Quest Diagnostics 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.exercise behavior of employees. In addition, SFAS 123R requires us to estimate the expected impact of forfeited

awards and recognize stock-based compensation cost only for those awards expected to vest. We use historical

experience to estimate projected forfeitures. If actual forfeiture rates are materially different from our estimates,

stock-based compensation expense could be significantly different from what we have recorded in the current

period. We periodically review actual forfeiture experience and revise our estimates, as considered necessary. The

cumulative effect on current and prior periods of a change in the estimated forfeiture rate is recognized as

compensation cost in earnings in the period of the revision.

Finally, the terms of our performance share unit grants allow the recipients of such awards to earn a variable

number of shares based on the achievement of the performance goals specified in the awards. The actual amount

of any stock award is based on the Company’s earnings per share growth as measured in accordance with its

Amended and Restated Employee Long-Term Incentive Plan for the performance period compared to that of a

peer group of companies. Stock-based compensation expense associated with performance share units is

recognized based on management’s best estimates of the achievement of the performance goals specified in such

awards and the resulting number of shares that will be earned. If the actual number of performance share units

earned is different from our estimates, stock-based compensation could be significantly different from what we

have recorded in the current period. We periodically obtain and review publicly available financial information

for the members of the peer group and compare that to actual and estimated future performance of the Company,

including historical earnings per share growth as well as published estimates of projected earnings per share

growth. This information is used to evaluate our progress towards achieving the performance criteria and our

estimate of the number of performance share units expected to be earned at the end of the performance period.

The cumulative effect on current and prior periods of a change in the estimated number of performance share

units expected to be earned is recognized as compensation cost in earnings in the period of the revision. While

the assumptions used to calculate and account for stock-based compensation awards represent management’s best

estimates, these estimates involve inherent uncertainties and the application of management’s judgment. As a

result, if revisions are made to our assumptions and estimates, our stock-based compensation expense could vary

significantly from period to period. In addition, the number of awards made under our equity compensation plans,

changes in the design of those plans, the price of our shares and the performance of our Company can all cause

stock-based compensation expense to vary from period to period.

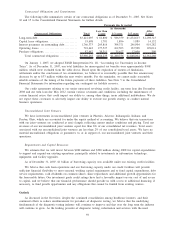

Results of Operations

Our clinical testing business currently represents our one reportable business segment. The clinical testing

business for each of the three years in the period ended December 31, 2007 accounted for more than 90% of net

revenues from continuing operations. Our other operating segments consist of our risk assessment services

business, our clinical trials testing business, our healthcare information technology business, MedPlus, and our

diagnostic products business. On April 19, 2006, we decided to discontinue the operations of a test kit

manufacturing subsidiary, NID. During the third quarter of 2006, we completed the wind down of NID and

classified the operations of NID as discontinued operations for all periods presented. Our business segment

information is disclosed in Note 17 to the Consolidated Financial Statements.

Year Ended December 31, 2007 Compared with Year Ended December 31, 2006

Continuing Operations

Income from continuing operations for the year ended December 31, 2007 was $554 million, or $2.84 per

diluted share, compared to $626 million, or $3.14 per diluted share in 2006. The decrease in income from

continuing operations is principally due to the impact of the change in contract status with UNH, discussed

earlier under “Recent Changes in Payer Relationships”. However, we successfully mitigated the ongoing impact

during the third quarter of 2007 as a result of actions taken to reduce costs, and higher reimbursement for the

testing we continue to perform for UNH members. During the second half of the year our profits, before

considering the acquisition of AmeriPath, exceeded those of the prior year, when we were a contracted provider

to UNH. The acquisition of AmeriPath, which was completed in May 2007, also served to reduce income from

continuing operations compared to the prior year. We expect the acquisition of AmeriPath to improve our

revenue growth and earnings once the anticipated growth opportunities and cost synergies associated with the

acquisition are realized. Results for the year ended December 31, 2007 include first quarter pre-tax charges of

$10.7 million, or $0.03 per diluted share, associated with workforce reductions in response to reduced volume

levels and $4.0 million, or $0.01 per diluted share, related to in-process research and development expense

associated with the HemoCue acquisition.

51