Salesforce.com 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

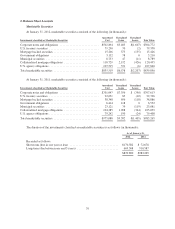

computers, equipment and software under capital leases totaled $31.7 million and $18.5 million, respectively, at

January 31, 2012 and 2011. Amortization of assets under capital leases is included in depreciation and

amortization expense.

Land and buildings and improvements

During the fourth quarter of fiscal 2011, the Company purchased approximately 14 acres of undeveloped

land in San Francisco, California, including entitlements and improvements associated with the land, and

perpetual parking rights in an existing garage for approximately $278.0 million in cash. During fiscal 2011, the

Company recorded $248.3 million to the undeveloped land and $6.4 million to buildings and improvements. The

Company recorded $23.3 million for the perpetual parking rights as a purchased intangible asset in other assets

on the consolidated balance sheet.

Pre-construction costs capitalized related to the development of the land including interest costs and

property taxes were $33.8 million in fiscal 2012.

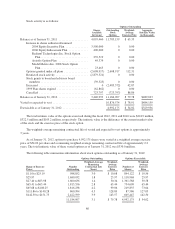

Capitalized Software

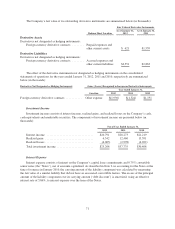

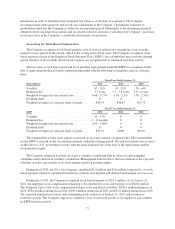

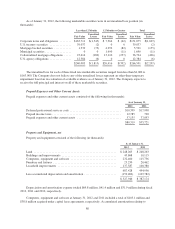

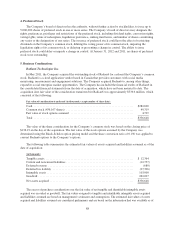

Capitalized software consisted of the following (in thousands):

As of January 31,

2012 2011

Capitalized internal-use software development costs, net of accumulated

amortization of $50,300 and $34,513, respectively ................... $ 41,442 $ 29,154

Acquired developed technology, net of accumulated amortization of $99,886

and $37,818, respectively ....................................... 146,970 98,833

$188,412 $127,987

Capitalized internal-use software amortization expense totaled $15.8 million and $13.1 million for the years

ended January 31, 2012 and 2011, respectively. Acquired developed technology amortization expense totaled

$62.1 million and $16.9 million for the years ended January 31, 2012 and 2011, respectively.

As described in Note 5 “Business Combinations” the Company acquired Radian6 in May 2011.

Approximately $84.2 million of the purchase consideration was allocated to acquired developed technology.

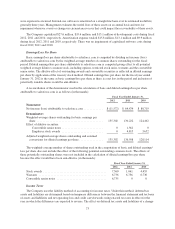

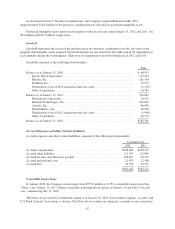

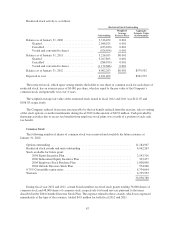

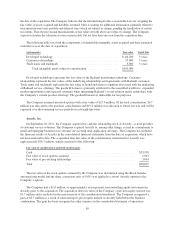

Other Assets, net

Other assets consisted of the following (in thousands):

As of January 31,

2012 2011

Deferred professional services costs, noncurrent portion ................. $ 3,935 $ 10,201

Long-term deposits .............................................. 13,941 12,114

Purchased intangible assets, net of accumulated amortization of $17,868 and

$9,868, respectively ............................................ 46,110 31,660

Acquired intellectual property, net of accumulated amortization of $3,139

and $746, respectively. ......................................... 15,020 5,874

Strategic investments ............................................ 53,949 27,065

Other ......................................................... 22,194 17,457

$155,149 $104,371

81