Salesforce.com 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

valuation allowance for a significant portion of our deferred tax assets was established that resulted in a tax

expense of $186.8 million. We will continue to assess the realizability of the deferred tax assets in each of the

applicable jurisdictions going forward and adjust the valuation allowance accordingly. Due to the valuation

allowance, the effective tax rate could be volatile and is therefore difficult to forecast in future periods. See

Note 8 “Income Taxes” to the Notes to the Consolidated Financial Statements for our reconciliation of income

taxes at the statutory federal rate to the provision for income taxes.

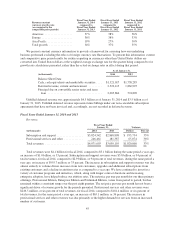

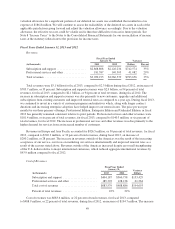

Fiscal Years Ended January 31, 2013 and 2012

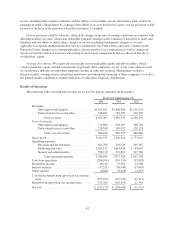

Revenues.

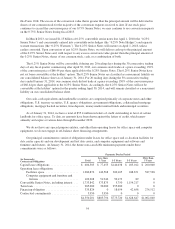

Fiscal Year Ended

January 31, Variance

(in thousands) 2013 2012 Dollars Percent

Subscription and support .................... $2,868,808 $2,126,234 $742,574 35%

Professional services and other ............... 181,387 140,305 41,082 29%

Total revenues ............................ $3,050,195 $2,266,539 $783,656 35%

Total revenues were $3.1 billion for fiscal 2013, compared to $2.3 billion during fiscal 2012, an increase of

$783.7 million, or 35 percent. Subscription and support revenues were $2.9 billion, or 94 percent of total

revenues, for fiscal 2013, compared to $2.1 billion, or 94 percent of total revenues, during fiscal 2012. The

increase in subscription and support revenues was due primarily to new customers, upgrades and additional

subscriptions from existing customers and improved renewal rates as compared to a year ago. During fiscal 2013,

we continued to invest in a variety of customer programs and initiatives which, along with longer contract

durations and increasing enterprise adoption, have helped improve our renewal rates. The price per user per

month for our three primary offerings, Professional Edition, Enterprise Edition and Unlimited Edition, in fiscal

2013 has generally remained consistent relative to prior periods. Professional services and other revenues were

$181.4 million, or six percent of total revenues, for fiscal 2013, compared to $140.3 million, or six percent of

total revenues, for fiscal 2012. The increase in professional services and other revenues was due primarily to the

higher demand for services from an increased number of customers.

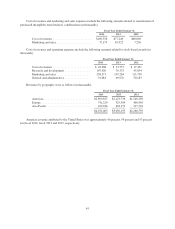

Revenues in Europe and Asia Pacific accounted for $926.5 million, or 30 percent of total revenues, for fiscal

2013, compared to $726.3 million, or 32 percent of total revenues, during fiscal 2012, an increase of

$200.2 million, or 28 percent. The increase in revenues outside of the Americas was the result of the increasing

acceptance of our service, our focus on marketing our services internationally and improved renewal rates as a

result of the reasons stated above. Revenues outside of the Americas increased despite an overall strengthening

of the U.S. dollar relative to major international currencies, which reduced aggregate international revenues by

$43.9 million compared to fiscal 2012.

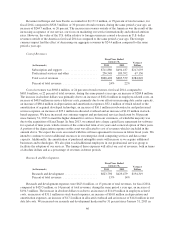

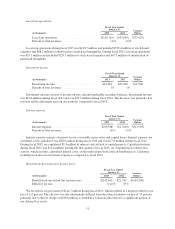

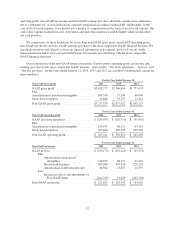

Cost of Revenues.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2013 2012

Subscription and support ....................... $494,187 $360,758 $133,429

Professional services and other .................. 189,392 128,128 61,264

Total cost of revenues ......................... $683,579 $488,886 $194,693

Percent of total revenues ....................... 22% 22%

Cost of revenues was $683.6 million, or 22 percent of total revenues, for fiscal 2013, compared

to $488.9 million, or 22 percent of total revenues, during fiscal 2012, an increase of $194.7 million. The increase

49