Salesforce.com 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

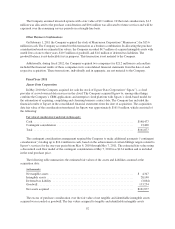

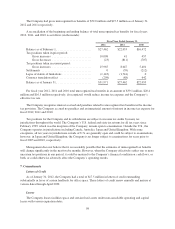

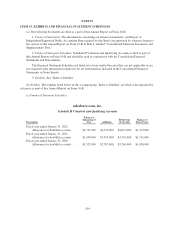

The Company had gross unrecognized tax benefits of $52.0 million and $27.5 million as of January 31,

2012 and 2011 respectively.

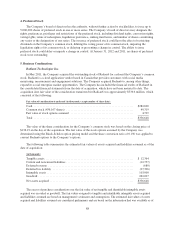

A reconciliation of the beginning and ending balance of total unrecognized tax benefits for fiscal years

2012, 2011, and 2010 is as follows (in thousands):

Fiscal Year Ended January 31,

2012 2011 2010

Balance as of February 1, ....................... $27,462 $22,053 $16,472

Tax positions taken in prior period:

Gross increases ........................... 10,008 41 457

Gross decreases ........................... (23) (811) (707)

Tax positions taken in current period:

Gross increases ........................... 15,965 8,047 5,401

Settlements .................................. 0 (39) (212)

Lapse of statute of limitations .................... (1,143) (1,741) 0

Currency translation effect ...................... (298) (88) 642

Balance as of January 31, ....................... $51,971 $27,462 $22,053

For fiscal year 2012, 2011 and 2010 total unrecognized tax benefits in an amount of $39.1 million, $20.4

million and $16.5 million respectively, if recognized, would reduce income tax expense and the Company’s

effective tax rate.

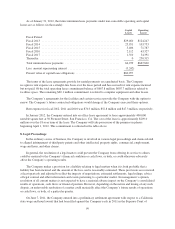

The Company recognizes interest accrued and penalties related to unrecognized tax benefits in the income

tax provision. The Company accrued no penalties and an immaterial amount of interest in income tax expense for

fiscal 2012, 2011 and 2010.

Tax positions for the Company and its subsidiaries are subject to income tax audits by many tax

jurisdictions throughout the world. The Company’s U.S. federal and state tax returns for all tax years since

February 1999, which was the inception of the Company, remain open to examination. Outside the U.S., the

Company operates in jurisdictions including Canada, Australia, Japan and United Kingdom. With some

exceptions, all tax years in jurisdictions outside of U.S. are generally open and could be subject to examinations,

however, in Japan and United Kingdom, the Company is no longer subject to examinations for years prior to

fiscal 2005 and 2010, respectively.

Management does not believe that it is reasonably possible that the estimates of unrecognized tax benefits

will change significantly in the next twelve months. However, when the Company effectively settles one or more

uncertain tax positions in any period, it could be material to the Company’s financial condition or cash flows, or

both, or could otherwise adversely affect the Company’s operating results.

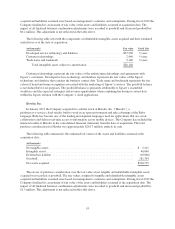

7. Commitments

Letters of Credit

As of January 31, 2012, the Company had a total of $17.5 million in letters of credit outstanding

substantially in favor of certain landlords for office space. These letters of credit renew annually and mature at

various dates through April 2030.

Leases

The Company leases facilities space and certain fixed assets under non-cancelable operating and capital

leases with various expiration dates.

98