Panera Bread 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

60

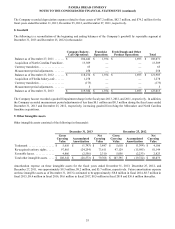

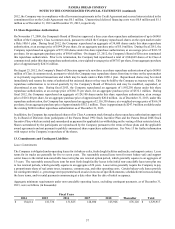

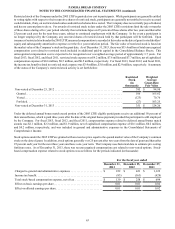

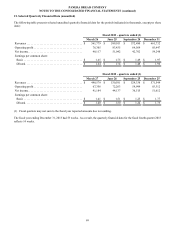

The tax effects of the significant temporary differences which comprise the deferred tax assets and liabilities were as follows for

the periods indicated (in thousands):

December 31,

2013

December 25,

2012

Deferred tax assets:

Accrued expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 71,245 $ 78,198

Stock-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,534 3,002

Net operating losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,124 1,761

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,008 139

Less: valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,173)(1,761)

Total deferred tax assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 75,738 $ 81,339

Deferred tax liabilities:

Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(90,940)$ (88,590)

Goodwill and other intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (22,307)(19,902)

Total deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(113,247)$ (108,492)

Net deferred tax liability. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(37,509)$ (27,153)

Net deferred current tax asset . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 27,889 $ 33,502

Net deferred non-current tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(65,398)$ (60,655)

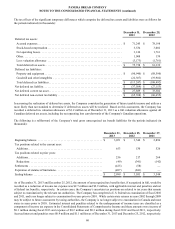

In assessing the realization of deferred tax assets, the Company considers the generation of future taxable income and utilizes a

more likely than not standard to determine if deferred tax assets will be realized. Based on this assessment, the Company has

recorded a deferred tax valuation allowance of $3.2 million as of December 31, 2013 as a full valuation allowance against all

Canadian deferred tax assets, including the net operating loss carryforwards of the Company's Canadian operations.

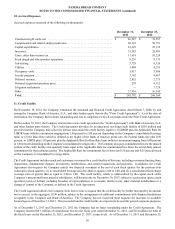

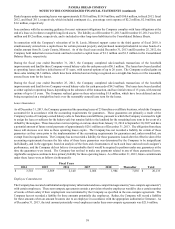

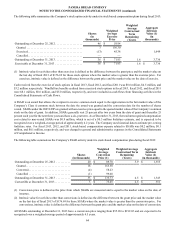

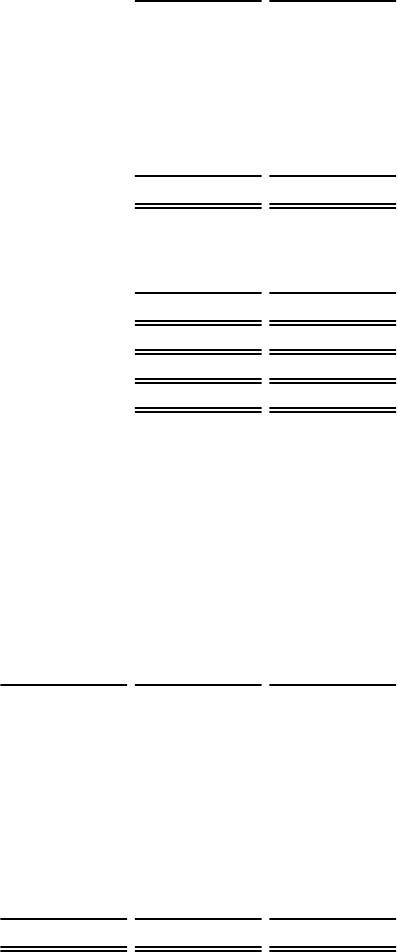

The following is a rollforward of the Company’s total gross unrecognized tax benefit liabilities for the periods indicated (in

thousands):

December 31,

2013

December 25,

2012

December 27,

2011

Beginning balance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,051 $ 3,544 $ 2,896

Tax positions related to the current year:

Additions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 653 530 526

Tax positions related to prior years:

Additions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 256 217 264

Reductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (49)(341)(142)

Settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (425)(58)—

Expiration of statutes of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (487)(841)—

Ending balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,999 $ 3,051 $ 3,544

As of December 31, 2013 and December 25, 2012, the amount of unrecognized tax benefits that, if recognized in full, would be

recorded as a reduction of income tax expense was $2.7 million and $2.9 million, with applicable interest and penalties and net

of federal tax benefits, respectively. In certain cases, the Company’s uncertain tax positions are related to tax years that remain

subject to examination by the relevant tax authorities. The Company has completed a U.S. federal tax examination of fiscal 2010

and 2011, and is no longer subject to examination for years prior to 2010. While certain state returns in years 2002 through 2009

may be subject to future assessment by taxing authorities, the Company is no longer subject to examination in Canada and most

states in years prior to 2010. Estimated interest and penalties related to the underpayment of income taxes are classified as a

component of income tax expense in the Consolidated Statements of Comprehensive Income and these amounts were income of

$0.1 million during fiscal 2013 and expense of $0.2 million and $0.3 million during fiscal 2012 and fiscal 2011, respectively.

Accrued interest and penalties were $0.9 million and $1.1 million as of December 31, 2013 and December 25, 2012, respectively.