Salesforce.com 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

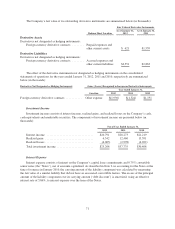

information in order to determine their estimated fair values as of the date of acquisition. The Company

reevaluates these items quarterly and records any adjustments to the Company’s preliminary estimates to

goodwill provided that the Company is within the measurement period. Subsequent to the measurement period,

changes to these uncertain tax positions and tax related valuation allowances will affect the Company’s provision

for income taxes in the Company’s consolidated statements of operations.

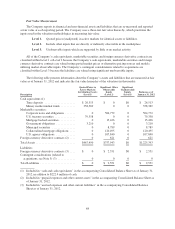

Accounting for Stock-Based Compensation

The Company recognizes stock-based expenses related to stock options on a straight-line basis over the

requisite service period of the awards, which is the vesting term of four years. The Company recognizes stock-

based expenses related to the Employee Stock Purchase Plan (“ESPP”) on a straight-line basis over the offering

period, which is twelve months. Stock-based expenses are recognized net of estimated forfeiture activity.

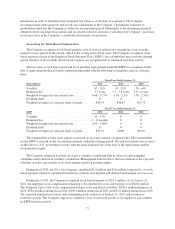

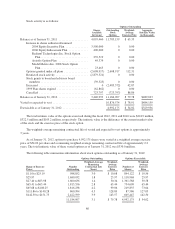

The fair value of each option grant and stock purchase right granted under the ESPP was estimated on the

date of grant using the Black-Scholes option pricing model with the following assumptions and fair value per

share:

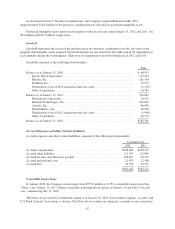

Fiscal Year Ended January 31,

Stock Options 2012 2011 2010

Volatility ................................. 47-51% 45-50% 50-60%

Estimated life .............................. 3.7years 3.7 - 3.8 years 3.8 - 4 years

Weighted-average risk-free interest rate ......... 0.68 - 1.77% 0.98 - 2.1% 1.78 - 2.39%

Dividend yield ............................. 0 0 0

Weighted-average fair value per share of grants . . . $49.14 $48.83 $24.73

Fiscal Year Ended January 31,

ESPP 2012 2011 2010

Volatility ................................. 50-53% 0 0

Estimated life .............................. 6-12months 0 0

Weighted-average risk-free interest rate ......... 0.95 - 1.08% 0 0

Dividend yield ............................. 0 0 0

Weighted-average fair value per share of grants . . . $34.34 $0.00 $0.00

The estimated life for the stock options was based on an actual analysis of expected life. The estimated life

for the ESPP was based on the two purchase periods within the offering period. The risk free interest rate is based

on the rate for a U.S. government security with the same estimated life at the time of the option grant and the

stock purchase rights.

The Company estimated its future stock price volatility considering both its observed option-implied

volatilities and its historical volatility calculations. Management believes this is the best estimate of the expected

volatility over the expected life of its stock options and stock purchase rights.

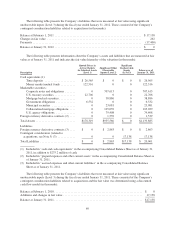

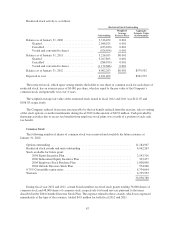

During fiscal 2012 and 2011, the Company capitalized $2.4 million and $2.6 million, respectively, of stock

based expenses related to capitalized internal-use software development and deferred professional services costs.

During fiscal 2012, the Company recognized stock-based expense of $229.3 million. As of January 31,

2012, the aggregate stock compensation remaining to be amortized to costs and expenses was $820.6 million.

The Company expects this stock compensation balance to be amortized as follows: $296.5 million during fiscal

2013; $256.4 million during fiscal 2014; $196.1 million during fiscal 2015 and $71.6 million during fiscal 2016.

The expected amortization reflects only outstanding stock awards as of January 31, 2012 and assumes no

forfeiture activity. The Company expects to continue to issue stock-based awards to its employees and continue

its ESPP in future periods.

77