Quest Diagnostics 2007 Annual Report Download - page 81

Download and view the complete annual report

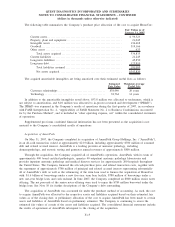

Please find page 81 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the reporting unit. The first step screens for potential impairment and the second step measures the amount of the

impairment, if any. Management’s estimate of fair value considers publicly available information regarding the

market capitalization of the Company as well as (i) publicly available information regarding comparable publicly-

traded companies in the clinical testing industry, (ii) the financial projections and future prospects of the

Company’s business, including its growth opportunities and likely operational improvements, and (iii) comparable

sales prices, if available. As part of the first step to assess potential impairment, management compares the

estimate of fair value for the reporting unit to the book value of the reporting unit. If the book value is greater

than the estimate of fair value, the Company would then proceed to the second step to measure the impairment,

if any. The second step compares the implied fair value of goodwill with its carrying value. The implied fair

value is determined by allocating the fair value of the reporting unit to all of the assets and liabilities of that unit

as if the reporting unit had been acquired in a business combination and the fair value of the reporting unit was

the purchase price paid to acquire the reporting unit. The excess of the fair value of the reporting unit over the

amounts assigned to its assets and liabilities is the implied fair value of goodwill. If the carrying amount of the

reporting unit’s goodwill is greater than its implied fair value, an impairment loss will be recognized in the

amount of the excess. Management believes its estimation methods are reasonable and reflective of common

valuation practices.

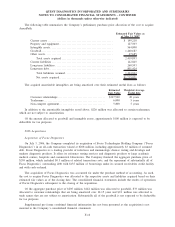

On a quarterly basis, management performs a review of the Company’s business to determine if events or

changes in circumstances have occurred which could have a material adverse effect on the fair value of the

Company and its goodwill. If such events or changes in circumstances were deemed to have occurred, the

Company would perform an impairment test of goodwill as of the end of the quarter, consistent with the annual

impairment test, and record any noted impairment loss.

Recoverability and Impairment of Intangible Assets and Other Long-Lived Assets

The Company evaluates the possible impairment of its long-lived assets, including intangible assets which

are amortized pursuant to the provisions of SFAS 142, under SFAS No. 144, “Accounting for Impairment or

Disposal of Long-Lived Assets”. The Company reviews the recoverability of its long-lived assets when events or

changes in circumstances occur that indicate that the carrying value of the asset may not be recoverable.

Evaluation of possible impairment is based on the Company’s ability to recover the asset from the expected

future pretax cash flows (undiscounted and without interest charges) of the related operations. If the expected

undiscounted pretax cash flows are less than the carrying amount of such asset, an impairment loss is recognized

for the difference between the estimated fair value and carrying amount of the asset.

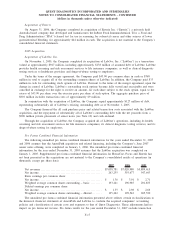

Investments

The Company accounts for investments in equity securities, which are included in “other assets” in the

consolidated balance sheet, in conformity with SFAS No. 115, “Accounting for Certain Investments in Debt and

Equity Securities”, which requires the use of fair value accounting for trading or available-for-sale securities.

Both realized and unrealized gains and losses for trading securities are recorded currently in earnings as a

component of non-operating expenses within “other expense, net” in the consolidated statements of operations.

Unrealized gains and losses, net of tax, for available-for-sale securities are recorded as a component of

“accumulated other comprehensive income (loss)” within stockholders’ equity. Recognized gains and losses for

available-for-sale securities are recorded in “other expense, net” in the consolidated statements of operations.

Gains and losses on securities sold are based on the average cost method.

The Company periodically reviews its investments to determine whether a decline in fair value below the

cost basis is other than temporary. The primary factors considered in the determination are: the length of time

that the fair value of the investment is below carrying value; the financial condition, operating performance and

near term prospects of the investee; and the Company’s intent and ability to hold the investment for a period of

time sufficient to allow for a recovery in fair value. If the decline in fair value is deemed to be other than

temporary, the cost basis of the security is written down to fair value.

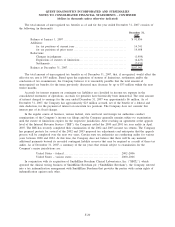

F-11

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)