Salesforce.com 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

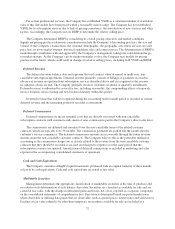

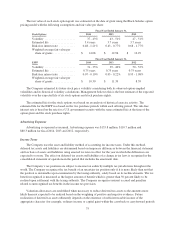

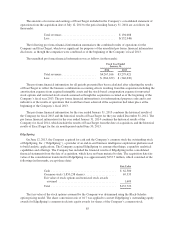

The fair value of each stock option grant was estimated on the date of grant using the Black-Scholes option

pricing model with the following assumptions and fair value per share:

Fiscal Year Ended January 31,

Stock Options 2014 2013 2012

Volatility ..................... 37-43% 43-51% 47-51%

Estimated life ................. 3.4years 3.7 years 3.7 years

Risk-free interest rate ........... 0.48 - 1.21% 0.43 - 0.77% 0.68 - 1.77%

Weighted-average fair value per

share of grants ............... $ 14.08 $ 12.94 $ 12.29

Fiscal Year Ended January 31,

ESPP 2014 2013 2012

Volatility ..................... 31-35% 39-46% 50-53%

Estimated life ................. 0.75 years 0.75 years 0.75 years

Risk-free interest rate ........... 0.07 - 0.10% 0.03 - 0.22% 0.95 - 1.08%

Weighted-average fair value per

share of grants ............... $ 10.30 $ 11.39 8.59

The Company estimated its future stock price volatility considering both its observed option-implied

volatilities and its historical volatility calculations. Management believes this is the best estimate of the expected

volatility over the expected life of its stock options and stock purchase rights.

The estimated life for the stock options was based on an analysis of historical exercise activity. The

estimated life for the ESPP was based on the two purchase periods within each offering period. The risk-free

interest rate is based on the rate for a U.S. government security with the same estimated life at the time of the

option grant and the stock purchase rights.

Advertising Expenses

Advertising is expensed as incurred. Advertising expense was $155.8 million, $110.7 million and

$80.3 million for fiscal 2014, 2013 and 2012, respectively.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. Under this method,

deferred tax assets and liabilities are determined based on temporary differences between the financial statement

and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are

expected to reverse. The effect on deferred tax assets and liabilities of a change in tax laws is recognized in the

consolidated statement of operations in the period that includes the enactment date.

The Company’s tax positions are subject to income tax audits by multiple tax jurisdictions throughout the

world. The Company recognizes the tax benefit of an uncertain tax position only if it is more likely than not that

the position is sustainable upon examination by the taxing authority, solely based on its technical merits. The tax

benefit recognized is measured as the largest amount of benefit which is greater than 50 percent likely to be

realized upon settlement with the taxing authority. The Company recognizes interest accrued and penalties

related to unrecognized tax benefits in the income tax provision.

Valuation allowances are established when necessary to reduce deferred tax assets to the amounts more

likely than not expected to be realized based on the weighting of positive and negative evidence. Future

realization of deferred tax assets ultimately depends on the existence of sufficient taxable income of the

appropriate character (for example, ordinary income or capital gain) within the carryback or carryforward periods

75