Salesforce.com 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

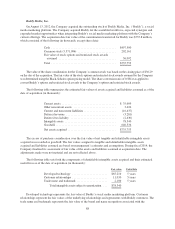

marketing of Buddy’s service offerings. The goodwill balance is primarily attributed to the assembled workforce

and expanded market opportunities when integrating Buddy’s social media marketing platform with the

Company’s other social media marketing offerings. The goodwill balance is not deductible for U.S. income tax

purposes.

The Company assumed unvested options and restricted stock awards with a fair value of $67.4 million. Of

the total consideration, $36.1 million was allocated to the purchase consideration and $31.3 million was allocated

to future services that are expensed over the remaining service periods on a straight-line basis.

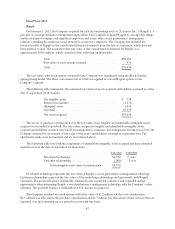

GoInstant, Inc.

On September 4, 2012, the Company acquired for cash the outstanding stock of GoInstant, Inc.

(“GoInstant”) a provider of co-browsing technology that allows two or more people to collaboratively browse the

same website together. The Company acquired GoInstant to, among other things, deliver its customers an easy to

use co-browse experience. The Company has included the financial results of GoInstant in the consolidated

financial statements from the date of acquisition, which have not been material to date. The acquisition date fair

value of the consideration transferred for GoInstant was approximately $50.6 million, which consisted of the

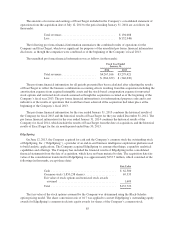

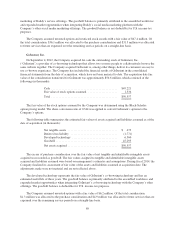

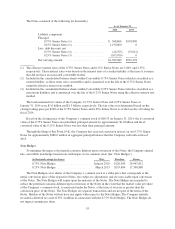

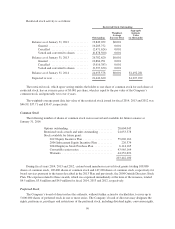

following (in thousands):

Cash ............................................. $49,221

Fair value of stock options assumed .................... 1,336

Total ............................................. $50,557

The fair value of the stock options assumed by the Company was determined using the Black-Scholes

option pricing model. The share conversion ratio of 0.344 was applied to convert GoInstant’s options to the

Company’s options.

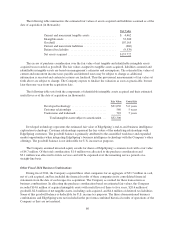

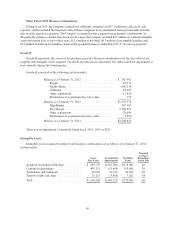

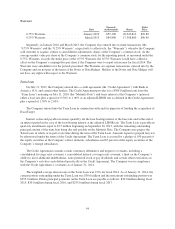

The following table summarizes the estimated fair values of assets acquired and liabilities assumed as of the

date of acquisition (in thousands):

Net tangible assets .................................. $ 473

Deferred tax liability ................................ (1,771)

Developed technology ............................... 6,560

Goodwill .......................................... 45,295

Net assets acquired .................................. $50,557

The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets

acquired was recorded as goodwill. The fair values assigned to tangible and identifiable intangible assets

acquired and liabilities assumed were based on management’s estimates and assumptions. During fiscal 2014, the

Company finalized its assessment of fair value of the assets and liabilities assumed at acquisition date. The

adjustments made were not material and are not reflected above.

The developed technology represents the fair value of GoInstant’s co-browsing technology and has an

estimated useful life of three years. The goodwill balance is primarily attributed to the assembled workforce and

expanded market opportunities when integrating GoInstant’s co-browsing technology with the Company’s other

offerings. The goodwill balance is deductible for U.S. income tax purposes.

The Company assumed unvested options with a fair value of $6.2 million. Of the total consideration,

$1.3 million was allocated to the purchase consideration and $4.9 million was allocated to future services that are

expensed over the remaining service periods on a straight-line basis.

89