Salesforce.com 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 ANNUAL REPORT

Table of contents

-

Page 1

2012 ANNUAL REPORT -

Page 2

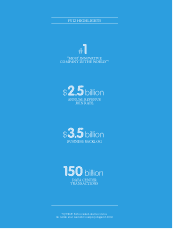

FY12 HIGHLIGHTS # 1 "MOST INNOVATIVE COMPANY IN THE WORLD"* $ 2.5 billion ANNUAL REVENUE RUN RATE $ 3.5 billion BUSINESS BACKLOG 150 billion DATA CENTER TRANSACTIONS *SOURCE: Forbes ranked salesforce.com as the world's most innovative company (August 8, 2011) -

Page 3

...the acquisition of Radian6, and human capital management with the acquisition of Rypple. With next-generation sales, service, marketing, and work apps, we're able to help customers revolutionize the entire front o ce experience. We also opened up our Force.com and Heroku platforms, giving developers... -

Page 4

... the Sarbanes-Oxley Act of 2002 and Exchange Act Rule 13a-14 in its Annual Report on Form 10-K for the fiscal year ended January 31, 2012. Salesforce.com, inc. also submitted to the New York Stock Exchange ("NYSE") a certification by its Chief Executive Officer that he was not aware of any violation... -

Page 5

... No.) The Landmark @ One Market, Suite 300 San Francisco, California 94105 (Address of principal executive offices) Telephone Number (415) 901-7000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each... -

Page 6

...4A. Executive Officers of the Registrant ...PART II Item 5. Item 6. Item 7. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ...Selected Financial Data ...Management's Discussion and Analysis of Financial Condition and Results of Operations... -

Page 7

... acquisition, we have augmented our CRM service with new editions, services and enhanced features. In recent years, we have seen a broad shift in the information technology ("IT") industry to social networking and the use of mobile devices. Industry analysts describe how social networking users... -

Page 8

We have designed, developed and acquired applications and platforms that are easy-to-use and intuitive, that can be deployed rapidly, customized easily and integrated with other enterprise applications or platforms. We deliver our service through all of the market-leading Internet browsers and ... -

Page 9

... levels. Cloud platforms enable corporate IT developers and ISVs to leverage the benefits of a multi-tenant platform for developing new applications. Cloud platforms allow developers to build applications using only a browser and an Internet connection, just as cloud applications allow users to use... -

Page 10

... and chat; Web portals for self-service and customer collaboration; and community interactions within social networks. In addition, built-in collaboration tools enable customer service agents to share information on how to better service customers. Salesforce Chatter. Our Chatter application enables... -

Page 11

... for managing collaboration of data between users, a user interface model to handle forms and other interactions, and a Web services API for programmatic access and integration. The Force.com platform provides the tools and infrastructure required to deploy our applications; customize and integrate... -

Page 12

... our customers in our acquisition of Model Metrics in December 2011. Consulting services consist of services such as business process mapping, project management services and guidance on best practices in using our service. Deployment services include systems integration, technical architecture and... -

Page 13

...invest in hardware and distribution. A developer with an idea for a new application can log on to our platforms, develop, test and support their system on Force.com or Heroku and make the application accessible for a fee to our customers. Lower total cost of ownership. We enable customers to achieve... -

Page 14

...internal research and development activities with outside development resources and acquired technology. Our customers access our service over the Internet through supported Internet browsers and mobile devices. We currently serve our customers from third-party data center hosting facilities located... -

Page 15

... product information and demonstrations, free trials, case studies, white papers, and marketing collateral; email, direct mail, and phone campaigns to capture leads that can be funneled into our sales organization; use of customer testimonials; and sales tools and field marketing events to enable... -

Page 16

Customer Service and Support Our global customer support group responds to both business and technical inquires from our customers relating to how to use our products and is available to customers by the web, telephone and email. Basic customer support during business hours is available at no charge... -

Page 17

... Web site at http://www.salesforce.com/company/investor/sec-filings/ as soon as reasonably practicable following our filing of any of these reports with the SEC. You can also obtain copies free of charge by contacting our Investor Relations department at our office address listed above. The public... -

Page 18

... customers believe our service is unreliable. As part of our current disaster recovery arrangements, our production environment and all of our customers' data is currently replicated in near real-time in a facility located in the United States. Companies and products added through acquisition... -

Page 19

... completion, introduction and market acceptance of the feature or edition. Failure in this regard may significantly impair our revenue growth. In addition, because our service is designed to operate on a variety of network hardware and software platforms using a standard browser, we will need to... -

Page 20

... levels, decreases in the number of users at our customers, pricing changes and deteriorating general economic conditions. If our customers do not renew their subscriptions for our service or reduce the number of paying subscriptions at the time of renewal, our revenue will decline and our business... -

Page 21

... duration, invoice timing and new business linearity; the number of new employees; changes in our pricing policies and terms of contracts, whether initiated by us or as a result of competition; the cost, timing and management effort for the introduction of new features to our service; the rate of... -

Page 22

...customers' purchasing decision, or reduce the value of new subscription contracts, or affect renewal rates; timing of additional investments in our enterprise cloud computing application and platform services and in our consulting service; regulatory compliance costs; the timing of customer payments... -

Page 23

... deferred revenue; delays in customer purchases due to uncertainty related to any acquisition; the need to implement controls, procedures and policies appropriate for a public company at private companies that we acquire; challenges caused by distance, language and cultural differences; and the... -

Page 24

... operations. In addition, larger customers may demand more customization, integration services and features. As a result of these factors, these sales opportunities may require us to devote greater sales support and professional services resources to individual customers, driving up costs and time... -

Page 25

...our rate of growth. We periodically change and make adjustments to our sales organization in response to market opportunities, competitive threats, management changes, product introductions or enhancements, acquisitions, sales performance, increases in sales headcount, cost levels and other internal... -

Page 26

...our business plan, lead to attempts on the part of other parties to pursue similar claims and, in the case of intellectual property claims, require us to change our technology, change our business practices and/or pay monetary damages or enter into short- or long-term royalty or licensing agreements... -

Page 27

... of our service and technologies. We do not have employment agreements with any of our executive officers, key management, development or operations personnel and they could terminate their employment with us at any time. The loss of one or more of our key employees or groups could seriously... -

Page 28

...corporate headquarters, information technology systems, and other critical business operations, are located near major seismic faults in the San Francisco Bay Area. Because we do not carry earthquake insurance for direct quake-related losses, and significant recovery time could be required to resume... -

Page 29

... in customer purchases; recruitment or departure of key personnel; disruptions in our service due to computer hardware, software, network or data center problems; the economy as a whole, market conditions in our industry and the industries of our customers; trading activity by a limited number of... -

Page 30

... UNRESOLVED STAFF COMMENTS None. ITEM 2. PROPERTIES As of January 31, 2012, our executive offices and principal office for domestic marketing, sales, professional services and development occupy over 650,000 square feet in the San Francisco Bay Area under leases that expire at various times through... -

Page 31

... Corporation, where he held a number of positions in sales, marketing and product development, lastly as a Senior Vice President. Mr. Benioff also serves as Chairman of the Board of Directors of the salesforce.com/foundation. Mr. Benioff received a Bachelor of Science in Business Administration... -

Page 32

... as our Executive Vice President and Chief Financial Officer Designate from December 2007 to March 2008. Prior to salesforce.com, Mr. Smith was at Advent Software, Inc., a provider of portfolio management software, and served as its Chief Financial Officer from January 2003 to December 2007. In... -

Page 33

...common stock as reported by the New York Stock Exchange. High Low Fiscal year ending January 31, 2012 First quarter ...Second quarter ...Third quarter ...Fourth quarter ...Fiscal year ending January 31, 2011 First quarter ...Second quarter ...Third quarter ...Fourth quarter ...Dividend Policy $143... -

Page 34

... data and are not indicative of, nor intended to forecast, future performance of our common stock. Comparison of Cumulative Total Return of salesforce.com, inc. 1400 1200 1000 DOLLARS 800 600 400 200 0 6/23/2004 1/31/2005 1/31/2006 1/31/2007 1/31/2008 1/30/2009 1/31/2010 1/31/2011 1/31/2012... -

Page 35

... 68,119 Total revenues ...Cost of revenues (1): Subscription and support ...Professional services and other ...Total cost of revenues ...Gross profit ...Operating expenses (1): Research and development ...Marketing and sales ...General and administrative ...Total operating expenses ...Income (loss... -

Page 36

... of revenues and operating expenses include stock-based expenses, consisting of: 2012 Fiscal Year Ended January 31, 2011 2010 2009 2008 Cost of revenues ...Research and development ...Marketing and sales ...General and administrative ... $ 17,451 45,894 115,730 50,183 2012 $12,158 18,897 56,451... -

Page 37

... the acquisition of Heroku, Inc. ("Heroku") an application development platform and the launch of Database.com, the world's first enterprise cloud database. We acquired Radian6 Technologies, Inc. ("Radian6") to help companies monitor and engage with their customers via social media. Our objective is... -

Page 38

... subscriptions, upgrade our customers to fully featured versions such as our Unlimited Edition or arrangements such as a social enterprise license agreement, provide high quality technical support to our customers and encourage the development of third-party applications on our platforms. Our plans... -

Page 39

... such as process mapping and project management, and implementation services including systems integration, technical architecture and development, and data conversion; and (4) other revenue, which consists primarily of training fees. Subscription and support revenues accounted for approximately 94... -

Page 40

..., primarily as a result of large enterprise account buying patterns. Currently, there is greater operational discipline around annual invoicing, for both new business and renewals. Occasionally, we bill customers for their multi-year contract on a single invoice which results in an increase in... -

Page 41

... and Administrative. General and administrative expenses consist of salaries and related expenses, including stock-based expenses, for finance and accounting, legal, internal audit, human resources and management information systems personnel, legal costs, professional fees, other corporate expenses... -

Page 42

... of subscription fees from customers accessing our enterprise cloud computing services and from customers purchasing additional support beyond the standard support that is included in the basic subscription fee; and (2) related professional services such as process mapping, project management... -

Page 43

...February 1, 2011 which is the beginning of our fiscal year. The adoption of this updated accounting guidance did not have a material impact on our financial condition, results of operations or cash flows. As of January 31, 2012, the deferred professional services revenue and deferred costs under the... -

Page 44

... timing and new business linearity within the quarter. As a result of the updated accounting guidance previously described, billings against professional services arrangements entered into prior to February 1, 2011 were generally added to deferred revenue and recognized over the remaining related... -

Page 45

...-line basis over the requisite service period of the award which is the vesting term of generally four years or one year for the Employee Stock Purchase Plan ("ESPP"). The fair value of each award is estimated on the date of grant using the Black-Scholes option pricing model. The estimated life for... -

Page 46

... 31, 2012 2011 2010 Revenues: Subscription and support ...Professional services and other ...Total revenues ...Cost of revenues: Subscription and support ...Professional services and other ...Total cost of revenues ...Gross profit ...Operating expenses: Research and development ...Marketing and... -

Page 47

... $15,459 4,209 $8,010 3,241 Cost of revenues and operating expenses include the following amounts related to stock-based awards: Fiscal Year Ended January 31, 2012 2011 2010 Cost of revenues ...Research and development ...Marketing and sales ...General and administrative ... $ 17,451 45,894 115... -

Page 48

... 31, 2012 2011 2010 Revenues: Subscription and support ...Professional services and other ...Total revenues ...Cost of revenues: Subscription and support ...Professional services and other ...Total cost of revenues ...Gross profit ...Operating expenses: Research and development ...Marketing and... -

Page 49

... subscriptions from existing customers and improved renewal rates as compared to a year ago. The price per user per month for our three primary offerings, Professional Edition, Enterprise Edition and Unlimited Edition, in fiscal 2012 has generally remained consistent relative to fiscal 2011... -

Page 50

... of purchased intangible assets will increase as we acquire additional businesses and technologies. We also plan to add additional employees in our professional services group to facilitate the adoption of our services. The timing of these expenses will affect our cost of revenues, both in terms of... -

Page 51

... a year ago. During fiscal 2012, we capitalized $14.6 million of interest costs related to capital projects, specifically costs related to our real estate holdings, which began during the fourth quarter of fiscal 2011, and our capitalized internal-use software development costs. Capitalized interest... -

Page 52

...upgrades and additional subscriptions from existing customers and improved renewal rates as compared to fiscal 2010. The price per user per month for our three primary offerings, Professional Edition, Enterprise Edition and Unlimited Edition, in fiscal 2011 has generally remained consistent relative... -

Page 53

... since January 31, 2010 in order to upgrade and extend our service offerings and develop new technologies. Some of the increase in headcount was due to acquired businesses. Marketing and Sales. (In thousands) Fiscal Year Ended January 31, 2011 2010 Variance Dollars Marketing and sales ...Percent... -

Page 54

... employee-related costs, $9.5 million in stock-based expenses, and increases in depreciation and amortization, service delivery costs, and professional and outside service costs. Our general and administrative headcount increased by 30 percent since January 31, 2010 as we added personnel to support... -

Page 55

... our data center capacity. During fiscal 2011, we capitalized $4.0 million of interest costs related to major capital projects, specifically our campus project and our capitalized internal-use software development costs. Other expense. (In thousands) Fiscal Year Ended January 31, 2011 2010 Variance... -

Page 56

... of subscriptions, support and professional services; changes in working capital accounts, particularly increases and seasonality in accounts receivable and deferred revenue as described above, the timing of commission and bonus payments, and the timing of collections from large enterprise customers... -

Page 57

... filed against us early in 2011 in the Superior Court of California, County of San Francisco. The settlement agreement is subject to approval of the court, which is expected to rule by mid 2012. Our current estimate of the expense charge for the settlement is approximately $0.04 per diluted share... -

Page 58

... an acquired company's research and development efforts, trade names, customer lists and customer relationships, as items arising from pre-acquisition activities determined at the time of an acquisition. While it is continually viewed for impairment, amortization of the cost of purchased intangibles... -

Page 59

... to salesforce.com" and "Diluted earnings (loss) per share" for the years ended January 31, 2012, 2011 and 2010 is as follows (in thousands): Non-GAAP gross profit For the Year Ended January 31, 2012 2011 2010 GAAP gross profit ...Plus: Amortization of purchased intangibles ...Stock-based... -

Page 60

... ...Plus: Amortization of purchased intangibles ...Stock-based expenses ...Non-GAAP operating profit ... $ (35,085) 67,319 229,258 $261,492 $ 97,497 19,668 120,429 $237,594 $115,272 11,251 88,892 $215,415 Non-GAAP net income attributable to salesforce.com For the Year Ended January 31, 2012 2011... -

Page 61

..., 2012. This amount was invested primarily in money market funds, time deposits, corporate notes and bonds, government securities and other debt securities with credit ratings of at least single A or better. The cash, cash equivalents and short-term marketable securities are held for working capital... -

Page 62

...exert significant influence, we account for investments in non-marketable equity and debt securities of the privately-held companies using the cost method of accounting. Otherwise, we account for the investments using the equity method of accounting. As of January 31, 2012 and 2011 the fair value of... -

Page 63

... FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA INDEX TO CONSOLIDATED FINANCIAL STATEMENTS The following financial statements are filed as part of this Annual Report on Form 10-K: Page No. Reports of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets ...Consolidated... -

Page 64

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders of salesforce.com, inc. We have audited the accompanying consolidated balance sheets of salesforce.com, inc. as of January 31, 2012 and 2011, and the related consolidated statements of operations, ... -

Page 65

... become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. In our opinion, salesforce.com, inc. maintained, in all material respects, effective internal control over financial reporting as of January 31, 2012, based on the... -

Page 66

salesforce.com, inc. Consolidated Balance Sheets (in thousands, except share and per share data) January 31, 2012 January 31, 2011 Assets Current assets: Cash and cash equivalents ...Short-term marketable securities ...Accounts receivable, net of allowance for doubtful accounts of $1,273 and $1,711... -

Page 67

... share data) Fiscal Year Ended January 31, 2012 2011 2010 Revenues: Subscription and support ...Professional services and other ...Total revenues ...Cost of revenues (1)(2): Subscription and support ...Professional services and other ...Total cost of revenues ...Gross profit ...Operating expenses... -

Page 68

... board services ...2,517,431 3 111,779 0 0 111,782 0 111,782 Vested restricted stock units converted to shares ...1,075,001 1 0 0 0 1 0 1 Shares issued related to business combinations ...522,962 0 56,612 56,612 56,612 Tax benefits from employee stock plans ...0 0 1,611 0 0 1,611 0 1,611 Stock-based... -

Page 69

... of warrants ...Purchase of convertible note hedge ...Purchase of subsidiary stock ...Proceeds from equity plans ...Excess tax benefits from employee stock plans ...Contingent consideration payment related to prior business combinations ...Principal payments on capital lease obligations ...Net... -

Page 70

... making group, in deciding how to allocate resources and assessing performance. The Company has made several acquisitions to expand its business and offerings. For example in fiscal 2012, the Company acquired Radian6 Technologies Inc. ("Radian6") to provide cloud based social media monitoring... -

Page 71

... January 31, 2012 and no single customer accounted for more than 5 percent of accounts receivable at January 31, 2011. No single customer accounted for 5 percent or more of total revenue during fiscal 2012, 2011, and 2010. As of January 31, 2012 and 2011, assets located outside the Americas were 13... -

Page 72

... Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) Description Balances as of January 31, 2012 Cash equivalents (1): Time deposits ...Money market mutual funds ...Marketable securities: Corporate... -

Page 73

... at fair value using significant unobservable inputs (Level 3) during the fiscal year ended January 31, 2012. These consisted of the Company's contingent consideration liabilities related to acquisitions (in thousands): Balance at February 1, 2011 ...Changes in fair value ...Payments ...Balance at... -

Page 74

... are used to reduce the exchange rate risk associated primarily with intercompany receivables and payables. The Company's program is not designated for trading or speculative purposes. As of January 31, 2012 and 2011 the foreign currency derivative contracts that were not settled are recorded at... -

Page 75

... January 31, 2012, 2011 and 2010, respectively are summarized below (in thousands): Derivatives Not Designated as Hedging Instruments Gains (Losses) Recognized in Income on Derivative Instruments Year ended January 31, Location 2012 2011 2010 Foreign currency derivative contracts ... Other expense... -

Page 76

...no impairment of long-lived assets during fiscal 2012, 2011 and 2010. Capitalized Software Costs The Company capitalizes costs related to its enterprise cloud computing services incurred during the application development stage. Costs related to preliminary project activities and post implementation... -

Page 77

...no impairment of capitalized software costs during fiscal 2012, 2011 and 2010. Earnings/Loss Per Share Basic earnings/loss per share attributable to salesforce.com is computed by dividing net income (loss) attributable to salesforce.com by the weighted-average number of common shares outstanding for... -

Page 78

...subscription fees from customers accessing the Company's enterprise cloud computing services and from customers purchasing additional support beyond the standard support that is included in the basic subscription fees; and (2) related professional services such as process mapping, project management... -

Page 79

... 2011, which is the beginning of the Company's fiscal year. The adoption of this updated accounting guidance did not have a material impact on the Company's financial condition, results of operations or cash flows. As of January 31, 2012, the deferred professional services revenue and deferred costs... -

Page 80

... timing and new business linearity within the quarter. As a result of the updated accounting guidance previously described, billings against professional services arrangements entered into prior to February 1, 2011 were generally added to deferred revenue and recognized over the remaining related... -

Page 81

...of its stock options and stock purchase rights. During fiscal 2012 and 2011, the Company capitalized $2.4 million and $2.6 million, respectively, of stock based expenses related to capitalized internal-use software development and deferred professional services costs. During fiscal 2012, the Company... -

Page 82

... the date this Annual Report on Form 10-K was filed with the SEC. New Accounting Pronouncements In December 2010, the FASB issued Accounting Standards Update No. 2010-29, Disclosure of Supplementary Pro Forma Information for Business Combinations (Topic 805)-Business Combinations ("ASU 2010-29... -

Page 83

...,408 $(1,405) $983,265 The duration of the investments classified as marketable securities is as follows (in thousands): As of January 31, 2012 2011 Recorded as follows: Short-term (due in one year or less) ...Long-term (due between one and 3 years) ... $170,582 669,308 $839,890 $ 72,678 910,587... -

Page 84

... on all of these marketable securities. Prepaid Expenses and Other Current Assets Prepaid expenses and other current assets consisted of the following (in thousands): As of January 31, 2012 2011 Deferred professional services costs ...Prepaid income taxes ...Prepaid expenses and other current... -

Page 85

... Radian6 in May 2011. Approximately $84.2 million of the purchase consideration was allocated to acquired developed technology. Other Assets, net Other assets consisted of the following (in thousands): As of January 31, 2012 2011 Deferred professional services costs, noncurrent portion ...Long-term... -

Page 86

...as of January 31, 2010 ...Jigsaw Data Corporation ...Heroku, Inc...DimDim, Inc...Finalization of fiscal 2010 acquisition date fair value ...Other Acquisitions ...Balance as of January 31, 2011 ...Manymoon Corporation ...Radian6 Technologies, Inc...Assistly, Inc...Model Metrics, Inc...Finalization of... -

Page 87

... of a fundamental change, such as a change of control at a purchase price equal to 100% of the principal amount of the Notes plus accrued and unpaid interest. Following certain corporate transactions that constitute a change of control, the Company will increase the conversion rate for a holder... -

Page 88

... interest expense recognized related to the Notes prior to capitalization of interest (in thousands): Fiscal Year Ended January 31, 2012 2011 Contractual interest expense ...Amortization of debt issuance costs ...Amortization of debt discount ...Effective interest rate of the liability component... -

Page 89

... purchase shares of common stock at a price per share that is 85% of the lesser of the fair market value of the shares at (1) the beginning of a rolling one-year offering period or (2) the end of each semi-annual purchase period, subject to a plan limit on the number of shares that may be purchased... -

Page 90

...2006 Equity Inducement Plan ...400,000 0 Radian6 Technologies Inc. Stock Option Plan ...239,519 0 Assistly Option Plan ...49,379 0 Model Metrics Inc. 2008 Stock Option Plan ...23,463 0 Options granted under all plans ...(2,608,917) 2,608,917 Restricted stock activity ...(2,879,321) 0 Stock grants to... -

Page 91

...,780 During fiscal year 2012 and 2011, certain board members received stock grants totaling 36,800 shares of common stock and 48,000 shares of common stock, respectively for board services pursuant to the terms described in the 2004 Outside Directors Stock Plan. The expense related to these awards... -

Page 92

..., 2012 and 2011, no shares of preferred stock were outstanding. 5. Business Combinations Radian6 Technologies Inc. In May 2011, the Company acquired the outstanding stock of Radian6 for cash and the Company's common stock. Radian6 is a cloud application vendor based in Canada that provides customers... -

Page 93

...-year from the acquisition date. The following table sets forth the components of identifiable intangible assets acquired and their estimated useful lives as of the date of acquisition: (in thousands) Fair value Useful Life Developed technology ...Customer relationships ...Trade name and trademark... -

Page 94

... relationships and agreements with Assistly customers. The goodwill balance is primarily attributed to the assembled workforce and expanded market opportunities for small and emerging businesses when integrating Assistly's customer service technology with the Company's other product offerings. The... -

Page 95

... relationships and agreements with Model Metrics customers. The Company determined the useful life of the customer relationships to be less than one year. The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets acquired was recorded as goodwill... -

Page 96

... of certain billings targets related to Jigsaw's services for the one-year period from May 8, 2010 through May 7, 2011. The estimated fair value using a discounted cash flow model of the contingent consideration at May 7, 2010 was $13.4 million and is included in the total purchase price. The... -

Page 97

...the leading development languages used for applications that are social, collaborative and deliver real-time access to information across mobile devices. The Company has included the financial results of Heroku in the consolidated financial statements from the date of acquisition. The total purchase... -

Page 98

... as of the date of acquisition: (in thousands) Fair value Useful life Developed technology ...Trade name and trademark ...Total intangible assets subject to amortization ... $39,280 780 $40,060 3 years 3 years Developed technology represents the fair value of the Heroku platform technology. Trade... -

Page 99

... resulting from the acquisitions described above as of January 31, 2012 are as follows (in thousands): Gross Fair Value Accumulated Amortization Net Book Value Weighted Average Remaining Useful Life Acquired developed technology ...Customer relationships ...Trade name and trademark ... $196,915 21... -

Page 100

...): Fiscal Year Ended January 31, 2012 2011 2010 U.S. federal taxes at statutory rate ...State, net of the federal benefit ...Foreign taxes in excess of the U.S. statutory rate ...Tax credits ...Non-deductible expenses ...Tax benefit from acquisitions ...Impact of California tax law change ...Tax... -

Page 101

...tax benefits associated with stock option exercises are recorded directly to stockholders' equity controlling interest only when realized. As a result, the excess tax benefits included in net operating loss carryforwards but not reflected in deferred tax assets for fiscal year 2012 and 2011 are $149... -

Page 102

... substantially in favor of certain landlords for office space. These letters of credit renew annually and mature at various dates through April 2030. Leases The Company leases facilities space and certain fixed assets under non-cancelable operating and capital leases with various expiration... -

Page 103

...related to computer equipment and other leases. The Company's agreements for the facilities and certain services provide the Company with the option to renew. The Company's future contractual obligations would change if the Company exercised these options. Rent expense for fiscal 2012, 2011 and 2010... -

Page 104

... during fiscal 2012, 2011 and 2010, were $15.7 million, $11.0 million and $8.5 million, respectively. 10. Related-Party Transactions In January 1999, the salesforce.com/foundation, also referred to as the Foundation, a non-profit public charity, was chartered to build philanthropic programs that are... -

Page 105

... January 31, 2012 has been audited by Ernst & Young LLP, an independent registered public accounting firm, as stated in its report which is included in Item 8 of this Annual Report on Form 10-K. (c) Changes in internal control over financial reporting There was no change in our internal control over... -

Page 106

... because of changes in conditions, or the degree of compliance with policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected. ITEM 9B. OTHER INFORMATION Not applicable. 102 -

Page 107

... without charge by contacting Investor Relations, salesforce.com, inc., The Landmark @ One Market, Suite 300, San Francisco, California 94105 or by calling (415) 901-7000. We plan to post on our Web site at the address described above any future amendments or waivers of our Code of Conduct. ITEM 11... -

Page 108

...part of this Annual Report on Form 10-K. (c) Financial Statement Schedules. salesforce.com, inc. Schedule II Valuation and Qualifying Accounts Balance at Beginning of Year Deductions Write-offs Balance at End of Year Description Additions Fiscal year ended January 31, 2012 Allowance for doubtful... -

Page 109

... to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. Dated: March 9, 2012 salesforce.com, inc. /s/ GRAHAM SMITH Graham Smith Chief Financial Officer... -

Page 110

... and on the dates indicated. Signature Title Date /S/ MARC BENIOFF Marc Benioff Chairman of the Board of Directors and Chief Executive Officer (Principal Executive Officer) Chief Financial Officer (Principal Financial & Accounting Officer) Director March 9, 2012 /S/ GRAHAM SMITH Graham... -

Page 111

... 2009 Stock Plan Model Metrics, Inc. 2008 Stock Plan Form of Indemnification Agreement between salesforce.com, inc. and its officers and directors 1999 Stock Option Plan, as amended 2004 Equity Incentive Plan, as amended 2004 Employee Stock Purchase Plan, as amended 2004 Outside Directors Stock Plan... -

Page 112

... Marc Benioff Form of Change of Control and Retention Agreement as entered into with Parker Harris, George Hu, Hilarie KoplowMcAdams, Burke Norton, Graham Smith, Jim Steele, Polly Sumner and Frank van Veenendaal Purchase Agreement dated January 12, 2010 between salesforce.com, inc. and Merrill Lynch... -

Page 113

... Form Incorporated by Reference SEC File No. Exhibit Filing Date 10.20 Office Lease dated as of January 5, 2012 by and between salesforce.com, inc. and Teachers Insurance and Annuity Association List of Subsidiaries Consent of Independent Registered Public Accounting Firm Power of Attorney... -

Page 114

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 115

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 116

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 117

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 118

Salesforce + You = -

Page 119

... President Services & Customer Adoption Frank van Veenendaal Vice Chairman Investor Relations [email protected] +1-415-536-6250 Stock Listing Salesforce.com trades on the New York Stock Exchange under the ticker symbol "CRM." Note on Forward-Looking Statements This annual report contains... -

Page 120

... Headquarters The Landmark @ One Market Suite 300 San Francisco, CA 94105 United States 1-800-NO-SOFTWARE www.salesforce.com /salesforce @salesforce Global Offices Latin America Japan Asia/Paciï¬c EMEA +1-415-536-4606 +81-3-5785-8201 +65-6302-5700 +4121-6953700 Copyright ©2012, salesforce.com...