Quest Diagnostics 2007 Annual Report Download - page 97

Download and view the complete annual report

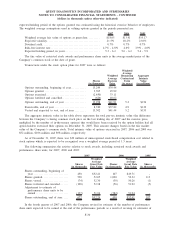

Please find page 97 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Forward Agreements were entered into to hedge a portion of the Company’s interest rate exposure associated

with the debt securities that were issued in the second quarter of 2007. In connection with the Company’s 2007

Senior Notes issued in June 2007, the Treasury Forward Agreements were settled and the Company paid $3.5

million, representing the loss on the settlement of the Treasury Forward Agreements. These losses are deferred in

stockholders’ equity, as a component of “accumulated other comprehensive income (loss)”, and are amortized as

an adjustment to interest expense over the term of the Senior Notes due 2017.

Interest Rate Swap Agreements

In August 2007, the Company entered into four separate variable-to-fixed interest rate swap agreements (“the

Interest Rate Swap Agreements”), whereby the Company fixed the interest rates on $500 million of its Term

Loan due May 2012 for periods ranging from October 2007 through October 2009. The fixed interest rates range

from 5.095% to 5.267%.

The Interest Rate Swap Agreements qualify as cash flow hedges under the requirements of SFAS 133. As

such, gains and losses on the Interest Rate Swap Agreements are deferred into “accumulated other comprehensive

income (loss)” until the hedged transaction impacts the Company’s earnings. During the year ended December

31, 2007, the Company deferred losses of $2.7 million into “accumulated other comprehensive income (loss)”.

The cash flow hedges were effective during 2007.

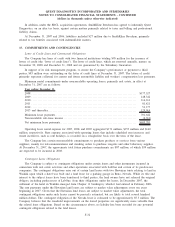

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, accounts receivable and accounts payable and accrued

expenses approximate fair value based on the short maturity of these instruments. At December 31, 2007, the fair

value of the interest rate swap agreements was not material. At December 31, 2007 and 2006, the fair value of

the Company’s debt was estimated at $3.6 billion and $1.6 billion, respectively, using quoted market prices and

yields for the same or similar types of borrowings, taking into account the underlying terms of the debt

instruments. At December 31, 2007 and 2006, the estimated fair value exceeded the carrying value of the debt by

$59.1 million and $0.4 million, respectively.

12. PREFERRED STOCK AND COMMON STOCKHOLDERS’ EQUITY

Series Preferred Stock

Quest Diagnostics is authorized to issue up to 10 million shares of Series Preferred Stock, par value $1.00

per share. The Company’s Board of Directors has the authority to issue such shares without stockholder approval

and to determine the designations, preferences, rights and restrictions of such shares. Of the authorized shares,

1,300,000 shares have been designated Series A Preferred Stock and 1,000 shares have been designated Voting

Cumulative Preferred Stock. No shares are currently outstanding.

Common Stock

On May 4, 2006, the Company’s Restated Certificate of Incorporation was amended to increase the number

of shares of common stock, par value $0.01 per share, from 300 million shares to 600 million shares.

F-27

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)