Quest Diagnostics 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In addition, under the SBCL acquisition agreements, SmithKline Beecham has agreed to indemnify Quest

Diagnostics, on an after tax basis, against certain matters primarily related to taxes and billing and professional

liability claims.

At December 31, 2007 and 2006, liabilities included $27 million due to SmithKline Beecham, primarily

related to tax benefits associated with indemnifiable matters.

15. COMMITMENTS AND CONTINGENCIES

Letter of Credit Lines and Contractual Obligations

The Company has lines of credit with two financial institutions totaling $95 million for the issuance of

letters of credit (the “letter of credit lines”). The letter of credit lines, which are renewed annually, mature on

November 30, 2008 and December 31, 2008 and are guaranteed by the Subsidiary Guarantors.

In support of its risk management program, to ensure the Company’s performance or payment to third

parties, $83 million were outstanding on the letter of credit lines at December 31, 2007. The letters of credit

primarily represent collateral for current and future automobile liability and workers’ compensation loss payments.

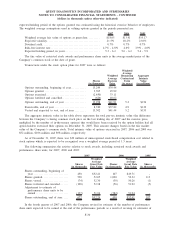

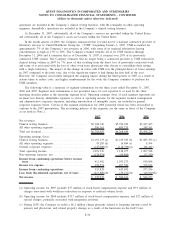

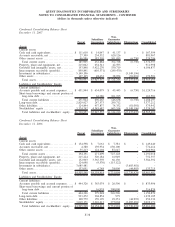

Minimum rental commitments under noncancelable operating leases, primarily real estate, in effect at

December 31, 2007 are as follows:

Year ending December 31,

2008 . . . ................................................................................. $177,527

2009 . . . ................................................................................. 148,342

2010 . . . ................................................................................. 114,161

2011 . . . ................................................................................. 81,421

2012 . . . ................................................................................. 51,177

2013 and thereafter. ...................................................................... 129,014

Minimum lease payments. . ............................................................... 701,642

Noncancelable sub-lease income .......................................................... (6,361)

Net minimum lease payments............................................................. $695,281

Operating lease rental expense for 2007, 2006 and 2005 aggregated $171 million, $153 million and $140

million, respectively. Rent expense associated with operating leases that include scheduled rent increases and

tenant incentives, such as rent holidays, is recorded on a straight-line basis over the term of the lease.

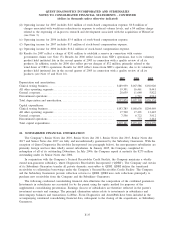

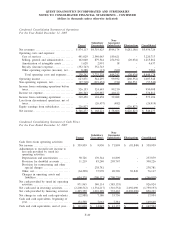

The Company has certain noncancelable commitments to purchase products or services from various

suppliers, mainly for telecommunications and standing orders to purchase reagents and other laboratory supplies.

At December 31, 2007, the approximate total future purchase commitments are $87 million, of which $39 million

are expected to be incurred in 2008.

Contingent Lease Obligations

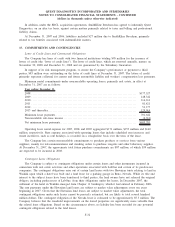

The Company is subject to contingent obligations under certain leases and other instruments incurred in

connection with real estate activities and other operations associated with LabOne and certain of its predecessor

companies. The contingent obligations arise out of certain land leases with two Hawaiian trusts relating to land in

Waikiki upon which a hotel was built and a land lease for a parking garage in Reno, Nevada. While its title and

interest to the subject leases have been transferred to third parties, the land owners have not released the original

obligors, including predecessors of LabOne, from their obligations under the leases. In December 2007, the

subtenant of the hotel in Waikiki emerged from Chapter 11 bankruptcy which it had entered in February 2006.

The rent payments under the Hawaiian land leases are subject to market value adjustments every ten years

beginning in 2007. Given that the Hawaiian land leases are subject to market value adjustments, the total

contingent obligations under such leases cannot be precisely estimated, but are likely to total several hundred

million dollars. The contingent obligation of the Nevada lease is estimated to be approximately $5.3 million. The

Company believes that the leasehold improvements on the leased properties are significantly more valuable than

the related lease obligations. Based on the circumstances above, no liability has been recorded for any potential

contingent obligations related to the land leases.

F-32

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)