Pentax 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

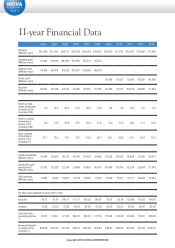

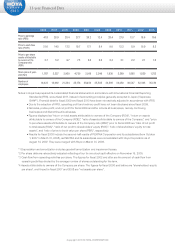

Financial Review

Copyright 2013 © HOYA CORPORATION

7

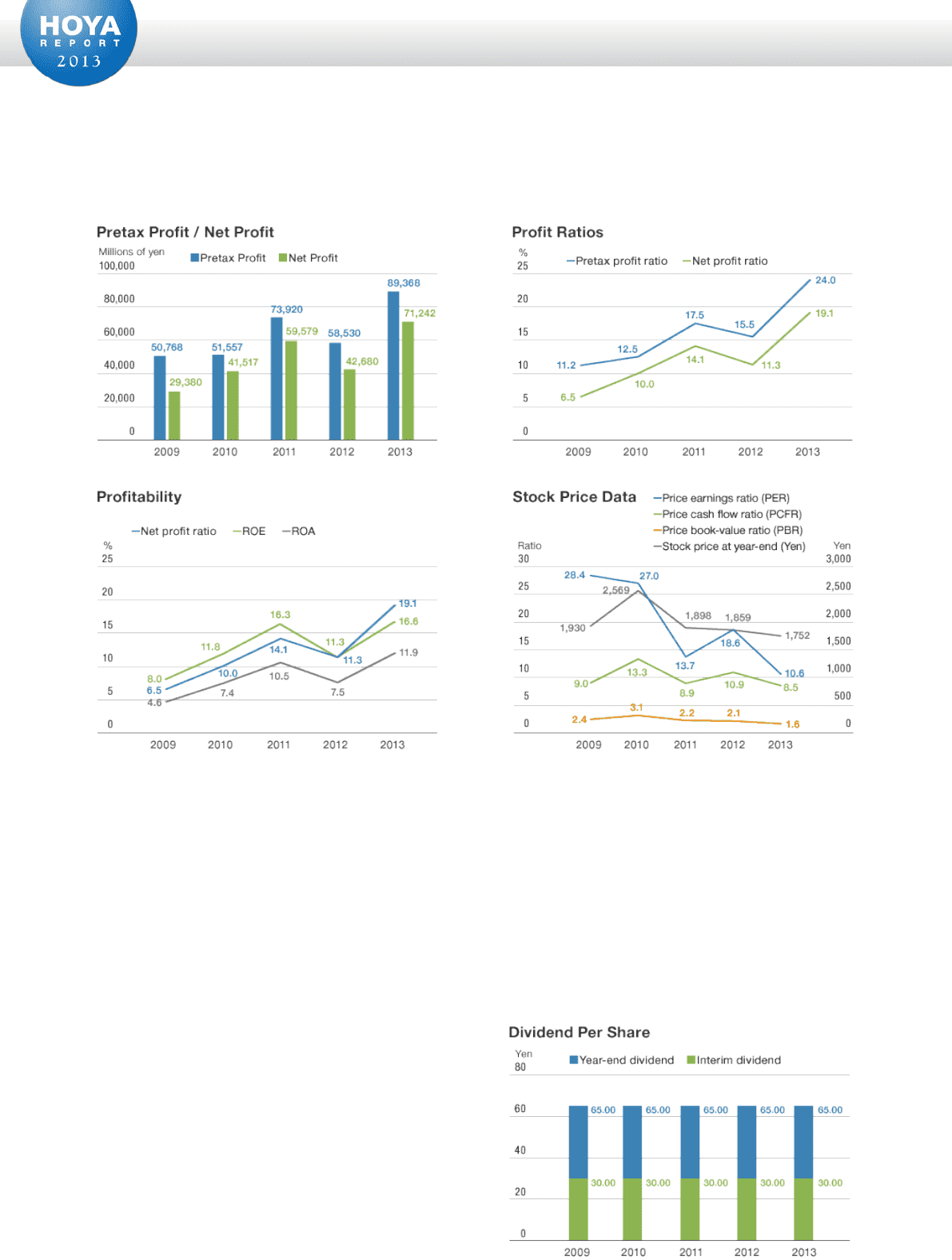

Dividends

HOYA determines dividends for each fiscal year by taking into account the Company's performance and

medium- and long-term capital requirements. It also tries to strike a balance between returning profits to

shareholders and supplementing internal reserves to fund future growth. HOYA's policy regarding internal

reserves is to continue to actively appropriate resources for marketing for consumer products, primarily in the

medical field, while also making timely investments in

corporate mergers and acquisitions and R&D for

future growth, as well as investing to ensure sufficient

production capacity and to develop next-generation

technologies and new products.

In the fiscal year under review, after balancing the need

for internal reserves for future growth, HOYA paid an

interim dividend of ¥30 per share and a year-end

dividend of ¥35 per share, for an aggregate dividend of

¥65 per share for the full year, on a par with the previous

fiscal year. The consolidated payout ratio was 39.4%.

a profit margin of 14.1%.

Return on assets (ROA) was 11.9%, and return on equity attributable to owners of the Company (ROE) was 16.7%.