Salesforce.com 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

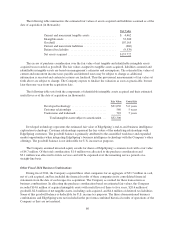

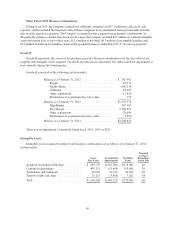

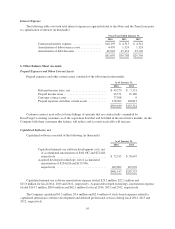

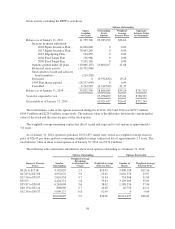

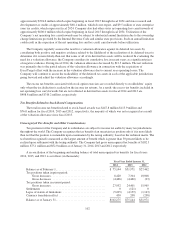

Other Assets, net

Other assets consisted of the following (in thousands):

As of January 31,

2014 2013

Deferred income taxes, noncurrent, net .............. $ 9,691 $ 19,212

Long-term deposits .............................. 17,970 13,422

Purchased intangible assets, net of accumulated

amortization of $66,399 and $28,790, respectively . . . 416,119 49,354

Acquired intellectual property, net of accumulated

amortization of $11,304 and $7,074, respectively .... 11,957 13,872

Strategic investments ............................ 92,489 51,685

Customer contract asset ........................... 18,182 0

Other ......................................... 47,082 21,415

$613,490 $168,960

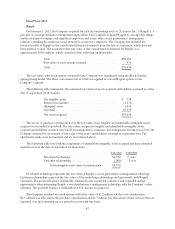

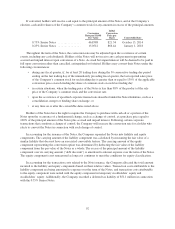

Customer contract asset reflects the noncurrent portion of future billings that are contractually committed by

ExactTarget’s existing customers as of the acquisition date.

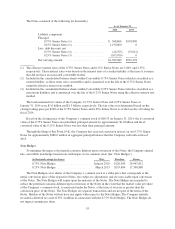

Purchased intangible assets amortization expense for fiscal 2014, 2013 and 2012 was $37.6 million,

$10.9 million and $8.0 million, respectively. Acquired intellectual property amortization expense for fiscal 2014,

2013 and 2012 was $4.2 million, $3.9 million and $2.4 million, respectively.

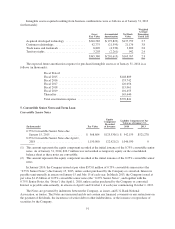

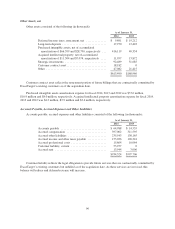

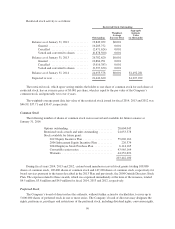

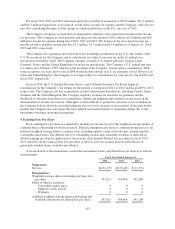

Accounts Payable, Accrued Expenses and Other Liabilities

Accounts payable, accrued expenses and other liabilities consisted of the following (in thousands):

As of January 31,

2014 2013

Accounts payable ............................... $ 64,988 $ 14,535

Accrued compensation ........................... 397,002 311,595

Accrued other liabilities .......................... 235,543 138,165

Accrued income and other taxes payable ............. 153,026 120,341

Accrued professional costs ........................ 15,864 10,064

Customer liability, current ........................ 53,957 0

Accrued rent ................................... 13,944 3,006

$934,324 $597,706

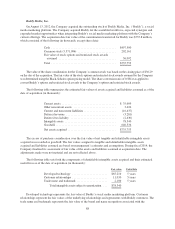

Customer liability reflects the legal obligation to provide future services that are contractually committed by

ExactTarget’s existing customers but unbilled as of the acquisition date. As these services are invoiced, this

balance will reduce and deferred revenue will increase.

96