Salesforce.com 2014 Annual Report Download - page 39

Download and view the complete annual report

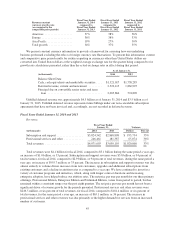

Please find page 39 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On July 12, 2013, we acquired for cash the outstanding stock of ExactTarget, a leading global provider of

cross-channel, digital marketing solutions. We acquired ExactTarget for the assembled workforce, expected

synergies and to create a world-class marketing platform across the channels of email, social, mobile and the

web. The financial results of ExactTarget are included in our consolidated financial statements from the date of

acquisition. The total purchase price for ExactTarget was approximately $2.6 billion.

Fiscal Year

Our fiscal year ends on January 31. References to fiscal 2014, for example, refer to the fiscal year ending

January 31, 2014.

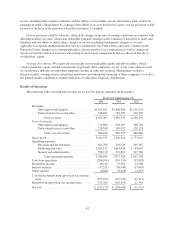

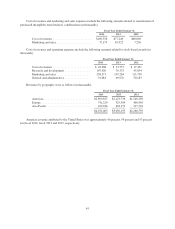

Sources of Revenues

We derive our revenues from two sources: (1) subscription revenues, which are comprised of subscription

fees from customers accessing our enterprise cloud computing services and from customers purchasing

additional support beyond the standard support that is included in the basic subscription fees; and (2) related

professional services such as process mapping, project management, implementation services and other revenue.

“Other revenue” consists primarily of training fees. Subscription and support revenues accounted for

approximately 94 percent of our total revenues for fiscal 2014. Subscription revenues are driven primarily by the

number of paying subscribers, varying service types, the price of our service and renewals. We define a

“customer” as a separate and distinct buying entity (e.g., a company, a distinct business unit of a large

corporation, a partnership, etc.) that has entered into a contract to access our enterprise cloud computing services.

We define a “subscription” as a unique user account purchased by a customer for use by its employees or other

customer-authorized users, and we refer to each such user as a “subscriber.” The number of paying subscriptions

at each of our customers ranges from one to hundreds of thousands. None of our customers accounted for more

than five percent of our revenues during fiscal 2014, 2013 and 2012.

Subscription and support revenues are recognized ratably over the contract terms beginning on the

commencement dates of each contract. The typical subscription and support term is 12 to 36 months, although

terms range from one to 60 months. Our subscription and support contracts are non-cancelable, though customers

typically have the right to terminate their contracts for cause if we materially fail to perform. We generally

invoice our customers in advance, in annual or quarterly installments, and typical payment terms provide that our

customers pay us within 30 days of invoice. Amounts that have been invoiced are recorded in accounts

receivable and in deferred revenue, or in revenue depending on whether the revenue recognition criteria have

been met. In general, we collect our billings in advance of the subscription service period.

Professional services and other revenues consist of fees associated with consulting and implementation

services and training. Our consulting and implementation engagements are typically billed on a time and

materials basis. We also offer a number of training classes on implementing, using and administering our service

that are billed on a per person, per class basis. Our typical professional services payment terms provide that our

customers pay us within 30 days of invoice.

In determining whether professional services can be accounted for separately from subscription and support

revenues, we consider a number of factors, which are described in “Critical Accounting Estimates—Revenue

Recognition” below.

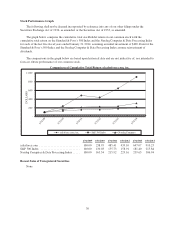

Seasonal Nature of Deferred Revenue and Accounts Receivable

Deferred revenue primarily consists of billings to customers for our subscription service. Over 90 percent of

the value of our billings to customers is for our subscription and support service. We generally invoice our

customers in either annual or quarterly cycles. Occasionally, we bill customers for their multi-year contract on a

single invoice which results in an increase in noncurrent deferred revenue. We typically issue renewal invoices in

35