Quest Diagnostics 2007 Annual Report Download - page 113

Download and view the complete annual report

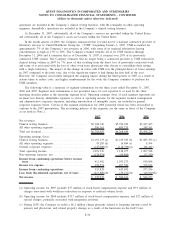

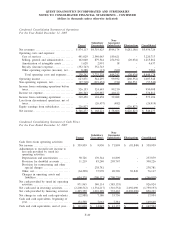

Please find page 113 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(e) In the third quarter of 2007, the Company recorded a charge of $51 million associated with the government’s

investigation in connection with NID (see Note 15).

(f) In the fourth quarter of 2007, the Company recorded a $4.0 million charge associated with the write-down of

an investment and $190 million associated with the government’s investigation in connection with NID (see

Note 15).

(g) In the first quarter of 2006, the Company recorded $21 million in charges as a result of finalizing its plan of

integration of LabOne, $4.1 million in charges related to consolidating operations in California into a new

facility and a $15.8 million gain on the sale of an investment.

(h) In the second quarter of 2006, the Company recorded $28 million in charges as a result of discontinuing

NID’s operations and a $12.3 million charge associated with the write-down of an investment.

(i) In the third quarter of 2006, the Company recorded $2.7 million in charges as a result of discontinuing NID’s

operations and a $4.0 million charge associated with the write-down of an investment.

(j) In the fourth quarter of 2006, the Company recorded an additional $1.0 million in charges as a result of

discontinuing NID’s operations and a $10.0 million charge associated with the write-down of an investment.

During the fourth quarter of 2006, the Company revised its estimate of the number of performance share

units expected to be earned at the end of the performance periods as a result of revising its estimates of

projected performance and reduced stock-based compensation expense associated with performance share units

by approximately $8 million.

F-43