Salesforce.com 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Warrants

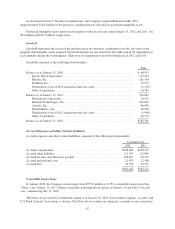

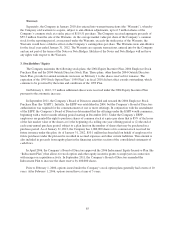

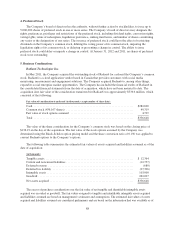

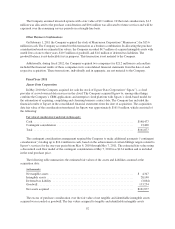

Separately, the Company in January 2010 also entered into warrant transactions (the “Warrants”), whereby

the Company sold warrants to acquire, subject to anti-dilution adjustments, up to 6.7 million shares of the

Company’s common stock at a strike price of $119.51 per share. The Company received aggregate proceeds of

$59.3 million from the sale of the Warrants. As the average market value per share of the Company’s common

stock for the reporting period, as measured under the Warrants, exceeds the strike price of the Warrants, the

Warrants would have a dilutive effect on the Company’s earnings/loss per share. The Warrants were anti-dilutive

for the fiscal year ended January 31, 2012. The Warrants are separate transactions, entered into by the Company

and are not part of the terms of the Notes or Note Hedges. Holders of the Notes and Note Hedges will not have

any rights with respect to the Warrants.

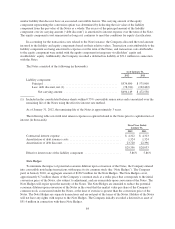

3. Stockholders’ Equity

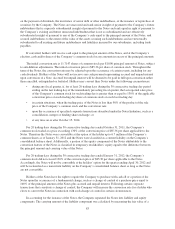

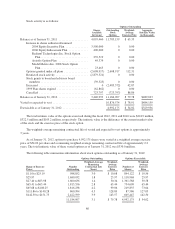

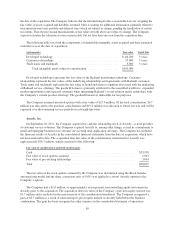

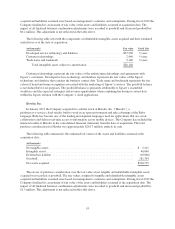

The Company maintains the following stock plans: the 2004 Equity Incentive Plan, 2004 Employee Stock

Purchase Plan and the 2004 Outside Directors Stock Plan. These plans, other than the 2004 Outside Directors

Stock Plan, provide for annual automatic increases on February 1 to the shares reserved for issuance. The

expiration of the 1999 Stock Option Plan (“1999 Plan”) in fiscal 2010 did not affect awards outstanding, which

continue to be governed by the terms and conditions of the 1999 Plan.

On February 1, 2012, 3.5 million additional shares were reserved under the 2004 Equity Incentive Plan

pursuant to the automatic increase.

In September 2011, the Company’s Board of Directors amended and restated the 2004 Employee Stock

Purchase Plan (the “ESPP”). Initially, the ESPP was established in 2004, but the Company’s Board of Directors

authorization was required for the commencement of one or more offerings. In conjunction with the amendment

of the ESPP, the Company’s Board of Directors determined that the offerings under the ESPP would commence,

beginning with a twelve month offering period starting in December 2011. Under the Company’s ESPP,

employees are granted the right to purchase shares of common stock at a price per share that is 85% of the lesser

of the fair market value of the shares at (1) the beginning of a rolling one-year offering period or (2) the end of

each semi-annual purchase period, subject to a plan limit on the number of shares that may be purchased in a

purchase period. As of January 31, 2012, the Company has 1,000,000 shares of its common stock reserved for

future issuance under this plan. As of January 31, 2012, $10.1 million has been held on behalf of employees for

future purchases under the plan and is recorded in accrued expenses and other current liabilities. This amount is

also included in proceeds from equity plans in the financing activities section of the consolidated statements of

cash flows.

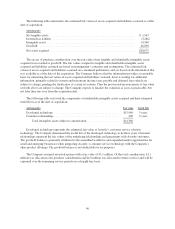

In April 2006, the Company’s Board of Directors approved the 2006 Inducement Equity Incentive Plan (the

“Inducement Plan”) that allows for stock option and other equity incentive grants to employees in connection

with merger or acquisition activity. In September 2011, the Company’s Board of Directors amended the

Inducement Plan to increase the share reserve by 400,000 shares.

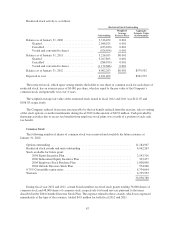

Prior to February 1, 2006, options issued under the Company’s stock option plans generally had a term of 10

years. After February 1, 2006, options issued have a term of 5 years.

85