Quest Diagnostics 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

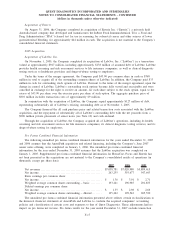

A reconciliation of the federal statutory rate to the Company’s effective tax rate for 2007, 2006 and 2005

was as follows:

2007 2006 2005

Tax provision at statutory rate .......................................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit ...................... 4.6 4.3 4.6

Impact of foreign operations ............................................ (0.8) 0.3 -

Non-deductible expenses, primarily meals and entertainment expenses ..... 0.3 0.3 0.2

Other, net .............................................................. 0.2 (0.5) (0.1)

Effective tax rate..................................................... 39.3% 39.4% 39.7%

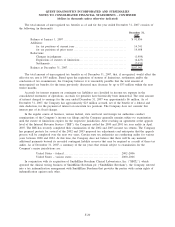

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets

(liabilities) at December 31, 2007 and 2006 were as follows:

2007 2006

Current deferred tax assets:

Accounts receivable reserve .................................................... $ 54,226 $ 36,888

Liabilities not currently deductible.............................................. 95,615 83,652

Total current deferred tax assets. ............................................. $ 149,841 $ 120,540

Non-current deferred tax assets (liabilities):

Liabilities not currently deductible.............................................. $ 117,647 $ 85,821

Stock-based compensation...................................................... 36,664 19,896

Net operating loss carryforwards ............................................... 29,131 18,229

Depreciation and amortization . . ................................................ (393,134) (128,814)

Total non-current deferred tax liabilities ...................................... $(209,692) $ (4,868)

At December 31, 2006, non-current deferred tax assets of $16 million are included in other long-term assets

in the consolidated balance sheet. At December 31, 2007 and 2006, non-current deferred tax liabilities of $210

million and $21 million, respectively, are included in other long-term liabilities in the consolidated balance sheet.

As of December 31, 2007, the Company had estimated net operating loss carryforwards for federal, state and

foreign income tax purposes of $98 million, $508 million and $33 million, respectively, which expire at various

dates through 2027. As of December 31, 2007 and 2006, deferred tax assets associated with net operating loss

carryforwards of $71 million and $29 million, respectively, have each been reduced by a valuation allowance of

$42 million and $11 million, respectively.

Income taxes payable including those classified in other long-term liabilities in the consolidated balance

sheets at December 31, 2007 and 2006, were $83 million and $36 million, respectively.

The Company has identified and categorized its tax positions and these positions have been evaluated and

assessed for recognition and measurement under the guidelines of FIN 48. The adoption of FIN 48 resulted in an

increase to our contingent tax liability reserves of $30 million with corresponding charges to retained earnings,

goodwill and additional paid-in capital. The contingent liabilities for tax positions under FIN 48 primarily relate

to uncertainties associated with the realization of tax benefits derived from certain state net operating loss carry

forwards, the allocation of income and expense among state jurisdictions, the characterization and timing of

certain tax deductions associated with business combinations and employee compensation, and income and

expenses associated with certain intercompany licensing arrangements. As of January 1, 2007, the amount of

unrecognized tax benefits was $92 million which, if recognized, $46 million would affect the effective tax rate.

Included in the balance of unrecognized tax benefits is approximately $43 million related to tax positions

associated with the intercompany licensing arrangements and the allocation of income and expenses among state

jurisdictions.

The recognition and measurement of certain tax benefits includes estimates and judgment by management

and inherently includes subjectivity. Changes in estimates may create volatility in the Company’s effective tax

rate in future periods and may be due to settlements with various tax authorities (either favorable or unfavorable),

the expiration of the statute of limitations on some tax positions and obtaining new information about particular

tax positions that may cause management to change its estimates.

F-19

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)