Quest Diagnostics 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

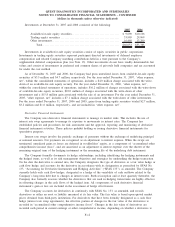

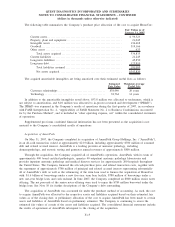

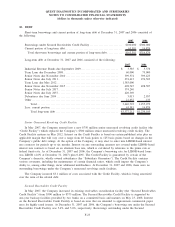

The following table summarizes the Company’s preliminary purchase price allocation of the cost to acquire

AmeriPath:

Estimated Fair Values as

of May 31, 2007

Current assets .................................................... $ 199,218

Property and equipment . .......................................... 127,503

Intangible assets .................................................. 564,800

Goodwill ......................................................... 1,460,687

Other assets . . .................................................... 67,685

Total assets acquired ......................................... 2,419,893

Current liabilities ................................................. 142,845

Long-term liabilities .............................................. 260,593

Long-term debt ................................................... 801,424

Total liabilities assumed ...................................... 1,204,862

Net assets acquired. .......................................... $1,215,031

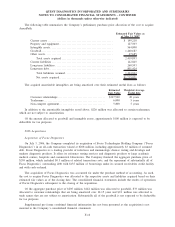

The acquired amortizable intangibles are being amortized over their estimated useful lives as follows:

Estimated

Fair Value

Weighted Average

Useful Life

Customer relationships ...................................... $327,500 20 years

Tradename ................................................. 6,000 5 years

Non-compete agreement. .................................... 5,800 5 years

In addition to the amortizable intangibles noted above, $226 million was allocated to certain tradenames,

which are not subject to amortization.

Of the amount allocated to goodwill and intangible assets, approximately $100 million is expected to be

deductible for tax purposes.

2006 Acquisitions

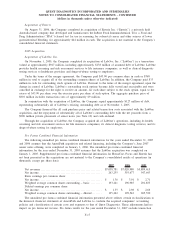

Acquisition of Focus Diagnostics

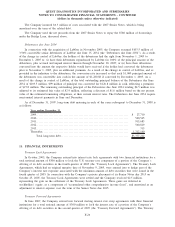

On July 3, 2006, the Company completed its acquisition of Focus Technologies Holding Company (“Focus

Diagnostics”) in an all-cash transaction valued at $208 million, including approximately $3 million of assumed

debt. Focus Diagnostics is a leading provider of infectious and immunologic disease testing and develops and

markets diagnostic products. It offers its reference testing services and diagnostic products to large academic

medical centers, hospitals and commercial laboratories. The Company financed the aggregate purchase price of

$205 million, which included $0.5 million of related transaction costs, and the repayment of substantially all of

Focus Diagnostics’ outstanding debt with $135 million of borrowings under its secured receivables credit facility

and with cash on-hand.

The acquisition of Focus Diagnostics was accounted for under the purchase method of accounting. As such,

the cost to acquire Focus Diagnostics was allocated to the respective assets and liabilities acquired based on their

estimated fair values as of the closing date. The consolidated financial statements include the results of operations

of Focus Diagnostics subsequent to the closing of the acquisition.

Of the aggregate purchase price of $205 million, $142 million was allocated to goodwill, $33 million was

allocated to customer relationships that are being amortized over 10-15 years and $9.1 million was allocated to

trade names that are not subject to amortization. Substantially all of the goodwill is not expected to be deductible

for tax purposes.

Supplemental pro forma combined financial information has not been presented as the acquisition is not

material to the Company’s consolidated financial statements.

F-16

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)