Quest Diagnostics 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands unless otherwise indicated)

10. DEBT

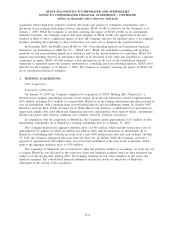

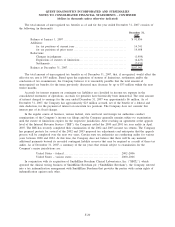

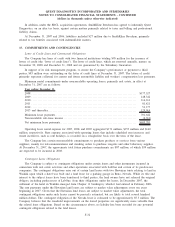

Short-term borrowings and current portion of long-term debt at December 31, 2007 and 2006 consisted of

the following:

2007 2006

Borrowings under Secured Receivables Credit Facility .......................... $100,000 $300,000

Current portion of long-term debt.............................................. 63,581 16,874

Total short-term borrowings and current portion of long-term debt . . . ......... $163,581 $316,874

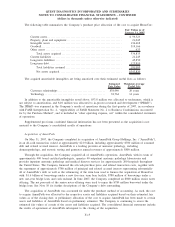

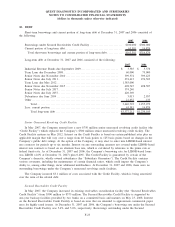

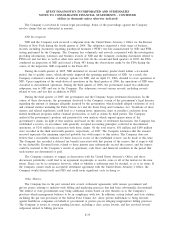

Long-term debt at December 31, 2007 and 2006 consisted of the following:

2007 2006

Industrial Revenue Bonds due September 2009.............................. $ 3,585 $ 5,376

Term Loan due December 2008............................................ 60,000 75,000

Senior Notes due November 2010 . . ........................................ 399,574 399,423

Senior Notes due July 2011 ................................................ 274,613 274,503

Term Loan due May 2012 ................................................. 1,385,000 -

Senior Notes due November 2015 . . ........................................ 498,747 498,587

Senior Notes due July 2017 ................................................ 374,240 -

Senior Notes due July 2037 ................................................ 420,369 -

Debentures due June 2034 ................................................. 3,013 2,957

Other . . ................................................................... 21,652 133

Total ................................................................. 3,440,793 1,255,979

Less: current portion....................................................... 63,581 16,874

Total long-term debt . ................................................. $3,377,212 $1,239,105

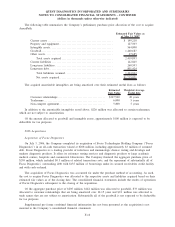

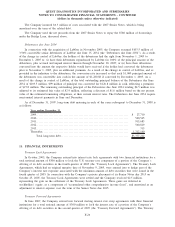

Senior Unsecured Revolving Credit Facility

In May 2007, the Company entered into a new $750 million senior unsecured revolving credit facility (the

“Credit Facility”) which replaced the Company’s $500 million senior unsecured revolving credit facility. The

Credit Facility matures in May 2012. Interest on the Credit Facility is based on certain published rates plus an

applicable margin that will vary over a range from 40 basis points to 125 basis points based on changes in the

Company’s public debt ratings. At the option of the Company, it may elect to enter into LIBOR-based interest

rate contracts for periods up to six months. Interest on any outstanding amounts not covered under LIBOR-based

interest rate contracts is based on an alternate base rate, which is calculated by reference to the prime rate or

federal funds rate. As of December 31, 2007 and 2006, the Company’s borrowing rate for LIBOR-based loans

was LIBOR (4.6% at December 31, 2007) plus 0.40%. The Credit Facility is guaranteed by certain of the

Company’s domestic, wholly owned subsidiaries (the “Subsidiary Guarantors”). The Credit Facility contains

various covenants, including the maintenance of certain financial ratios, which could impact the Company’s

ability to, among other things, incur additional indebtedness. At December 31, 2007 and 2006, there were no

outstanding borrowings under the Company’s unsecured revolving credit facilities.

The Company incurred $3.1 million of costs associated with the Credit Facility, which is being amortized

over the term of the related debt.

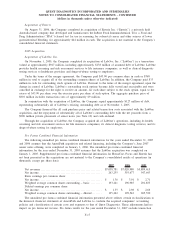

Secured Receivables Credit Facility

In May 2007, the Company increased its existing receivables securitization facility (the “Secured Receivables

Credit Facility”) from $300 million to $375 million. The Secured Receivables Credit Facility is supported by

one-year back-up facilities provided by two banks on a committed basis and matures on May 23, 2008. Interest

on the Secured Receivables Credit Facility is based on rates that are intended to approximate commercial paper

rates for highly rated issuers. At December 31, 2007 and 2006, the Company’s borrowing rate under the Secured

Receivables Credit Facility was 5.4% and 5.6%, respectively. Borrowings outstanding under the Secured

F-23