Salesforce.com 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

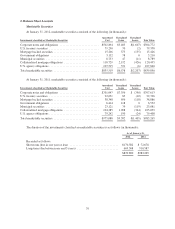

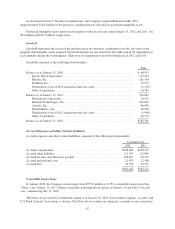

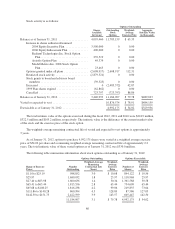

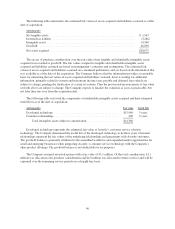

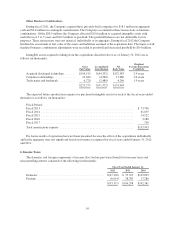

Restricted stock activity is as follows:

Restricted Stock Outstanding

Outstanding

Weighted-

Average

Exercise Price

Aggregate

Intrinsic Value

(in thousands)

Balance as of January 31, 2010 .................... 2,316,452 0.001

Granted ................................... 2,048,925 0.001

Cancelled ................................. (223,220) 0.001

Vested and converted to shares ................ (926,054) 0.001

Balance as of January 31, 2011 .................... 3,216,103 $0.001

Granted ................................... 3,207,805 0.001

Cancelled ................................. (288,959) 0.001

Vested and converted to shares ................ (1,172,686) 0.001

Balance as of January 31, 2012 .................... 4,962,263 $0.001 $579,592

Expected to vest ................................ 4,811,402 $561,972

The restricted stock, which upon vesting entitles the holder to one share of common stock for each share of

restricted stock, has an exercise price of $0.001 per share, which is equal to the par value of the Company’s

common stock, and generally vest over 4 years.

The weighed-average fair value of the restricted stock issued in fiscal 2012 and 2011 was $121.87 and

$108.03, respectively.

The Company reduced its income taxes payable by the tax benefit realized from the exercise, sale or vesting

of the stock options or similar instruments during fiscal 2012 in the amount of $49.0 million. Cash provided by

financing activities due to excess tax benefits from employee stock plans was a result of a portion of such cash

tax benefit.

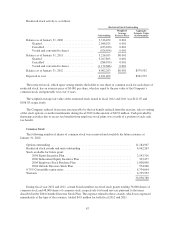

Common Stock

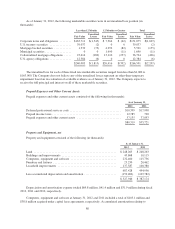

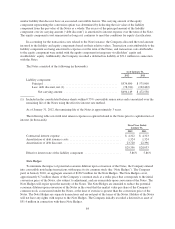

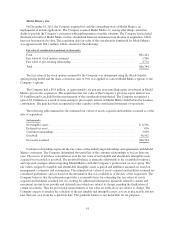

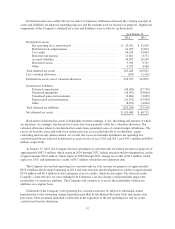

The following number of shares of common stock were reserved and available for future issuance at

January 31, 2012:

Options outstanding ....................................................... 11,184,907

Restricted stock awards and units outstanding .................................. 4,962,263

Stock available for future grant:

2004 Equity Incentive Plan ............................................. 2,543,316

2006 Inducement Equity Incentive Plan ................................... 323,477

2004 Employee Stock Purchase Plan ..................................... 1,000,000

2004 Outside Directors Stock Plan ....................................... 574,200

0.75% Convertible senior notes ............................................. 6,734,664

Warrants ............................................................... 6,735,953

34,058,780

During fiscal year 2012 and 2011, certain board members received stock grants totaling 36,800 shares of

common stock and 48,000 shares of common stock, respectively for board services pursuant to the terms

described in the 2004 Outside Directors Stock Plan. The expense related to these awards, which was expensed

immediately at the time of the issuance, totaled $4.9 million for both fiscal 2012 and 2011.

87