Salesforce.com 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

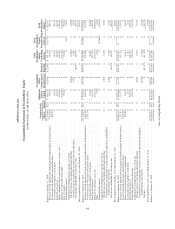

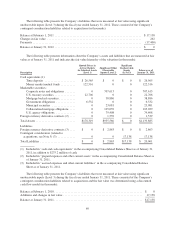

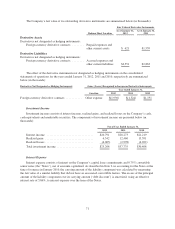

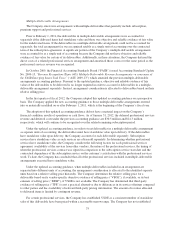

The following table presents the Company’s liabilities that were measured at fair value using significant

unobservable inputs (Level 3) during the fiscal year ended January 31, 2012. These consisted of the Company’s

contingent consideration liabilities related to acquisitions (in thousands):

Balance at February 1, 2011 ........................................................... $17,138

Changes in fair value ................................................................ 262

Payments .......................................................................... (17,400)

Balance at January 31, 2012 ........................................................... $ 0

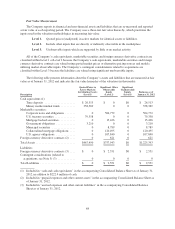

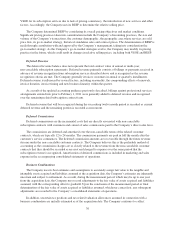

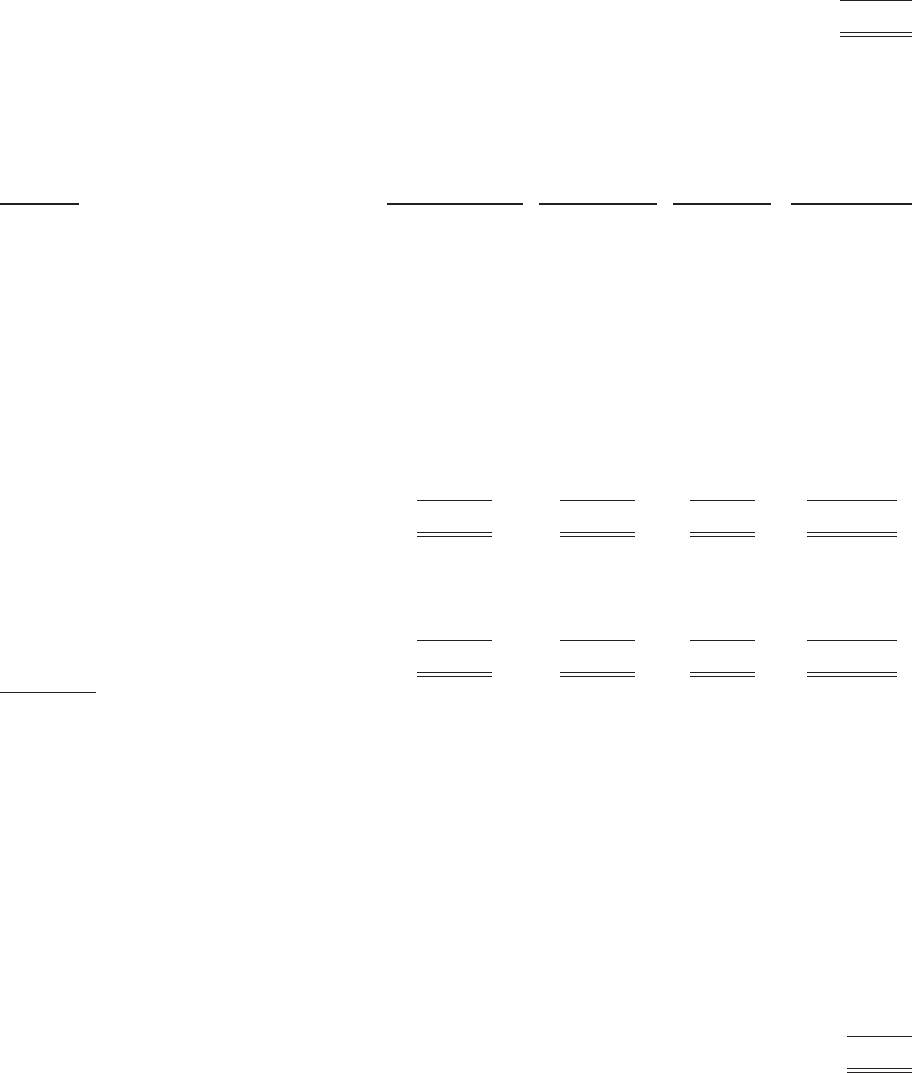

The following table presents information about the Company’s assets and liabilities that are measured at fair

value as of January 31, 2011 and indicates the fair value hierarchy of the valuation (in thousands):

Description

Quoted Prices in

Active Markets

for Identical Assets

(Level 1)

Significant Other

Observable

Inputs (Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balances as of

January 31, 2011

Cash equivalents (1):

Time deposits ..................... $ 26,565 $ 0 $ 0 $ 26,565

Money market mutual funds .......... 122,516 0 0 122,516

Marketable securities:

Corporate notes and obligations ....... 0 707,613 0 707,613

U.S. treasury securities .............. 22,706 0 0 22,706

Mortgage backed securities ........... 0 38,886 0 38,886

Government obligations ............. 6,532 0 0 6,532

Municipal securities ................ 0 23,081 0 23,081

Collateralized mortgage obligations .... 0 105,039 0 105,039

U.S. agency obligations ............. 0 79,408 0 79,408

Foreign currency derivative contracts (2) .... 0 1,539 0 1,539

Total Assets ........................... $178,319 $955,566 $ 0 $1,133,885

Liabilities

Foreign currency derivative contracts (3) .... $ 0 $ 2,863 $ 0 $ 2,863

Contingent consideration (related to

acquisitions, see Note 5) (3) ............ 0 0 17,138 17,138

Total Liabilities ........................ $ 0 $ 2,863 $17,138 $ 20,001

(1) Included in “cash and cash equivalents” in the accompanying Consolidated Balance Sheet as of January 31,

2011, in addition to $275.2 million of cash.

(2) Included in “prepaid expenses and other current assets” in the accompanying Consolidated Balance Sheet as

of January 31, 2011.

(3) Included in “accrued expenses and other current liabilities” in the accompanying Consolidated Balance

Sheet as of January 31, 2011.

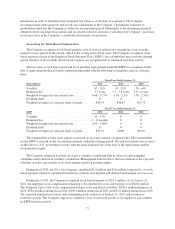

The following table presents the Company’s liabilities that were measured at fair value using significant

unobservable inputs (Level 3) during the fiscal year ended January 31, 2011. These consisted of the Company’s

contingent consideration liabilities related to acquisitions and the fair value was determined using a discounted

cash flow model (in thousands):

Balance at February 1, 2010 ............................................................ $ 0

Additions and changes in fair value ...................................................... 17,138

Balance at January 31, 2011 ............................................................ $17,138

69