Salesforce.com 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

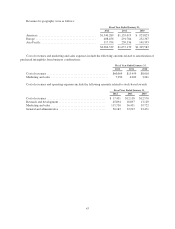

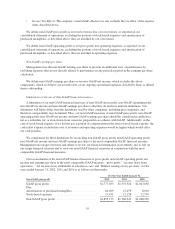

Marketing and sales expenses were $792.0 million, or 48 percent of total revenues, during fiscal 2011,

compared to $605.2 million, or 46 percent of total revenues, during fiscal 2010, an increase of $186.8 million.

The increase in absolute dollars was primarily due to increases of $143.1 million in employee-related costs,

$16.7 million in stock-based expenses, $12.1 million in advertising costs and marketing and event costs, $1.0

million in depreciation and amortization, and $12.6 million in allocated overhead. Our marketing and sales

headcount increased by 34 percent since January 31, 2010 as we hired additional sales personnel to focus on

adding new customers and increasing penetration within our existing customer base. Some of the increase in

headcount was due to acquired businesses.

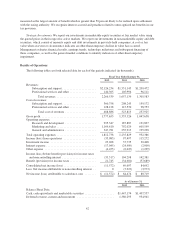

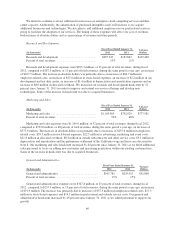

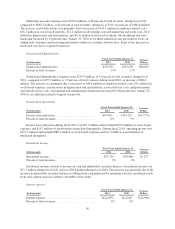

General and Administrative.

Fiscal Year Ended January 31, Variance

Dollars(In thousands) 2011 2010

General and administrative ......................... $255,913 $195,290 $60,623

Percent of total revenues ........................... 15% 15%

General and administrative expenses were $255.9 million, or 15 percent of total revenues, during fiscal

2011, compared to $195.3 million, or 15 percent of total revenues, during fiscal 2010, an increase of $60.6

million. The increase was primarily due to increases of $46.8 million in employee-related costs, $9.5 million in

stock-based expenses, and increases in depreciation and amortization, service delivery costs, and professional

and outside service costs. Our general and administrative headcount increased by 30 percent since January 31,

2010 as we added personnel to support our growth.

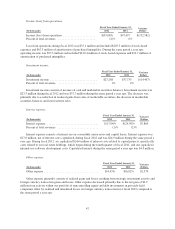

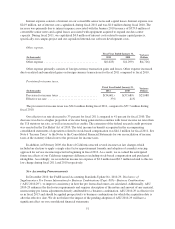

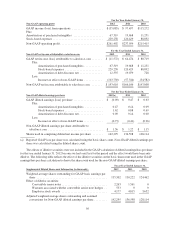

Income from operations.

Fiscal Year Ended January 31, Variance

Dollars(In thousands) 2011 2010

Income from operations ........................... $97,497 $115,272 $(17,775)

Percent of total revenues ........................... 6% 9%

Income from operations during fiscal 2011 was $97.5 million and included $120.4 million of stock-based

expenses and $19.7 million of amortization of purchased intangibles. During fiscal 2010, operating income was

$115.3 million and included $88.9 million of stock-based expenses and $11.3 million of amortization of

purchased intangibles.

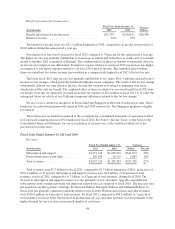

Investment income.

Fiscal Year Ended January 31, Variance

Dollars(In thousands) 2011 2010

Investment income ................................ $37,735 $30,408 $7,327

Percent of total revenues ............................ 2% 2%

Investment income consists of income on cash and marketable securities balances. Investment income was

$37.7 million during fiscal 2011 and was $30.4 million during fiscal 2010. The increase was primarily due to the

increase in marketable securities balances resulting from cash generated by operating activities and the proceeds

from stock option exercises and the convertible senior notes.

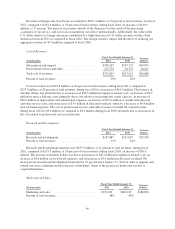

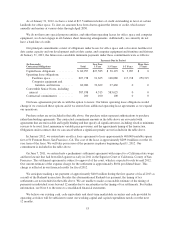

Interest expense.

Fiscal Year Ended January 31, Variance

Dollars(In thousands) 2011 2010

Interest expense .................................. $(24,909) $(2,000) $(22,909)

Percent of total revenues ........................... 2% 0%

50