Salesforce.com 2012 Annual Report Download - page 43

Download and view the complete annual report

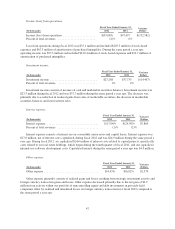

Please find page 43 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Prior to February 1, 2011, the deliverables in multiple-deliverable arrangements were accounted for separately

if the delivered items had standalone value and there was objective and reliable evidence of fair value for the

undelivered items. If the deliverables in a multiple-deliverable arrangement could not be accounted for separately,

the total arrangement fee was recognized ratably as a single unit of accounting over the contracted term of the

subscription agreement. A significant portion of our multiple-deliverable arrangements were accounted for as a

single unit of accounting because we did not have objective and reliable evidence of fair value for certain of our

deliverables. Additionally, in these situations, we deferred the direct costs of a professional services arrangement

and amortized those costs over the same period as the professional services revenue is recognized.

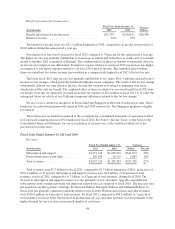

In October 2009, the FASB issued Accounting Standards Update No. 2009-13, “Revenue Recognition

(Topic 605), Multiple-Deliverable Revenue Arrangements—a consensus of the FASB Emerging Issues Task

Force” (“ASU 2009-13”) which amended the previous multiple-deliverable arrangements accounting guidance.

Pursuant to the updated guidance, objective and reliable evidence of fair value of the deliverables to be delivered

is no longer required in order to account for deliverables in a multiple-deliverable arrangement separately.

Instead, arrangement consideration is allocated to deliverables based on their relative selling price.

In the first quarter of fiscal 2012, we adopted this updated accounting guidance on a prospective basis. We

have applied the new accounting guidance to those multiple-deliverable arrangements entered into or materially

modified on or after February 1, 2011 which is the beginning of our fiscal year.

The adoption of this updated accounting guidance did not have a material impact on our financial condition,

results of operations or cash flows. As of January 31, 2012, the deferred professional services revenue and

deferred costs under the previous accounting guidance are $30.5 million and $14.3 million, respectively, which

will continue to be recognized over the related remaining subscription period.

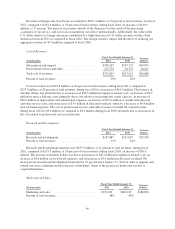

Under the updated accounting guidance, in order to treat deliverables in a multiple-deliverable arrangement

as separate units of accounting, the deliverables must have standalone value upon delivery. If the deliverables

have standalone value upon delivery, we account for each deliverable separately. Subscription services have

standalone value as such services are often sold separately. In determining whether professional services have

standalone value, we consider the following factors for each professional services agreement: availability of the

services from other vendors, the nature of the professional services, the timing of when the professional services

contract was signed in comparison to the subscription service start date, and the contractual dependence of the

subscription service on the customer’s satisfaction with the professional services work. To date, we have

concluded that all of the professional services included in multiple-deliverable arrangements executed have

standalone value.

Under the updated accounting guidance, when multiple-deliverables included in an arrangement are separated

into different units of accounting, the arrangement consideration is allocated to the identified separate units based on

a relative selling price hierarchy. We determine the relative selling price for a deliverable based on its vendor-

specific objective evidence of selling price (“VSOE”), if available, or our best estimate of selling price (“BESP”), if

VSOE is not available. We have determined that third-party evidence (“TPE”) is not a practical alternative due to

differences in our service offerings compared to other parties and the availability of relevant third-party pricing

information. The amount of revenue allocated to delivered items is limited by contingent revenue, if any.

For certain professional services, we have established VSOE as a consistent number of standalone sales of

this deliverable have been priced within a reasonably narrow range. We have not established VSOE for our

subscription services due to lack of pricing consistency, the introduction of new services and other factors.

Accordingly, we use our BESP to determine the relative selling price.

We determined BESP by considering our overall pricing objectives and market conditions. Significant

pricing practices taken into consideration include our discounting practices, the size and volume of our

transactions, the customer demographic, the geographic area where our services are sold, our price lists, our

39