Salesforce.com 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

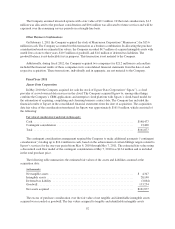

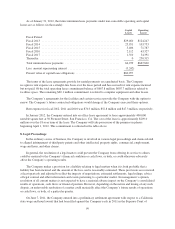

California, County of San Francisco. The settlement agreement is subject to approval of the court, which is

expected to rule by mid 2012. The Company’s current estimate of the expense charge for the settlement is

approximately $0.04 per diluted share. This charge is reflected in the Company’s financial results for fiscal 2012.

9. Employee Benefit Plan

The Company has a 401(k) plan covering all eligible employees in the United States. Since January 1, 2006,

the Company has been contributing to the plan. Total Company contributions during fiscal 2012, 2011 and 2010,

were $15.7 million, $11.0 million and $8.5 million, respectively.

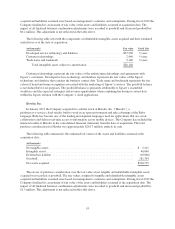

10. Related-Party Transactions

In January 1999, the salesforce.com/foundation, also referred to as the Foundation, a non-profit public

charity, was chartered to build philanthropic programs that are focused on youth and technology. The Company’s

chairman is the chairman of the Foundation. He, one of the Company’s employees and one of the Company’s

board members hold three of the Foundation’s seven board seats. The Company is not the primary beneficiary of

the Foundation’s activities, and accordingly, the Company does not consolidate the Foundation’s statement of

activities with its financial results.

Since the Foundation’s inception, the Company has provided at no charge certain resources to Foundation

employees such as office space. The value of these items was in excess of $125,000 per quarter during fiscal year

2012.

In addition to the resource sharing with the Foundation, the Company issued the Foundation warrants in

August 2002 to purchase shares of the Company’s common stock. All of the warrants were exercised in prior

years. As of January 31, 2012, the Foundation held 103,500 shares of salesforce.com common stock. Additionally,

the Company has donated subscriptions to the Company’s service to other qualified non-profit organizations. The

Company also allows an affiliate of the Foundation to resell the Company’s service to large non-profit

organizations. The Company does not charge the affiliate for the subscriptions. The fair value of the subscriptions

were in excess of $7.0 million per quarter during fiscal 2012. The Company plans to continue these programs.

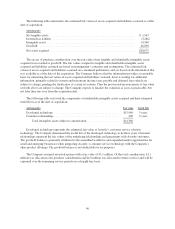

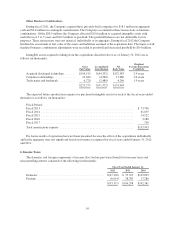

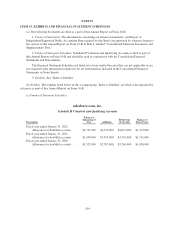

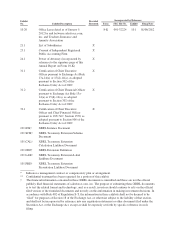

11. Selected Quarterly Financial Data (Unaudited)

Selected summarized quarterly financial information for fiscal 2012 and 2011 is as follows:

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

Fiscal

Year

(in thousands, except per share data)

Fiscal 2012

Revenues .................................. $504,364 $546,002 $584,260 $631,913 $2,266,539

Gross profit ................................ 401,298 425,092 455,695 495,568 1,777,653

Loss from operations ......................... (2,803) (15,748) (10,157) (6,377) (35,085)

Net income (loss) ........................... 530 (4,268) (3,756) (4,078) (11,572)

Basic net income (loss) per share ............... $ 0.00 $ (0.03) $ (0.03) $ (0.03) $ (0.09)

Diluted net income (loss) per share ............. $ 0.00 $ (0.03) $ (0.03) $ (0.03) $ (0.09)

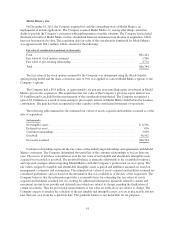

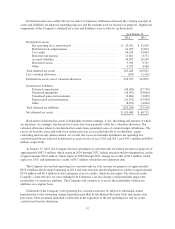

Fiscal 2011

Revenues .................................. $376,813 $394,372 $429,087 $456,867 $1,657,139

Gross profit ................................ 305,232 316,582 346,956 364,556 1,333,326

Income (loss) from operations ................. 33,050 29,682 35,156 (391) 97,497

Net income attributable to salesforce.com ........ 17,745 14,744 21,072 10,913 64,474

Basic net income per share attributable to

salesforce.com common shareholders .......... $ 0.14 $ 0.11 $ 0.16 $ 0.08 $ 0.50

Diluted net income per share attributable to

salesforce.com common shareholders .......... $ 0.13 $ 0.11 $ 0.15 $ 0.08 $ 0.47

100