Salesforce.com 2012 Annual Report Download - page 41

Download and view the complete annual report

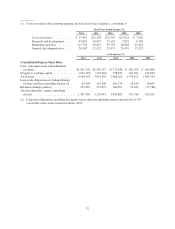

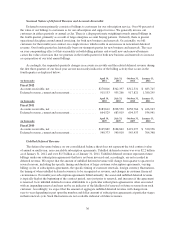

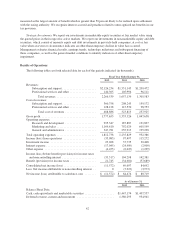

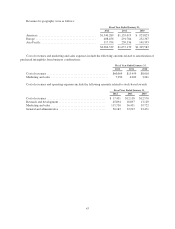

Please find page 41 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cost of Revenues and Operating Expenses

Cost of Revenues. Cost of subscription and support revenues primarily consists of expenses related to

hosting our service and providing support, the costs of data center capacity, depreciation or operating lease

expense associated with computer equipment and software, allocated overhead and amortization expense

associated with capitalized software related to our services and acquired developed technologies. We allocate

overhead such as rent and occupancy charges based on headcount. Employee benefit costs and taxes are allocated

based upon a percentage of total compensation expense. As such, general overhead expenses are reflected in each

cost of revenue and operating expense category. Cost of professional services and other revenues consists

primarily of employee-related costs associated with these services, including stock-based expenses, the cost of

subcontractors and allocated overhead. The cost of providing professional services is significantly higher as a

percentage of the related revenue than for our enterprise cloud computing subscription service due to the direct

labor costs and costs of subcontractors.

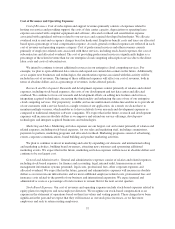

We intend to continue to invest additional resources in our enterprise cloud computing services. For

example, we plan to open additional data centers and expand our current data centers in the future. Additionally,

as we acquire new businesses and technologies, the amortization expense associated with this activity will be

included in cost of revenues. The timing of these additional expenses will affect our cost of revenues, both in

terms of absolute dollars and as a percentage of revenues, in the affected periods.

Research and Development. Research and development expenses consist primarily of salaries and related

expenses, including stock-based expenses, the costs of our development and test data center and allocated

overhead. We continue to focus our research and development efforts on adding new features and services,

integrating acquired technologies, increasing the functionality and enhancing the ease of use of our enterprise

cloud computing services. Our proprietary, scalable and secure multi-tenant architecture enables us to provide all

of our customers with a service based on a single version of our application. As a result, we do not have to

maintain multiple versions, which enables us to have relatively lower research and development expenses as

compared to traditional enterprise software companies. We expect that in the future, research and development

expenses will increase in absolute dollars as we improve and extend our service offerings, develop new

technologies and integrate acquired businesses and technologies.

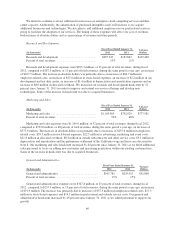

Marketing and Sales. Marketing and sales expenses are our largest cost and consist primarily of salaries and

related expenses, including stock-based expenses, for our sales and marketing staff, including commissions,

payments to partners, marketing programs and allocated overhead. Marketing programs consist of advertising,

events, corporate communications, brand building and product marketing activities.

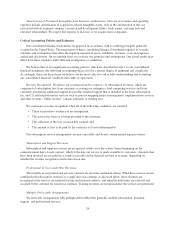

We plan to continue to invest in marketing and sales by expanding our domestic and international selling

and marketing activities, building brand awareness, attracting new customers and sponsoring additional

marketing events. We expect that in the future, marketing and sales expenses will increase in absolute dollars and

continue to be our largest cost.

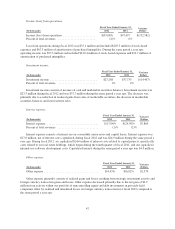

General and Administrative. General and administrative expenses consist of salaries and related expenses,

including stock-based expenses, for finance and accounting, legal, internal audit, human resources and

management information systems personnel, legal costs, professional fees, other corporate expenses and

allocated overhead. We expect that in the future, general and administrative expenses will increase in absolute

dollars as we invest in our infrastructure and we incur additional employee related costs, professional fees and

insurance costs related to the growth of our business and international expansion. We expect general and

administrative costs as a percentage of total revenues to remain flat for the next several quarters.

Stock-Based Expenses. Our cost of revenues and operating expenses include stock-based expenses related to

equity plans for employees and non-employee directors. We recognize our stock-based compensation as an

expense in the statement of operations based on their fair values and vesting periods. These charges have been

significant in the past and we expect that they will increase as our stock price increases, as we hire more

employees and seek to retain existing employees.

37