Quest Diagnostics 2007 Annual Report Download - page 84

Download and view the complete annual report

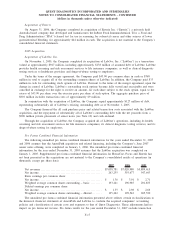

Please find page 84 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.acquisition related third-party expenses incurred, the nature and amount of contingent consideration, and a

discussion of pre-existing relationships between the parties. SFAS 141(R) is effective for the Company as of

January 1, 2009. While the Company is currently assessing the impact of SFAS 141(R) on its consolidated

financial statements, the Company expects that upon adoption of SFAS 141(R), the application of the new

standard is likely to have a significant impact on how the Company allocates the purchase price of an acquired

business, including the expensing of direct transaction costs and costs to integrate the acquired business.

In December 2007, the FASB issued SFAS No. 160 “Noncontrolling Interests in Consolidated Financial

Statements, an Amendment of ARB No. 51”, (“SFAS 160”). SFAS 160 establishes accounting and reporting

standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS 160

requires noncontrolling interests in subsidiaries initially to be measured at fair value and classified as a separate

component of equity. SFAS 160 also requires a new presentation on the face of the consolidated financial

statements to separately report the amounts attributable to controlling and non-controlling interests. SFAS 160 is

effective for the Company as of January 1, 2009. The Company is currently assessing the impact of SFAS 160

on its consolidated financial statements.

3. BUSINESS ACQUISITIONS

2007 Acquisitions

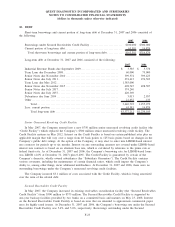

Acquisition of HemoCue

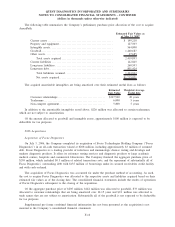

On January 31, 2007, the Company completed its acquisition of POCT Holding AB (“HemoCue”), a

Sweden-based company specializing in point-of-care testing, in an all-cash transaction valued at approximately

$450 million, including $113 million of assumed debt. HemoCue is the leading international provider in point-of-

care for hemoglobin, with a growing share in professional glucose and microalbumin testing. In October 2007,

HemoCue received FDA 510(k) clearance for its White Blood Cell Analyzer, a whole-blood test performed on

finger-stick samples that assist physicians diagnosing infection, inflammation, bone marrow failure, autoimmune

diseases and many other medical conditions now routinely tested by reference laboratories.

In conjunction with the acquisition of HemoCue, the Company repaid approximately $113 million of debt,

representing substantially all of HemoCue’s existing outstanding debt as of January 31, 2007.

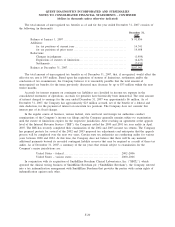

The Company financed the aggregate purchase price of $344 million, which includes transaction costs of

approximately $7 million, of which $2 million was paid in 2006, and the repayment of substantially all of

HemoCue’s outstanding debt with the proceeds from a new $450 million term loan and cash on-hand. On May

31, 2007, the Company refinanced this term loan (see Note 10). In January 2008, the Company received a

payment of approximately $24 million from an escrow fund established at the time of the acquisition, which

reduces the aggregate purchase price to $320 million.

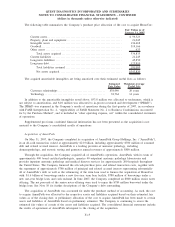

The acquisition of HemoCue was accounted for under the purchase method of accounting. As such, the cost

to acquire HemoCue was allocated to the respective assets and liabilities acquired based on their estimated fair

values as of the closing date. During 2007, the Company finalized its fair value estimates of the assets and

liabilities acquired. The consolidated financial statements include the results of operations of HemoCue

subsequent to the closing of the acquisition.

F-14

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)