Pentax 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

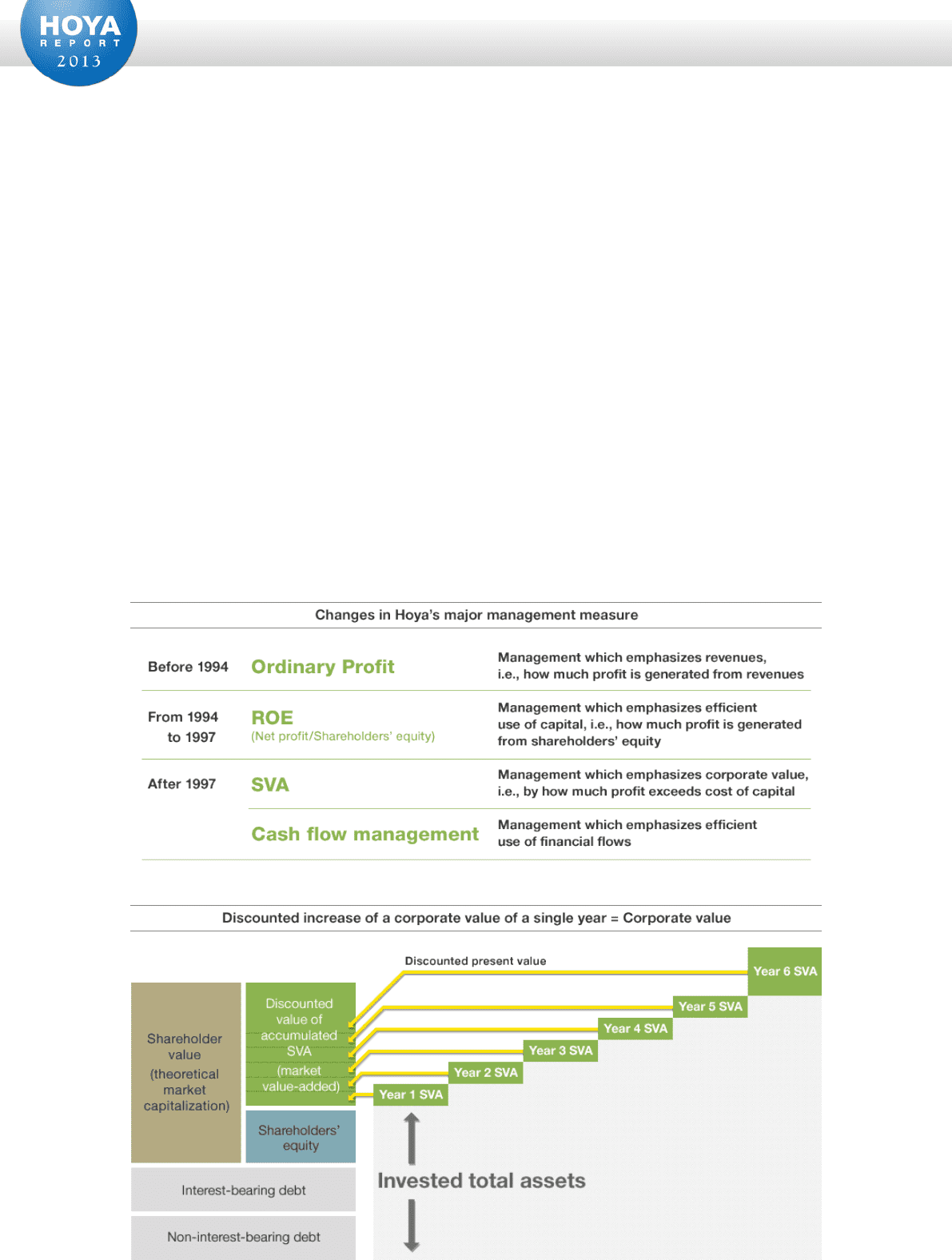

Special Features for 2013 What is SVA, that provides for Hoya's sustainable growth?

Copyright 2013 © HOYA CORPORATION

Discounted increase of a

corporate value of a single year

= Corporate value

In the long corporate history of Hoya, we once

generated net loss and was temporarily under control

of a bank. That was back in 1967. Five years after,

the bitter experience triggered us to adopt cash flow

management. Since then, we have upgraded our

major management measure from ordinary profit to

ROE in 1994, and further to SVA in 1997. ROE is an

effective tool to check the efficiency of shareholders'

equity, but as more debt can also generate more

income, the shareholders' equity ratio (or leverage)

needs to be counted.

Rather, we decided to adopt SVA, which is intended

to show the amount of increase or decrease of

c o rpor a te valu e . A re l a tive l y n e w c o n c e pt

incorporated in SVA was the "cost of shareholders'

equity." Historically, the Japanese accounting rules

had used the term "own capital," literally reflecting

the general idea that reserves, retained earnings, and

the like are the company's cost-free funds and have

no funding costs. SVA, however, is different. It is

based on the view that reserves and retained

earnings are part of shareholders' equity, which

incurs a cost, in the form of the expected return of

shareholders. Hence, the amount of net profit minus

expected return (cost) ends up to be an increase in

corporate value.