consolidated statements of operations is as follows (in thousands):

Fiscal Year Ended January 31,

2014 2013 2012

U.S. federal taxes at statutory rate ................ $(125,277) $ (44,729) $(11,661)

State, net of the federal benefit .................. (10,780) (969) (6)

Foreign taxes in excess of the U.S. statutory rate .... 33,412 16,931 10,555

Change in valuation allowance .................. (25,048) 186,806 0

Tax credits .................................. (22,293) (17,670) (15,049)

Non-deductible expenses ....................... 21,407 4,807 5,345

Tax expense/(benefit) from acquisitions ........... 1,811 (3,568) (12,575)

Other, net ................................... 1,008 1,043 1,646

$(125,760) $142,651 $(21,745)

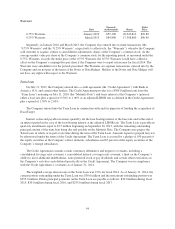

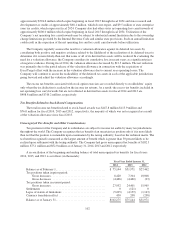

The Company receives certain tax incentives in Switzerland and Singapore in the form of reduced tax rates.

These temporary tax reduction programs will both expire in fiscal 2016.

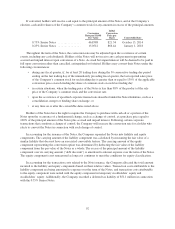

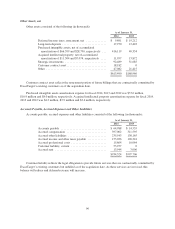

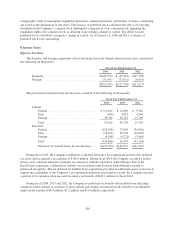

Deferred Income Taxes

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of the Company’s deferred tax assets and liabilities were as follows (in thousands):

As of January 31,

2014 2013

Deferred tax assets:

Net operating loss carryforwards .............. $259,465 $ 62,603

Deferred stock compensation ................. 82,840 69,593

Tax credits ............................... 107,381 75,812

Deferred rent expense ....................... 47,063 28,022

Accrued liabilities .......................... 79,235 63,257

Deferred revenue .......................... 8,522 30,441

Basis difference on investment ................ 11,999 8,569

Financing obligation ........................ 63,673 0

Other .................................... 17,762 9,916

Total deferred tax assets ......................... 677,940 348,213

Less valuation allowance ........................ (180,223) (192,682)

Deferred tax assets, net of valuation allowance ....... 497,717 155,531

Deferred tax liabilities:

Deferred commissions ...................... (87,625) (72,470)

Purchased intangibles ....................... (259,409) (14,739)

Unrealized gains on investments .............. (5,232) (2,768)

Depreciation and amortization ................ (144,752) (41,832)

Other .................................... (3,599) (7,351)

Total deferred tax liabilities ...................... (500,617) (139,160)

Net deferred tax assets .......................... $ (2,900) $ 16,371

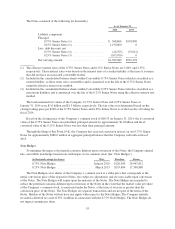

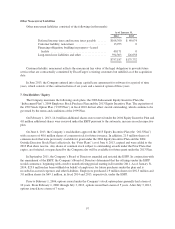

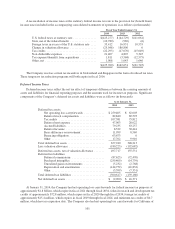

At January 31, 2014, the Company had net operating loss carryforwards for federal income tax purposes of

approximately $1.8 billion, which expire in fiscal 2021 through fiscal 2034, federal research and development tax

credits of approximately $72.8 million, which expire in fiscal 2020 through fiscal 2034, foreign tax credits of

approximately $15.4 million, which expires in fiscal 2019 through fiscal 2024, and minimum tax credits of $0.7

million, which have no expiration date. The Company also had net operating loss carryforwards for California of

101