Salesforce.com 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

acquired and liabilities assumed were based on management’s estimates and assumptions. During fiscal 2012 the

Company finalized its assessment of fair value of the assets and liabilities assumed at acquisition date. The

impact of all finalized business combination adjustments were recorded to goodwill and decreased goodwill by

$0.2 million. This adjustment is not reflected in the table above.

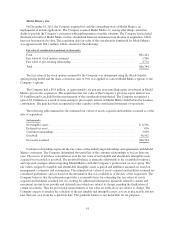

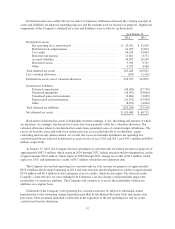

The following table sets forth the components of identifiable intangible assets acquired and their estimated

useful lives as of the date of acquisition:

(in thousands) Fair value Useful Life

Developed service technology and database ........................... $23,560 3 years

Customer relationships ............................................ 2,440 5 years

Trade name and trademark ......................................... 2,140 3 years

Total intangible assets subject to amortization ..................... $28,140

Customer relationships represent the fair values of the underlying relationships and agreements with

Jigsaw’s customers. Developed service technology and database represents the fair values of the Jigsaw

technology and database that contains the business contact data. Trade name and trademark represents the fair

values of brand and name recognition associated with the marketing of Jigsaw’s services. The goodwill balance

is not deductible for tax purposes. The goodwill balance is primarily attributable to Jigsaw’s assembled

workforce and the expected synergies and revenue opportunities when combining the business contact data

within the Jigsaw solution with the Company’s cloud applications.

Heroku, Inc.

In January 2011 the Company acquired for cash the stock of Heroku, Inc. (“Heroku”), a

platform-as-a-service cloud vendor, built to work in an open environment and take advantage of the Ruby

language. Ruby has become one of the leading development languages used for applications that are social,

collaborative and deliver real-time access to information across mobile devices. The Company has included the

financial results of Heroku in the consolidated financial statements from the date of acquisition. The total

purchase consideration for Heroku was approximately $216.7 million, entirely in cash.

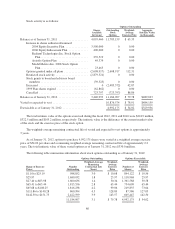

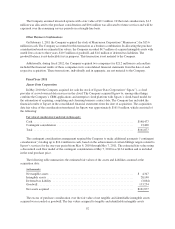

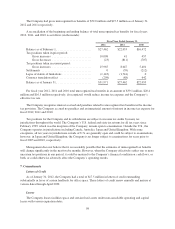

The following table summarizes the estimated fair values of the assets and liabilities assumed at the

acquisition date:.

(in thousands)

Net tangible assets ......................................................... $ 5,411

Intangible assets ........................................................... 40,060

Deferred tax liability ....................................................... (10,060)

Goodwill ................................................................. 181,304

Net assets acquired ......................................................... $216,715

The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets

acquired was recorded as goodwill. The fair values assigned to tangible and identifiable intangible assets

acquired and liabilities assumed were based on management’s estimates and assumptions. During fiscal 2012 the

Company finalized its assessment of fair value of the assets and liabilities assumed at the acquisition date. The

impact of all finalized business combination adjustments were recorded to goodwill and decreased goodwill by

$1.3 million. This adjustment is not reflected in the table above.

93