Salesforce.com 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

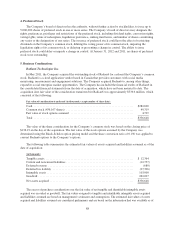

Model Metrics, Inc.

On December 16, 2011, the Company acquired for cash the outstanding stock of Model Metrics, an

implementer of mobile applications. The Company acquired Model Metrics to, among other things, extend its

ability to provide the Company’s customers with implementation of mobile solutions. The Company has included

the financial results of Model Metrics in the consolidated financial statements from the date of acquisition, which

have not been material to date. The acquisition date fair value of the consideration transferred for Model Metrics

was approximately $66.7 million, which consisted of the following:

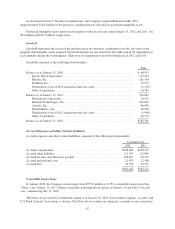

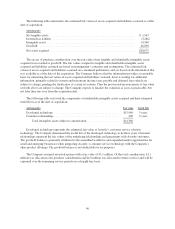

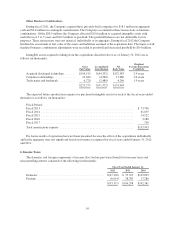

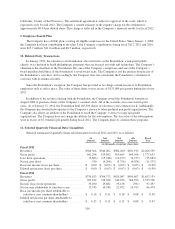

Fair value of consideration transferred (in thousands):

Cash ..................................................................... $61,424

Fair value of stock options assumed ............................................ 1,546

Fair value of pre-existing relationship ........................................... 3,774

Total ..................................................................... $66,744

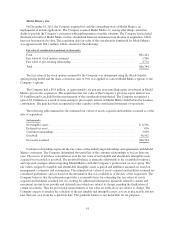

The fair value of the stock options assumed by the Company was determined using the Black-Scholes

option pricing model and the share conversion ratio of 0.05 was applied to convert Model Metrics options to the

Company’s options.

The Company had a $0.8 million, or approximately six percent, noncontrolling equity investment in Model

Metrics prior to the acquisition. The acquisition date fair value of the Company’s previous equity interest was

$3.8 million and is included in the measurement of the consideration transferred. The Company recognized a

gain of $3.0 million as a result of remeasuring its prior equity interest in Model Metrics held before the business

combination. The gain has been recognized in other expense on the consolidated statement of operations.

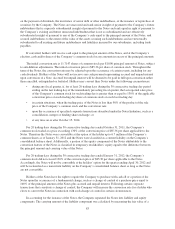

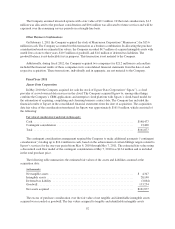

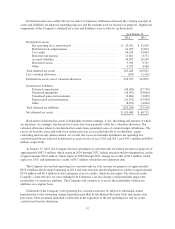

The following table summarizes the estimated fair values of assets acquired and liabilities assumed as of the

date of acquisition:

(in thousands)

Net tangible assets .......................................................... $ 6,556

Deferred tax asset ........................................................... 636

Customer relationships ....................................................... 3,050

Goodwill .................................................................. 56,502

Net assets acquired .......................................................... $66,744

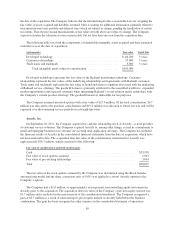

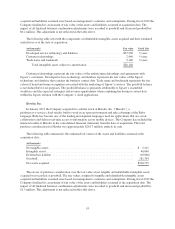

Customer relationships represent the fair values of the underlying relationships and agreements with Model

Metrics customers. The Company determined the useful life of the customer relationships to be less than one

year. The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets

acquired was recorded as goodwill. The goodwill balance is primarily attributable to the assembled workforce

and expected synergies when integrating Model Metrics with the Company’s professional services group. The

fair values assigned to tangible and identifiable intangible assets acquired and liabilities assumed are based on

management’s estimates and assumptions. The estimated fair values of assets acquired and liabilities assumed are

considered preliminary and are based on the information that was available as of the date of the acquisition. The

Company believes that the information provides a reasonable basis for estimating the fair values of assets

acquired and liabilities assumed, but it is waiting for additional information, primarily related to current and

noncurrent income taxes payable and deferred taxes which are subject to change, pending the finalization of

certain tax returns. Thus the provisional measurements of fair value set forth above are subject to change. The

Company expects to finalize the valuation of the net tangible and intangible assets as soon as practicable, but not

later than one-year from the acquisition date. The goodwill balance is not deductible for tax purposes.

91