Salesforce.com 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

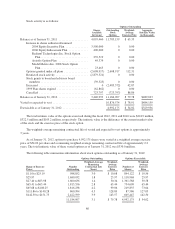

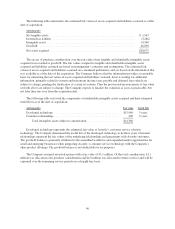

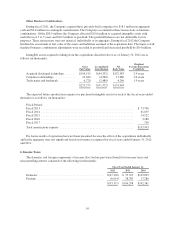

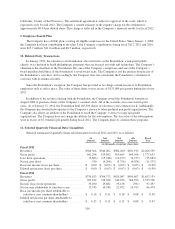

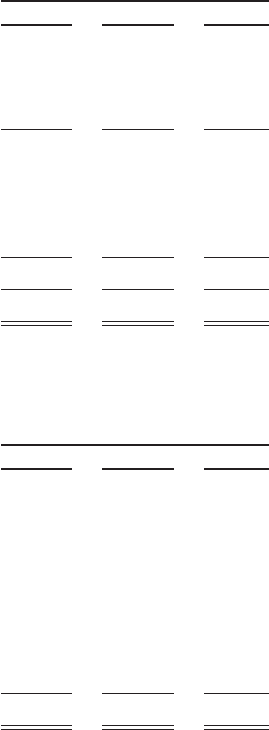

The provision (benefit) for income taxes consisted of the following (in thousands):

Fiscal Year Ended January 31,

2012 2011 2010

Current:

Federal ........................................... $ 9,344 $ 29,992 $43,313

State ............................................. 4,346 6,276 8,788

Foreign ........................................... 15,709 13,239 12,179

Total ............................................. 29,399 49,507 64,280

Deferred:

Federal ........................................... (36,601) (8,687) (4,506)

State ............................................. (10,603) (4,745) (979)

Foreign ........................................... (3,940) (1,474) (1,106)

Total ............................................. (51,144) (14,906) (6,591)

Provision (benefit) for income taxes .................... $(21,745) $ 34,601 $57,689

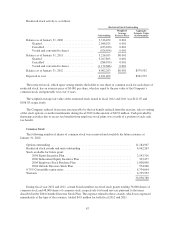

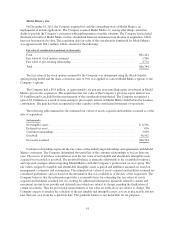

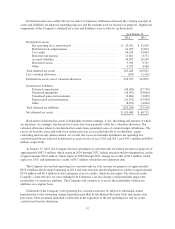

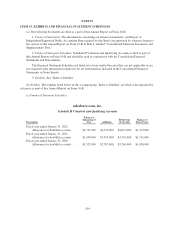

A reconciliation of income taxes at the statutory federal income tax rate to the provision (benefit) for

income taxes included in the accompanying consolidated statements of operations is as follows (in thousands):

Fiscal Year Ended January 31,

2012 2011 2010

U.S. federal taxes at statutory rate .......................... $(11,661) $ 36,504 $49,833

State, net of the federal benefit ............................ (6) 6,069 8,645

Foreign taxes in excess of the U.S. statutory rate .............. 10,555 3,412 6,748

Tax credits ............................................ (15,049) (13,625) (9,845)

Non-deductible expenses ................................. 5,345 2,621 755

Tax benefit from acquisitions ............................. (12,575) 0 0

Impact of California tax law change ........................ 0 2,199 2,747

Tax—noncontrolling interest .............................. 0 (1,825) (1,390)

Other, net ............................................. 1,646 (754) 196

$(21,745) $ 34,601 $57,689

The Company receives certain tax incentives in Switzerland and Singapore in the form of reduced tax rates.

These temporary tax reduction programs will expire in 2016 and 2014 respectively. The Singapore program is

eligible for renewal.

96