Quest Diagnostics 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of

Equity Securities

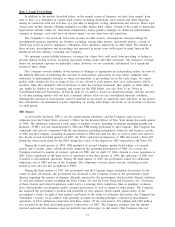

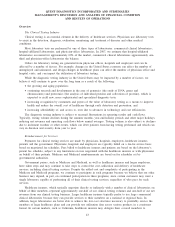

Our common stock is listed and traded on the New York Stock Exchange under the symbol “DGX.” As of

February 1, 2008, we had approximately 5,800 record holders of our common stock; we believe that the number

of beneficial holders of our common stock exceeds the number of record holders. The following table sets forth,

for the periods indicated, the high and low sales price per share as reported on the New York Stock Exchange

Consolidated Tape and dividend information.

High Low

Dividends

Declared

Common Stock

Market Price

2006

First Quarter .................. $54.33 $48.79 $0.10

Second Quarter ............... 60.35 49.26 0.10

Third Quarter ................. 64.69 57.69 0.10

Fourth Quarter ................ 61.11 48.59 0.10

2007

First Quarter .................. $54.29 $48.07 $0.10

Second Quarter ............... 54.75 47.98 0.10

Third Quarter ................. 58.63 51.36 0.10

Fourth Quarter ................ 58.23 51.91 0.10

We expect to fund future dividend payments with cash flows from operations, and do not expect the

dividend to have a material impact on our ability to finance future growth.

We did not repurchase any shares of our common stock during the fourth quarter of our fiscal year ended

December 31, 2007.

In 2003, our Board of Directors authorized a share repurchase program, which permitted us to purchase up

to $600 million of our common stock. In July 2004, our Board of Directors authorized us to purchase up to an

additional $300 million of our common stock. Under a separate authorization from our Board of Directors, in

December 2004 we repurchased 5.4 million shares of our common stock for approximately $254 million from

GlaxoSmithKline plc. Our Board of Directors expanded the share repurchase authorization in January 2005 and

January 2006 by an additional $350 million and an additional $600 million, respectively. As of December 31,

2007 and since the inception of the share repurchase program in May 2003, we have repurchased 44.1 million

shares of our common stock at an average price of $45.35 for $2.0 billion. At December 31, 2007, approximately

$104 million of the share repurchase authorizations remained available. The share repurchase program has no set

expiration or termination date.

34