Salesforce.com 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

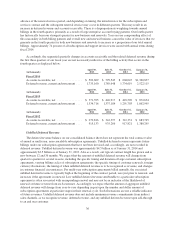

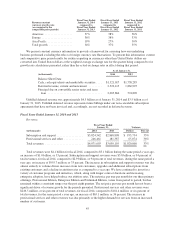

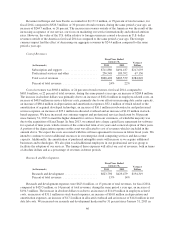

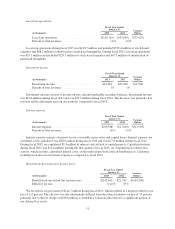

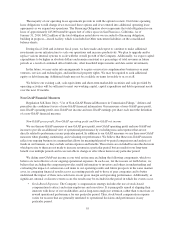

Revenue constant

currency growth rates

(as compared to the

comparable prior periods)

Fiscal Year Ended

January 31, 2014

compared to

Fiscal Year Ended

January 31, 2013

Fiscal Year Ended

January 31, 2013

compared to

Fiscal Year Ended

January 31, 2012

Fiscal Year Ended

January 31, 2012

compared to

Fiscal Year Ended

January 31, 2011

Americas ................... 37% 38% 36%

Europe ..................... 36% 38% 33%

Asia Pacific ................. 19% 27% 30%

Total growth ................ 34% 37% 35%

We present constant currency information to provide a framework for assessing how our underlying

business performed excluding the effect of foreign currency rate fluctuations. To present this information, current

and comparative prior period results for entities reporting in currencies other than United States dollars are

converted into United States dollars at the weighted average exchange rate for the quarter being compared to for

growth rate calculations presented, rather than the actual exchange rates in effect during that period.

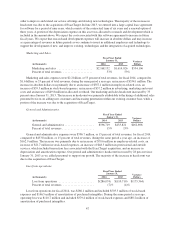

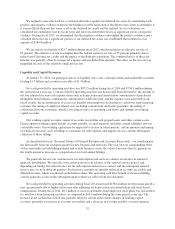

As of January 31,

(in thousands) 2014 2013

Balance Sheet Data:

Cash, cash equivalents and marketable securities .... $1,321,017 $1,758,285

Deferred revenue, current and noncurrent ......... 2,522,115 1,862,995

Principal due on convertible senior notes and term

loan ..................................... 2,003,864 574,890

Unbilled deferred revenue was approximately $4.5 billion as of January 31, 2014 and $3.5 billion as of

January 31, 2013. Unbilled deferred revenue represents future billings under our non-cancelable subscription

agreements that have not been invoiced and, accordingly, are not recorded in deferred revenue.

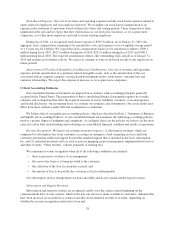

Fiscal Years Ended January 31, 2014 and 2013

Revenues.

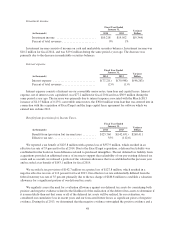

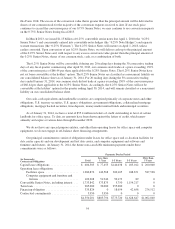

Fiscal Year Ended

January 31, Variance

(in thousands) 2014 2013 Dollars Percent

Subscription and support .................. $3,824,542 $2,868,808 $ 955,734 33%

Professional services and other ............. 246,461 181,387 65,074 36%

Total revenues .......................... $4,071,003 $3,050,195 $1,020,808 33%

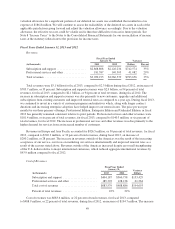

Total revenues were $4.1 billion for fiscal 2014, compared to $3.1 billion during the same period a year ago,

an increase of $1.0 billion, or 33 percent. Subscription and support revenues were $3.8 billion, or 94 percent of

total revenues, for fiscal 2014, compared to $2.9 billion, or 94 percent of total revenues, during the same period a

year ago, an increase of $955.7 million, or 33 percent. The increase in subscription and support revenues was due

almost entirely to volume-driven increases from new customers, upgrades and additional subscriptions from

existing customers and a decline in attrition rates as compared to a year ago. We have continued to invest in a

variety of customer programs and initiatives, which, along with longer contract durations and increasing

enterprise adoption, have helped reduce our attrition rates. The net price per user per month for our three primary

offerings, Professional Edition, Enterprise Edition and Unlimited Edition, varies from period to period, but has

remained within a consistent range over the past eight quarters. The net price per user per month has not been a

significant driver of revenue growth for the periods presented. Professional services and other revenues were

$246.5 million, or six percent of total revenues, for fiscal 2014, compared to $181.4 million, or six percent of

total revenues, for the same period a year ago, an increase of $65.1 million, or 36 percent. The increase in

professional services and other revenues was due primarily to the higher demand for services from an increased

number of customers.

45