Pentax 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Copyright 2013 © HOYA CORPORATION

8

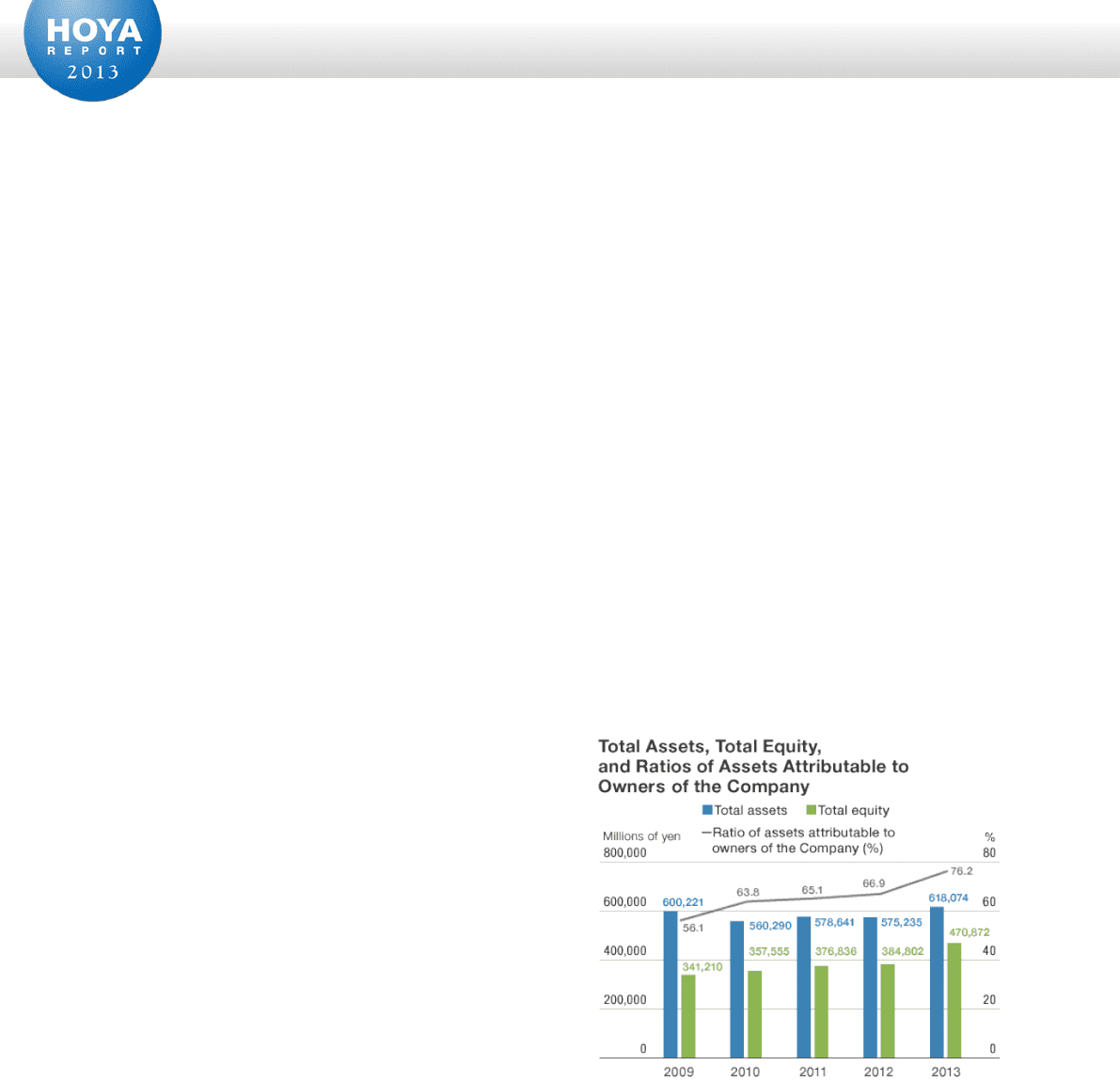

Financial Position

Total assets at the end of the fiscal year under review increased ¥42,839 million, or 7.4% year on year, to

¥618,074 million.

Non-current assets increased ¥24,357 million (14.2%) year on year, to ¥195,917 million. The cost of restoration

for major eyeglass lens production sites damaged by the flooding in Thailand and construction of a plant to

produce mask blanks for semiconductors in Singapore and others led to an increase of ¥32,343 million in

property, plant and equipment – net, while investments in associates decreased ¥12,401 million as a share of

losses from associates was recorded.

Current assets increased ¥18,483 million (4.6%) year on year, to ¥422,157 million. The increase was primarily due

to a rise in trade and other receivables of ¥13,133 million and a ¥44,124 million increase in cash and cash

equivalents, while other short-term financial assets decreased by ¥38,062 million partly due to payments for

redemption of corporate bonds.

Liabilities amounted to ¥147,389 million, a ¥43,193 million decrease from the level of a year earlier. This was

primarily due to a ¥39,333 million decrease in interest-bearing short-term debt, which was mainly caused by

payments for redemption of corporate bonds and a

¥4,224 million decrease in retirement benefits

obligation, stemming from the completion of a

closed-end defined-benefit plan (former Pentax

retirement fund plan), which was transferred at the

time of the business integration with Pentax.

Total equity increased by ¥86,032 million year on

year, to ¥470,685 million, partly due to a ¥43,055

million increase in reta ined e arnings. Equity

attributable to owners of the Company, which is

obtained by deducting non-controlling interest in

equity from total equity, amounted to ¥470,872

million, improving the ratio of equity attributable to

equity holders of the parent by 9.3 percentage points

from a year earlier levels, to 76.2%.