Pentax 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Copyright 2013 © HOYA CORPORATION

6

Income

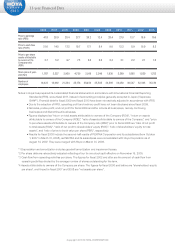

Profit before taxes amounted to ¥89,368 million and profit for the year amounted to ¥71,242 million, marking a

significant year-on-year increase of 52.7% and 66.9%, respectively. The pretax profit margin was 24.0%, an

increase of 8.5 percentage points over the previous fiscal year's level of 15.5%.

As for other income, the eyeglass lens business recorded ¥32,187 million in insurance income as part of

compensation for fixed assets and lost profit suffered from the flooding in Thailand and ¥2,238 million as a gain

on step acquisitions, associated with the additional acquisition of shares in Optotal Hoya LIMITADA (formerly

Optotal Hoya S.A.), HOYA's affiliate engaged in the manufacturing and sales of eyeglass lenses in Brazil, which

became a wholly owned subsidiary. In addition, the yen depreciated against other major currencies toward the

end of the fiscal year, which resulted in recording foreign exchange gain of ¥12,539 million on foreign currency-

denominated cash and deposits, and credits and debts which were held by the Group, and loans and

borrowings within the Group. Moreover, share of losses from associates of ¥11,912 million was recorded for the

structural reforms of AvanStrate Inc., an equity-method affiliate. Even after excluding these extraordinary factors,

profit before taxes for the current year exceeded year-on-year.

In the Information Technology segment, mask blanks for semiconductors secured a similar level of sales to the

previous year, despite the sluggish semiconductor market, as HOYA became more competitive in the blanks

market. As for photomasks for LCD panels, sales of small- and medium-sized photomasks for smartphones and

tablet PCs were firm, while sales of large-sized ones for LCD televisions showed signs of a recovery toward the

end of the fiscal year and drove earnings. On the other hand, sales of glass memory disks for HDDs were

affected by the shift in demand from notebook PCs to other products, including tablets and smartphones, and

were subdued. Among imaging related products, sales of optical lenses declined in the second half of the fiscal

year, due to the shrinking digital camera market. As a result, the Information Technology segment recorded profit

before tax of ¥31,841 million and a segment profit margin of 19.7%.

In the Life Care segment, the major plants in Thailand which suspended operations as a result of the massive

flooding resumed operations in April 2012, and sales of eyeglass lenses recovered to the pre-flooding level by

the fourth quarter of the fiscal year. In addition, Optotal Hoya LIMITADA (formerly Optotal Hoya S.A.), HOYA's

affiliate engaged in manufacturing and sales of eyeglass lenses in Brazil, became a wholly owned subsidiary,

while the eyeglass lens development and manufacturing business of Seiko Epson Corporation was transferred

to HOYA. These developments contributed to an increase in sales and profit in the eyeglass lens business

compared to the previous year. At the same time, the Eye City chain of contact lens specialty stores enjoyed

continued growth in sales and profit from the previous fiscal year, thanks to new store openings and growth in

sales of high-value-added lenses. The medical endoscope business also achieved increased sales and profit

against the previous year thanks to brisk sales mainly in emerging markets such as Russia, the Middle East, and

Asia. In addition, the launch of new products stimulated replacement demand in some regions and the trend of

the weaker yen contributed positively. With regard to intraocular lenses (IOL), we ranked No. 1 in sales in the

domestic market and enjoyed strong sales. In the fourth quarter, however, we suspended supply of some

products and undertook a voluntary recall of those products because incidence rates of inflammation and

endophthalmitis were reported to have exceeded certain levels in the third quarter. This resulted in a decrease in

sales and profit from the previous year.

In sum, the Life Care segment offset the profit decline for intraocular lenses with profit growth in other

businesses and posted pretax profit of ¥63,954 million and a segment profit margin of 30.6%. Pretax profit

included ¥32,187 million in insurance income as part of compensation for damage caused by the Thai flooding in

October 2011 and ¥2,238 million as a gain on step acquisitions, associated with the additional acquisition of

shares in Optotal Hoya S.A. Excluding such factors, segment pretax profit would have been ¥29,529 million with