Salesforce.com 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

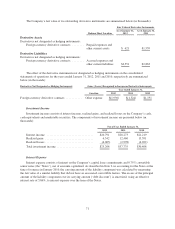

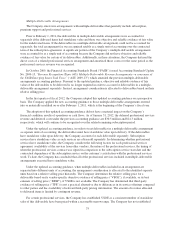

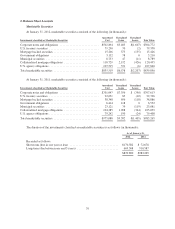

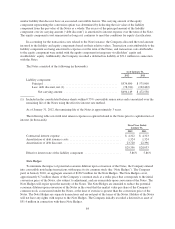

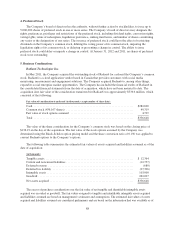

As of January 31, 2012, the following marketable securities were in an unrealized loss position (in

thousands):

Less than 12 Months 12 Months or Greater Total

Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

Corporate notes and obligations ........ $163,711 $(1,545) $ 7,364 $ (62) $171,075 $(1,607)

U.S. treasury securities ............... 39,037 (2) 0 0 39,037 (2)

Mortgage backed securities ............ 1,339 (73) 4,252 (82) 5,591 (155)

Municipal securities .................. 0 0 1,690 (11) 1,690 (11)

Collateralized mortgage obligations ..... 23,614 (189) 13,110 (237) 36,724 (426)

U.S. agency obligations ............... 12,384 (6) 0 0 12,384 (6)

$240,085 $(1,815) $26,416 $(392) $266,501 $(2,207)

The unrealized loss for each of these fixed rate marketable securities ranged from less than $1,000 to

$163,000. The Company does not believe any of the unrealized losses represent an other-than-temporary

impairment based on its evaluation of available evidence as of January 31, 2012. The Company expects to

receive the full principal and interest on all of these marketable securities.

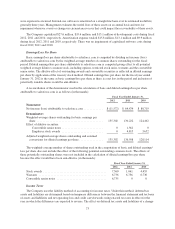

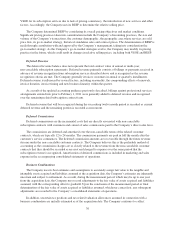

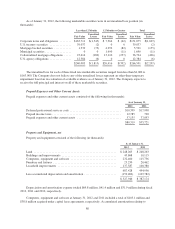

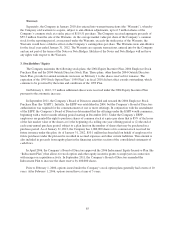

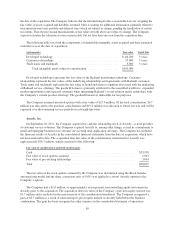

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following (in thousands):

As of January 31,

2012 2011

Deferred professional services costs ................................... $10,399 $17,908

Prepaid income taxes ............................................... 12,785 720

Prepaid expenses and other current assets .............................. 57,135 37,093

$80,319 $55,721

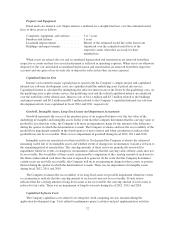

Property and Equipment, net

Property and equipment consisted of the following (in thousands):

As of January 31,

2012 2011

Land ........................................................ $248,263 $ 248,263

Buildings and improvements ..................................... 43,868 10,115

Computers, equipment and software ............................... 232,460 115,736

Furniture and fixtures ........................................... 25,250 20,462

Leasehold improvements ........................................ 137,587 100,380

687,428 494,956

Less accumulated depreciation and amortization ...................... (159,482) (107,782)

$ 527,946 $ 387,174

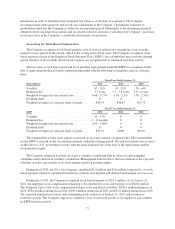

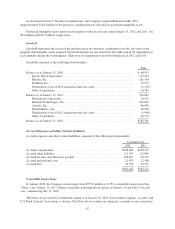

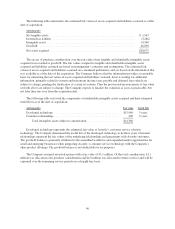

Depreciation and amortization expense totaled $69.8 million, $41.4 million and $31.9 million during fiscal

2012, 2011 and 2010, respectively.

Computers, equipment and software at January 31, 2012 and 2011 included a total of $105.1 million and

$38.8 million acquired under capital lease agreements, respectively. Accumulated amortization relating to

80