Quest Diagnostics 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.designated as part of a hedge transaction and, if it is, the type of hedge transaction based on the specific

qualifying conditions in SFAS 133. Amounts in “accumulated other comprehensive income (loss)” are reclassified

into earnings in “interest expense, net” during the same period in which the hedged item affects earnings. If it is

determined that a derivative ceases to be a highly effective hedge, the Company discontinues hedge accounting,

and any deferred gains or losses are recorded in the consolidated statement of operations.

Comprehensive Income (Loss)

Comprehensive income (loss) encompasses all changes in stockholders’ equity (except those arising from

transactions with stockholders) and includes net income, net unrealized capital gains or losses on available-for-

sale securities, foreign currency translation adjustments and deferred gains related to the settlement of certain

treasury lock agreements (see Note 11).

New Accounting Standards

In September 2006, the FASB issued SFAS No. 157 “Fair Value Measurements” (“SFAS 157”). SFAS 157

provides a new single authoritative definition of fair value and provides enhanced guidance for measuring the fair

value of assets and liabilities and requires additional disclosures related to the extent to which companies measure

assets and liabilities at fair value, the information used to measure fair value, and the effect of fair value

measurements on earnings. SFAS 157 is effective for the Company as of January 1, 2008 for financial assets and

financial liabilities within its scope and it is not expected to have a material impact on its consolidated financial

statements. In February 2008, the FASB issued FASB Staff Position No. FAS 157-2 “Effective Date of FASB

Statement No. 157” (“FSP FAS 157-2”), which defers the effective date of SFAS 157 for all non-financial assets

and non-financial liabilities, except those that are recognized or disclosed at fair value in the financial statements

on a recurring basis (at least annually), for fiscal years beginning after November 15, 2008 and interim periods

within those fiscal years for items within the scope of FSP FAS 157-2. The Company is currently assessing the

impact, if any, of SFAS 157 and FSP FAS 157-2 for non-financial assets and non-financial liabilities on its

consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159 “The Fair Value Option for Financial Assets and

Financial Liabilities” (“SFAS 159”). SFAS 159 provides companies with an option to irrevocably elect to

measure certain financial assets and financial liabilities at fair value on an instrument-by-instrument basis with the

resulting changes in fair value recorded in earnings. The objective of SFAS 159 is to reduce both the complexity

in accounting for financial instruments and the volatility in earnings caused by using different measurement

attributes for financial assets and financial liabilities. SFAS 159 is effective for the Company as of January 1,

2008 and as of this effective date, the Company has elected not to apply the fair value option to any of its

financial assets or financial liabilities.

In September 2007, the FASB ratified Emerging Issues Task Force Issue No. 07-1 “Accounting for

Collaborative Agreements”, (“EITF 07-1”). EITF 07-1 defines collaborative agreements as contractual

arrangements that involve a joint operating activity. These arrangements involve two (or more) parties who are

both active participants in the activity and that are exposed to significant risks and rewards dependent on the

commercial success of the activity. EITF 07-1 provides that a company should report the effects of adoption as a

change in accounting principle through retrospective application to all periods and requires additional disclosures

about a company’s collaborative arrangements. EITF 07-1 is effective for the Company as of January 1, 2009.

The adoption of EITF 07-1 is not expected to have a material impact on the Company’s consolidated financial

statements.

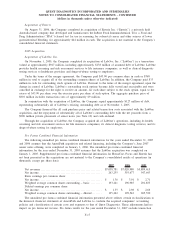

In December 2007, the FASB issued SFAS No. 141(R) “Business Combinations” (“SFAS 141(R)”). SFAS

141(R) changes several underlying principles in applying the purchase method of accounting. Among the

significant changes, SFAS 141(R) requires a redefining of the measurement date of a business combination,

expensing direct transaction costs as incurred, capitalizing in-process research and development costs as an

intangible asset and recording a liability for contingent consideration at the measurement date with subsequent re-

measurements recorded in the results of operations. SFAS 141(R) also requires that costs for business

restructuring and exit activities related to the acquired company will be included in the post-combination financial

results of operations and also provides new guidance for the recognition and measurement of contingent assets

and liabilities in a business combination. In addition, SFAS 141(R) requires several new disclosures, including the

reasons for the business combination, the factors that contribute to the recognition of goodwill, the amount of

F-13

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)