Salesforce.com 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

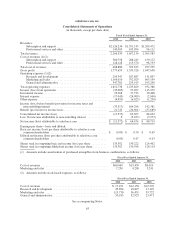

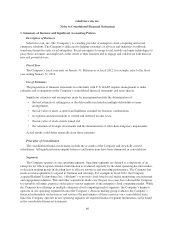

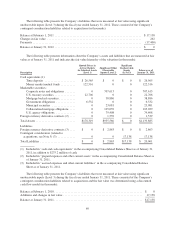

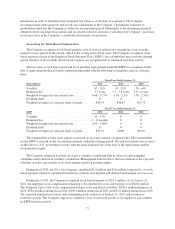

Fair Value Measurement

The Company reports its financial and non-financial assets and liabilities that are re-measured and reported

at fair value at each reporting period. The Company uses a three-tier fair value hierarchy, which prioritizes the

inputs used in the valuation methodologies in measuring fair value:

Level 1. Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2. Include other inputs that are directly or indirectly observable in the marketplace.

Level 3. Unobservable inputs which are supported by little or no market activity.

All of the Company’s cash equivalents, marketable securities and foreign currency derivative contracts are

classified within Level 1 or Level 2 because the Company’s cash equivalents, marketable securities and foreign

currency derivative contracts are valued using quoted market prices or alternative pricing sources and models

utilizing market observable inputs. The Company’s contingent considerations related to acquisitions are

classified within Level 3 because the liabilities are valued using significant unobservable inputs.

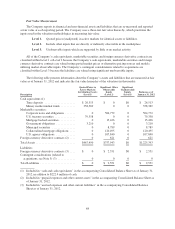

The following table presents information about the Company’s assets and liabilities that are measured at fair

value as of January 31, 2012 and indicates the fair value hierarchy of the valuation (in thousands):

Description

Quoted Prices in

Active Markets

for Identical Assets

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balances as of

January 31, 2012

Cash equivalents (1):

Time deposits ..................... $ 26,513 $ 0 $0 $ 26,513

Money market mutual funds .......... 358,369 0 0 358,369

Marketable securities:

Corporate notes and obligations ....... 0 504,772 0 504,772

U.S. treasury securities .............. 79,358 0 0 79,358

Mortgage backed securities ........... 0 15,426 0 15,426

Government obligations ............. 3,210 0 0 3,210

Municipal securities ................ 0 8,789 0 8,789

Collateralized mortgage obligations .... 0 120,495 0 120,495

U.S. agency obligations ............. 0 107,840 0 107,840

Foreign currency derivative contracts (2) .... 0 621 0 621

Total Assets ........................... $467,450 $757,943 $0 $1,225,393

Liabilities

Foreign currency derivative contracts (3) .... $ 0 $ 2,551 $0 $ 2,551

Contingent considerations (related to

acquisitions, see Note 5) (3) ............ 0 0 0 0

Total Liabilities ........................ $ 0 $ 2,551 $0 $ 2,551

(1) Included in “cash and cash equivalents” in the accompanying Consolidated Balance Sheet as of January 31,

2012, in addition to $222.4 million of cash.

(2) Included in “prepaid expenses and other current assets” in the accompanying Consolidated Balance Sheet as

of January 31, 2012.

(3) Included in “accrued expenses and other current liabilities” in the accompanying Consolidated Balance

Sheet as of January 31, 2012.

68