Quest Diagnostics 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LabOne integration plan. These additions were $142 million, $40 million and $10 million, respectively. In

connection with the Company’s decision to discontinue the operations of NID in the second quarter of 2006, the

Company eliminated the goodwill and related accumulated amortization associated with NID, which had no

impact on goodwill, net. In addition, goodwill was reduced $2.4 million primarily related to the favorable

resolution of certain pre-acquisition tax contingencies associated with businesses acquired.

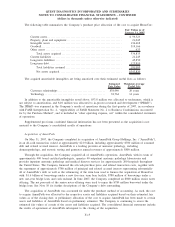

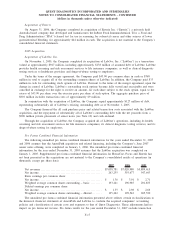

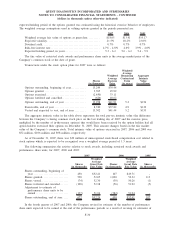

Intangible assets at December 31, 2007 and 2006 consisted of the following:

Cost

Accumulated

Amortization Net Cost

Accumulated

Amortization Net

Weighted

Average

Amortization

Period December 31, 2007 December 31, 2006

Amortizing intangible assets:

Customer-related

intangibles . . . . . 19 years $ 589,418 $ (70,036) $519,382 $206,880 $(48,010) $158,870

Non-compete

agreements . . . . . 5 years 53,832 (46,476) 7,356 47,165 (45,261) 1,904

Other . ........... 12 years 64,214 (8,394) 55,820 15,372 (3,500) 11,872

Total .......... 18 years 707,464 (124,906) 582,558 269,417 (96,771) 172,646

Intangible assets not subject to

amortization:

Tradenames . . ................... 304,175 - 304,175 20,700 - 20,700

Total intangible assets ......... $1,011,639 $(124,906) $886,733 $290,117 $(96,771) $193,346

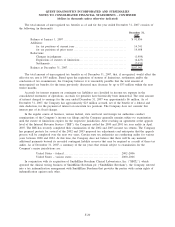

Amortization expense related to intangible assets was $27.9 million, $10.8 million and $4.6 million for the

years ended December 31, 2007, 2006 and 2005, respectively.

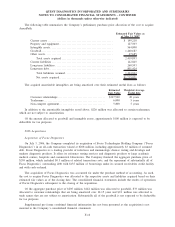

The estimated amortization expense related to amortizable intangible assets for each of the five succeeding

fiscal years and thereafter as of December 31, 2007 is as follows:

Fiscal Year Ending

December 31,

2008.............................................................. $ 36,015

2009.............................................................. 35,601

2010.............................................................. 35,343

2011.............................................................. 35,121

2012.............................................................. 33,880

Thereafter. . . ...................................................... 406,598

Total ........................................................... $582,558

For the year ended December 31, 2007, the increase in intangible assets not subject to amortization was due

to tradenames resulting from the acquisitions of AmeriPath, $226 million, and HemoCue, $53.8 million (see

Note 3).

For the year ended December 31, 2006, the increase in intangible assets not subject to amortization was due

to tradenames resulting from the acquisitions of Focus Diagnostics, $9.1 million, and Enterix, $2.2 million (see

Note 3).

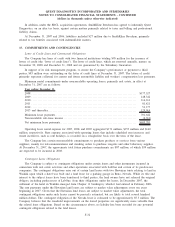

9. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses at December 31, 2007 and 2006 consisted of the following:

2007 2006

Trade accounts payable...................................................... $ 205,067 $215,721

Accrued wages and benefits . . ............................................... 318,285 321,539

Accrued expenses . . ......................................................... 359,355 295,476

Accrued settlement reserves. . . ............................................... 242,009 1,260

Total . . . .................................................................. $1,124,716 $833,996

F-22

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)