Quest Diagnostics 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company incurred $6.3 million of costs associated with the 2007 Senior Notes, which is being

amortized over the term of the related debt.

The Company used the net proceeds from the 2007 Senior Notes to repay the $780 million of borrowings

under the Bridge Loan, discussed above.

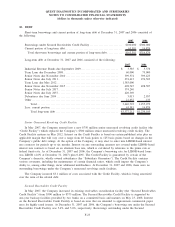

Debentures due June 2034

In connection with the acquisition of LabOne in November 2005, the Company assumed $103.5 million of

3.50% convertible senior debentures of LabOne due June 15, 2034 (the “Debentures due June 2034”). As a result

of the change in control of LabOne, the holders of the debentures had the right from November 1, 2005 to

December 1, 2005 to: (i) have their debentures repurchased by LabOne for 100% of the principal amount of the

debentures, plus accrued and unpaid interest thereon through November 30, 2005; or (ii) have their debentures

converted into the amount the respective holder would have received if the holder had converted the debentures

prior to November 1, 2005, plus an additional premium. As a result of the change in control of LabOne, and as

provided in the indenture to the debentures, the conversion rate increased so that each $1,000 principal amount of

the debentures was convertible into cash in the amount of $1,280.88 if converted by December 1, 2005. As a

result of the change in control of LabOne, of the total outstanding principal balance of the Debentures due June

2034 of $103.5 million, $99 million of principal was converted for $126.8 million in cash, reflecting a premium

of $27.8 million. The remaining outstanding principal of the Debentures due June 2034 totaling $4.5 million was

adjusted to its estimated fair value of $2.9 million, reflecting a discount of $1.6 million based on the net present

value of the estimated remaining obligations, at then current interest rates. The Debentures due June 2034 require

semi-annual interest payments in June and December.

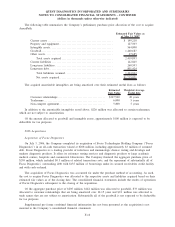

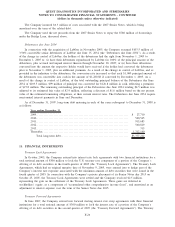

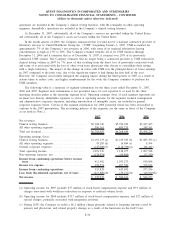

As of December 31, 2007, long-term debt maturing in each of the years subsequent to December 31, 2008 is

as follows:

Year ending December 31,

2009.......................................................................... $ 27,710

2010.......................................................................... 560,545

2011.......................................................................... 915,683

2012.......................................................................... 560,819

2013.......................................................................... 315

Thereafter..................................................................... 1,312,140

Total long-term debt . . . ................................................... $3,377,212

11. FINANCIAL INSTRUMENTS

Treasury Lock Agreements

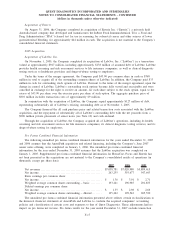

In October 2005, the Company entered into interest rate lock agreements with two financial institutions for a

total notional amount of $300 million to lock the U.S. treasury rate component of a portion of the Company’s

offering of its debt securities in the fourth quarter of 2005 (the “Treasury Lock Agreements”). The Treasury Lock

Agreements, which had an original maturity date of November 9, 2005, were entered into to hedge part of the

Company’s interest rate exposure associated with the minimum amount of debt securities that were issued in the

fourth quarter of 2005. In connection with the Company’s private placement of its Senior Notes due 2015 on

October 25, 2005, the Treasury Lock Agreements were settled and the Company received $2.5 million,

representing the gain on the settlement of the Treasury Lock Agreements. These gains are deferred in

stockholders’ equity, as a component of “accumulated other comprehensive income (loss)”, and amortized as an

adjustment to interest expense over the term of the Senior Notes due 2015.

Treasury Forward Agreements

In June 2007, the Company entered into forward starting interest rate swap agreements with three financial

institutions for a total notional amount of $300 million to lock the interest rate of a portion of the Company’s

offering of its debt securities in the second quarter of 2007 (the “Treasury Forward Agreements”). The Treasury

F-26

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)