Pentax 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

From CEO

Copyright 2013 © HOYA CORPORATION

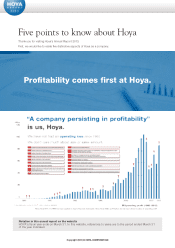

I believe my job as CEO is to further

enhance Hoya's business portfolio. Namely, to

strengthen and grow our existing businesses, to

identify what is missing in and appropriate to the

company and adding it to our portfolio, and to decide

to shrink or exit our declining businesses in a timely

manner. Obviously this is based on the long-term

premise that Hoya will keep growing. Being a CEO, I

look at our business portfolio as an aggregate of

diverse businesses and find it important to maintain a

good balance as a whole entity.

I believe that the information and technology industry

has passed the inflection point of its growth and is

entering into a long period of maturity. While it may

sink into a period of decline, we are not assuming

further expansion of this market.

In anticipation of this outlook, we have focused on

creating the condition to generate long-term steady

earnings for our related businesses in the past few

years. We anticipate that a decrease in the number of

players in these markets could stabilize pricing. In

addition to no need for heavy capital spending,

mature technologies should mean to lower production

costs. Combining all those factors, the related

businesses have fundamentally become able to

maintain profits. At any rate, we have created such a

structure by conscious efforts.

L e t u s n o w t h i n k a b o u t m a s k b l a n k s fo r

semiconductors and photo masks for LCD panels.

Change in structure of chips and other technological

shift and innovation can be expected in the future.

Nevertheless, the semiconductor industry itself

should be regarded as maturing. I am keenly aware

that Hoya's information technology business is based

on such mature industry.

Thus, I will continue to focus on creating an

environment that enables our related business to

maintain profits for a long time in the future. On the

other hand, in the case of a business in which we

cannot ensure a competitive positioning and in which

we keep generating negative cash flow, we may be

forced to select an exit strategy. This is what we have

done in the past, in case of business closures and

withdrawal. The most recent example was to close

down our history of more than 60 years in the crystal

glass business in 2009. When we assessed that we

could not become more competitive in a certain

business, we decided to make a speedy sale of that

business to the most appropriate buyer.

We sold the media business (HDD glass memory

disk coating) to Western Digital Corporation in

2010 and the PENTAX digital camera business to

Ricoh Company

in 2011.

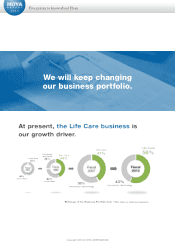

In contrast, Hoya

aims to achieve

high grow th in

t h e p romi s i n g

L i f e C a r e

bu sines se s. I b eli eve our p re se nt bus in ess

portfolio is insufficient to do so. We need to add

new businesses.

Having said this, I also firmly believe that we can

achieve a double-digit growth even with the current

businesses alone. As we have various products for

the elderly, the global aging trend is positive for us. In

addition, our eyeglass lens business has merely 10%

share in the global market. We will first approach

many of o ur u ntapped ma rkets or custome r

segments.

We have just begun global expansion of our

Intraocular Lens (IOL) businesses. Many overseas

markets remain unexplored. In addition, our market

share for medical endoscopes is still small, while

those endoscopes have a great growth potential. At

present, endoscopes are mainly used for diagnosis of

lesions. In the near future, technological innovation

will shift from diagnosis to treatment.

4My job as CEO