Panera Bread 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

57

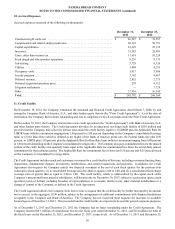

2012, the Company was in compliance with all covenant requirements in the Credit Agreement and accrued interest related to the

commitment fees on the Credit Agreement was $0.1 million. Unamortized deferred financing costs were $0.8 million and $1.1

million as of December 31, 2013 and December 25, 2012, respectively.

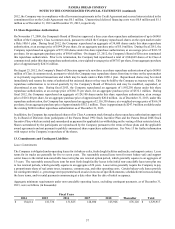

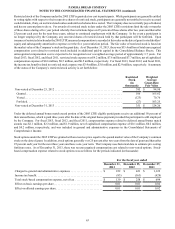

12. Share Repurchase Authorization

On November 17, 2009, the Company's Board of Directors approved a three year share repurchase authorization of up to $600.0

million of the Company's Class A common stock, pursuant to which the Company repurchased shares on the open market under

a Rule 10b5-1 plan. During fiscal 2012, the Company repurchased an aggregate of 34,600 shares under this share repurchase

authorization, at an average price of $144.24 per share, for an aggregate purchase price of $5.0 million. During fiscal 2011, the

Company repurchased an aggregate of 877,100 shares under this share repurchase authorization, at an average price of $103.55

per share, for an aggregate purchase price of $90.8 million. On August 23, 2012, the Company's Board of Directors terminated

this repurchase authorization. Prior to its termination, the Company had repurchased a total of 2,844,669 shares of its Class A

common stock under this share repurchase authorization, at a weighted-average price of $87.03 per share, for an aggregate purchase

price of approximately $247.6 million.

On August 23, 2012, the Company's Board of Directors approved a new three year share repurchase authorization of up to $600.0

million of Class A common stock, pursuant to which the Company may repurchase shares from time to time on the open market

or in privately negotiated transactions and which may be made under a Rule 10b5-1 plan. Repurchased shares may be retired

immediately and resume the status of authorized but unissued shares or they may be held by the Company as treasury stock. This

repurchase authorization is reviewed quarterly by the Company's Board of Directors and may be modified, suspended, or

discontinued at any time. During fiscal 2013, the Company repurchased an aggregate of 1,992,250 shares under this share

repurchase authorization, at an average price of $166.73 per share, for an aggregate purchase price of $332.1 million. During

fiscal 2012, the Company repurchased an aggregate of 124,100 shares under this share repurchase authorization, at an average

price of $161.00 per share, for an aggregate purchase price of approximately $20.0 million. As of December 31, 2013, under this

repurchase authorization, the Company has repurchased an aggregate of 2,116,350 shares, at a weighted-average price of $166.39

per share, for an aggregate purchase price of approximately $352.1 million. There is approximately $247.9 million available under

the existing $600.0 million repurchase authorization as of December 31, 2013.

In addition, the Company has repurchased shares of its Class A common stock through a share repurchase authorization approved

by its Board of Directors from participants of the Panera Bread 1992 Stock Incentive Plan and the Panera Bread 2006 Stock

Incentive Plan, which are netted and surrendered as payment for applicable tax withholding on the vesting of their restricted stock.

Shares surrendered by the participants are repurchased by the Company pursuant to the terms of those plans and the applicable

award agreements and not pursuant to publicly announced share repurchase authorizations. See Note 15 for further information

with respect to the Company’s repurchase of the shares.

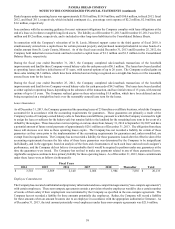

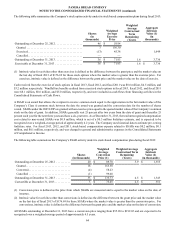

13. Commitments and Contingent Liabilities

Lease Commitments

The Company is obligated under operating leases for its bakery-cafes, fresh dough facilities and trucks, and support centers. Lease

terms for its trucks are generally for five to seven years. The reasonably assured lease term for most bakery-cafe and support

center leases is the initial non-cancelable lease term plus one renewal option period, which generally equates to an aggregate of

15 years. The reasonably assured lease term for most fresh dough facility leases is the initial non-cancelable lease term plus one

to two renewal periods, which generally equates to an aggregate of 20 years. Lease terms generally require the Company to pay

a proportionate share of real estate taxes, insurance, common area, and other operating costs. Certain bakery-cafe leases provide

for contingent rental (i.e., percentage rent) payments based on sales in excess of specified amounts, scheduled rent increases during

the lease terms, and/or rental payments commencing at a date other than the date of initial occupancy.

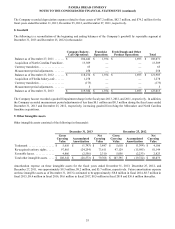

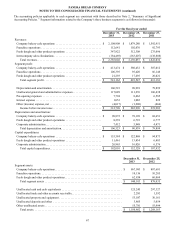

Aggregate minimum requirements under non-cancelable operating leases, excluding contingent payments, as of December 31,

2013, were as follows (in thousands):

Fiscal Years

2014 2015 2016 2017 2018 Thereafter Total

$ 134,614 132,736 131,825 128,690 125,926 676,126 $ 1,329,917