Quest Diagnostics 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

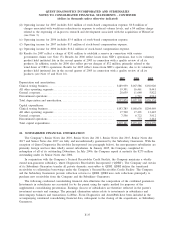

operations are included in the Company’s clinical testing business, with the remainder in other operating

segments. AmeriPath’s operations are included in the Company’s clinical testing business.

At December 31, 2007, substantially all of the Company’s services are provided within the United States,

and substantially all of the Company’s assets are located within the United States.

In the fourth quarter of 2006, the Company announced that it would not be a national contracted provider of

laboratory services to United Healthcare Group Inc. (“UNH”) beginning January 1, 2007. UNH accounted for

approximately 7% of the Company’s net revenues in 2006, with some of its regional laboratories having

concentrations as high as 15% to 20%. The Company retained virtually all of its UNH business through

December 31, 2006 and it estimates that as of December 31, 2007, it retained over 20% of its previously

contracted UNH volume. The Company estimates that no longer being a contracted provider to UNH reduced its

clinical testing volume in 2007 by 7%, most of that resulting from the direct loss of previously contracted work,

and some of it associated with the loss of other work from physicians who choose to consolidate their testing

with a single laboratory. The impact of the change in status with UNH was the principal driver of lower earnings

in 2007 compared to the prior year, due to the significant impact it had during the first half of the year.

However, the Company successfully mitigated the ongoing impact during the third quarter of 2007 as a result of

actions taken to reduce costs, and higher reimbursement for the work the Company continues to perform for

UNH members.

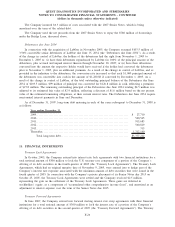

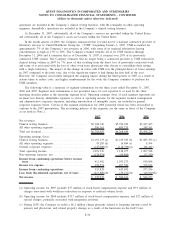

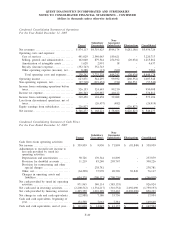

The following table is a summary of segment information for the three years ended December 31, 2007,

2006 and 2005. Segment asset information is not presented since it is not reported to or used by the chief

operating decision maker at the operating segment level. Operating earnings (loss) of each segment represents net

revenues less directly identifiable expenses to arrive at operating income for the segment. General management

and administrative corporate expenses, including amortization of intangible assets, are included in general

corporate expenses below. Certain of the segment information for 2006 presented below has been reclassified to

conform to the 2007 presentation. The accounting policies of the segments are the same as those of the Company

as set forth in Note 2.

2007 2006 2005

Net revenues:

Clinical testing business ............................. $6,108,746 $5,782,926 $5,247,465

All other operating segments......................... 596,161 485,733 209,261

Total net revenues................................... $6,704,907 $6,268,659 $5,456,726

Operating earnings (loss):

Clinical testing business ............................. $1,191,139 (a) $1,230,383 (b) $1,083,395 (c)

All other operating segments......................... 45,285 (d) 16,484 (e) 8,594

General corporate expenses .......................... (145,088)(f) (118,790)(g) (84,441)

Total operating income .............................. 1,091,336 1,128,077 1,007,548

Non-operating expenses, net ......................... (178,934) (94,804) (57,540)

Income from continuing operations before income

taxes ............................................. 912,402 1,033,273 950,008

Income tax expense ................................ 358,574 407,581 376,812

Income from continuing operations ................. 553,828 625,692 573,196

Loss from discontinued operations, net of taxes . . . . (213,889)(h) (39,271)(h) (26,919)(h)

Net income ......................................... $ 339,939 $ 586,421 $ 546,277

(a) Operating income for 2007 includes $37 million of stock-based compensation expense and $9.9 million of

charges associated with workforce reductions in response to reduced volume levels.

(b) Operating income for 2006 includes $33.7 million of stock-based compensation expense, and $27 million of

special charges, primarily associated with integration activities.

(c) During 2005, the Company recorded a $6.2 million charge primarily related to forgiving amounts owed by

patients and physicians, and related property damage as a result of the hurricanes in the Gulf Coast.

F-36

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)